A Twitter argument somehow resulted in the defense of gambling as insightful.

Polling savant Nate Silver is in a feud with actress Bette Midler. Under normal circumstances this is something not worth even a cursory glance on a Twitter timeline. Unfortunately for all of us though, our political discourse is stupid and a feud between an actress and a prominent election forecaster has somehow resulted in people defending the unshakable political insights of gambling addicts and political junkies because it involves a market.

Midler seemingly began the feud because she is angry that Silver has said that Trump is still the odds-on favorite to win the election come November. I do not understand this criticism. When I played sports, my coaches never talked to us during halftime and said that we should play as if we were winning. Instead, we were always instructed to play as if we were tied or a goal behind. To me, it seems as if this logic would also apply to a presidential campaign, and that running a campaign with a chip on your shoulder could only be an advantage (one that the 2016 Clinton campaign could have benefitted from).

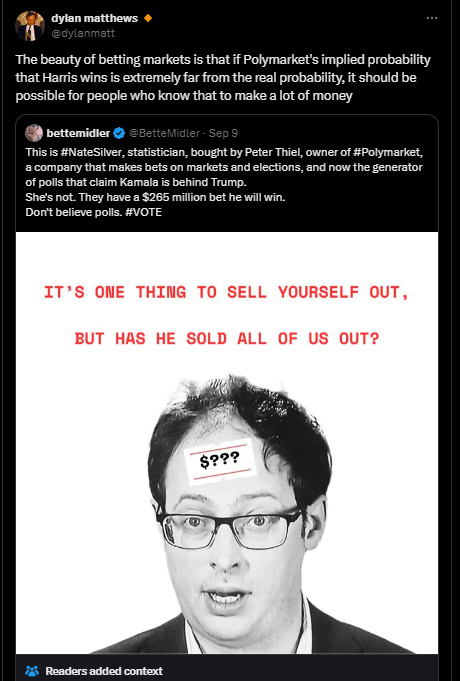

But, in her anger, Middler alleged that Silver’s forecasts were not in earnest and that instead, his predictions were “bought by Peter Thiel.” There’s a kernel of truth to this claim, Silver is paid by political betting market Polymarket which has received investment from Silicon Valley billionaire (and right-wing weirdo) Peter Thiel. But there’s no indication that Thiel has purchased Silver’s loyalty in an attempt to get him to change his forecasts, and like I said earlier, I don’t know what benefit that would have even if he did.

But rather than defend Silver with similar reasoning, neoliberals have emerged to defend Silver’s connection to the cryptocurrency-tied, offshore betting market itself. Because it is a market, and markets offer great insight.

I wrote about the strange faith in political betting markets just last month, but clearly the message hasn’t stuck. While competitive markets can be insightful–that’s why we’re unabashed advocates of strict antitrust enforcement–trusting betting markets to be accurate forecasts of political events is ridiculous. In part this is because political bettors are extremely biased in one way or another, in a way that is not normal for other markets. One 2015 study on the 2012 presidential election betting markets found that 87% political bettors never changed their position, and that only 6% of any given bettors were “unbiased” in their behavior – meaning a willingness to bet on either outcome. While this study concluded that the 2012 presidential election betting markets were not worse at predicting the outcome than polls had been, this hasn’t always proved true since then (and since bettors read and respond to polls, the only question is whether bettors add prognostication capacity to polls–”not worse” is hardly a positive outcome).

In 2016, Nate Silver was lambasted for giving Hillary Clinton a mere 66% chance of winning the election, but his odds proved to be far closer than the outcome predicted on betting market PredictIt, which gave Clinton 80% chances of winning as of election night. In 2020 many people continued to make money by betting on Joe Biden winning the election in December, weeks after the election was over and results had been called. And as we noted in our last piece, the markets had originally given Tim Walz a 1% chance of being named Harris’ running mate.

The fact that a market exists does not make it insightful. Those with an affinity for markets should not make the mistake of believing that they’re infallible. If they were, I’d be investing in subprime mortgage-backed securities.