Now federal regulators are poised to approve Calcasieu Pass 2, Venture Global’s disastrous long-term gas export expansion plan.

This newsletter was originally published on our Substack. Read and subscribe here.

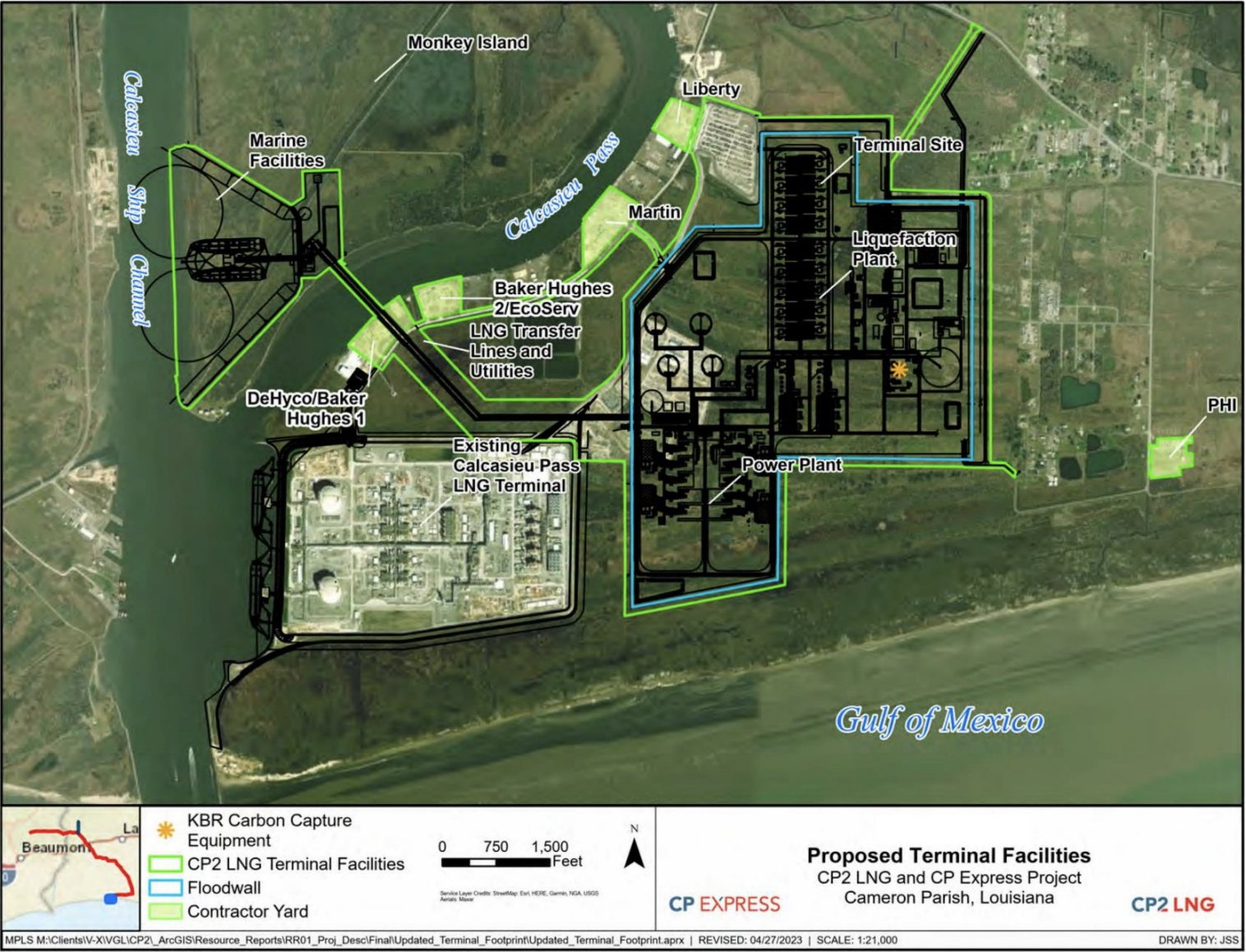

On Thursday the 19th, the Federal Energy Regulatory Commission is expected to vote on whether to approve Calcasieu Pass 2, a massive long-term natural gas liquefaction and export facility that intends to export 20 million metric tons of planet-warming methane gas a year. Dodging its responsibility so far to consider the full range of consequences of its infrastructure permitting decisions, FERC looks set to greenlight this monstrosity. As this newsletter will explore, not only are the global climate consequences of new gas export infrastructure enormous, but the immediate impacts are keenly felt by the local community inundated with pollution from the original Calcasieu Pass facility.

As Venture Global’s Senior Vice President put it, President Biden called for “a surge of American LNG exports into Europe,” and Venture Global heard the call.

Founded only a decade ago, Venture Global is one of the upstart oil and gas companies capitalizing upon the meteoric rise in U.S. exports of LNG, or liquified natural gas, which is natural gas that’s cooled to around -260° Fahrenheit and stored in cryogenic storage tanks for transport across long distances. After receiving federal permits and a final investment decision in 2019, Venture Global quickly built the massive Calcasieu Pass liquefaction and export facility atop former wetlands on the shore of the Gulf of Mexico in southwestern Louisiana.

In March 2022, just days after Russia invaded Ukraine, Calcasieu Pass exported its first shipment of LNG to France and the Netherlands. Since then, as Sara Sneath reported, “the facility has sold more than 200 LNG cargoes, capitalizing on record-high prices in 2022 as European countries scrambled to replace Russian gas during the Russia-Ukraine War.” According to Venture Global, the Calcasieu Pass facility alone sold about 10 percent of the total LNG exported between the U.S. and Europe in 2022 and 2023. Reuters calculates that Calcasieu Pass has made at least $18.2 billion since March 2022.

The company brags that it “holds the global record for the fastest large-scale greenfield LNG facility to ever be built,” with just 29 months between the final investment decision and the beginning of production. But this record is a bit misleading. Though Calcasieu Pass has been producing and selling massive quantities of LNG since early 2022, it technically has yet to begin commercial operations, as operational failures continue to prolong its commissioning period. In fact, Calcasieu Pass is not expected to officially enter commercial operation until the first quarter of 2024, making its expected commissioning period length “eight times longer than the industry’s typical three-month commissioning period.”

“While Calcasieu Pass is indeed able to produce LNG,” Venture Global wrote in a letter to the Federal Energy Regulatory Commission (FERC), “it remains in the commissioning phase because it continues to face periodic reliability challenges impacting the facility.” But while Calcasieu Pass has been producing and selling hundreds of pre-commercial LNG cargoes at top price, the facility’s “periodic reliability challenges” have caused it to exceed its air pollution limits at least 139 times in 2022, according to the Louisiana Department of Environmental Protection (LDEQ).

A report from Louisiana Bucket Brigade, which analyzed Venture Global Calcasieu Pass’s own deviation reports submitted to LDEQ in March 2023, calculated that the facility deviated from its permits over 2,000 times from 17 separate emissions sources in 2022. The facility violated its permits on 286 of its 343 days of operation last year, meaning it was only in compliance with the law 17 percent of the time. At various times, Calcasieu Pass exceeded its limits for releasing carbon monoxide, volatile organic compounds, hazardous air pollutants, toxic air pollutants, nitrogen oxides, sulfur dioxide, and particulate matter into the atmosphere.

The facility was well aware that it was exceeding its pollution limits, as its mandatory self-reporting of its “deviations” from its permits indicates, but continued to operate. Not only that: Venture Global actually requested that Louisiana increase the amount it was allowed to emit carbon dioxide and toxic pollutants by 17 percent each so that it could more easily come into compliance. And when LDEQ issued a compliance order to the facility in June 2023, though state law requires companies to submit a plan to fix their violations within 10 days of receiving a compliance order, Venture Global responded that it needed over 30 days—until September 4—to submit its plan. All the while, Calcasieu Pass continued to make billions from shipping LNG abroad.

Lately, the story about Venture Global’s profit-seeking excesses has revolved around the fact that several of its buyers—major oil and gas companies including Shell, BP, Edison and Repsol who locked in long-term contracts at fixed rates with Venture Global that take effect once Calcasieu Pass begins commercial operations—are furious that Venture Global is selling its pre-commercial cargoes at high prices on the spot market. Calcasieu Pass’s record-long commissioning period, in their eyes, is letting Venture Global dodge its long-term contractual obligations to sell LNG at a pre-established price. These companies have been unsuccessfully petitioning FERC to grant them access to Venture Global’s privileged reports, and generally raising a stink.

Forbes reported that with Shell’s executives publicly accusing Venture Global of “deceitful,” “damaging,” and “dangerous” actions, those statements won’t go unnoticed by ExxonMobil, Chevron, and Japan’s top LNG purchaser JERA, who are among the customers lined up for Venture Global next plant. Which brings us to the subject of that next plant: Calcasieu Pass 2, or CP2.

Doubling Down on Disaster

While the original Calcasieu Pass facility continues to knowingly violate the terms of its own environmental permits more days than not, federal regulators are in the process of approving its expansion project Calcasieu Pass 2. In July, FERC published its final environmental impact statement on CP2, clearing the way for a final vote from the commission at its next meeting in just eight days.

FERC’s environmental impact statement is a breathtaking exercise in bureaucratic myopia. While failing to characterize the global climate change impacts of this project, which may have a greenhouse gas footprint 20 times as large as the Willow Project, FERC’s staff concludes that CP2 will have “some adverse environmental impacts,” most of which are “less-than-significant, with the exception of visual resources, including cumulative visual impacts, and visual impacts on environmental justice communities in the region.” Uh, what? Visual impacts?

Yes, among other things, Calcasieu Pass 2 will be hideous. But the fact that environmental justice communities in the region are currently suffering from near-constant air pollution from the original Calcasieu Pass, while Venture Global has shown no hurry whatsoever to come into compliance with the law, seems to be rather more important! Initial estimates of the greenhouse gas pollution from Calcasieu Pass 2 put it at more than half a million metric tons of pollution per day as the gas is fracked, shipped across the sea, and then combusted, but sure, the primary adverse environmental impact is how unbearably ugly its 176 foot tall storage tanks are.

FERC claims that the “construction and operation” of the facility (note: not the product the facility is producing or its uses) will “contribute incrementally to future climate change impacts,” and refuses to characterize its impact on climate change as significant or insignificant. This sort of craven bureaucratic dithering about the scope of what a permitting agency is supposed to consider is how you get the Biden administration greenlighting record growth in U.S. oil and gas production while Biden calls climate change an existential threat to humanity.

Likewise, though FERC is required under NEPA to consider a “no action alternative” to proposed projects, its environmental impact statement only speculates briefly that “alternative energy” could replace this facility, but says that “alternative energy sources would not meet the Project objective of liquefying natural gas for export,” and insists an “agency should consider the applicant’s goals based on the agency’s statutory authorization to act in defining the proposed action’s purpose and need.” Nothing in NEPA requires FERC to adopt a project applicant’s goals as its own, but that’s the sycophantic approach that FERC has decided to take to permitting one of the largest-ever gas export facilities, in the midst of the hottest year on record.

FERC and the Department of Energy both play critical roles in permitting the ongoing expansion of U.S. gas export infrastructure. The enormous failure of both agencies to confront the cumulative cost of their willingness to approve, project by project, an astronomical increase in U.S. gas exports may end up being among the darkest stains on the Biden administration’s legacy.

Meanwhile, Louisiana communities continue to bear the immediate brunt of the U.S. oil and gas industry’s willingness to capitalize upon anything—whether it’s contractual loopholes, Putin’s war, red states’ dismal environmental enforcement practices, or the president’s willingness to overlook the real cost of replacing Russian gas with U.S. gas—to make easy money.

Follow the Revolving Door Project’s work on whatever social media platform works for you! You can find us on that website formerly known as Twitter, Bluesky, Instagram, and Facebook.

Want more? Check out some of the pieces that we have published or contributed research or thoughts to in the last week:

America’s Pipelines Are a Disaster Waiting to Happen

How Do You Get Tricked By The Effective Altruist Schtick When The Guy Is In Jail?

Top law firm in Google antitrust trial locked in ethics dispute