Scott Bessent’s appointment to CFPB acting director will undermine the agency’s mission.

This newsletter was originally published on our Substack. Read and subscribe here.

What Happened:

After firing former Consumer Financial Protection Bureau (CFPB) director Rohit Chopra on Saturday, President Trump appointed Treasury Secretary Scott Bessent as acting director on Monday.

This change in leadership will undoubtedly allow bad faith bankers and financiers to take advantage, via fraud and misconduct, of far more consumers.

Why It’s Important:

Under Chopra, the CFPB made good on its popular mandate through increased enforcement actions and comprehensive rulemaking.

Under Bessent, efforts to return billions of dollars back to consumers, close junk fee loopholes, strengthen data privacy protections, and remove medical debt from credit reports risk nonenforcement or complete rollback. His first action as acting director was to halt all activity at the agency “[i]n order to promote consistency with the goals of the [Trump] Administration.”

In other words, a get out of jail (or civil responsibility) for bad acts card to the financial sector. What could go wrong!

Who Benefits:

- Wall-Street: Bank lobbyists, like the Consumer Bankers Association, are delighted with Bessent’s appointment. Hindering the CFPB means the likes of Wells Fargo, JPMorgan Chase, and Bank of America can exploit the American public with little fear of consequences.

- Silicon Valley: “Banking-as-a-service” firms like Synapse Financial Technologies—whose predictable collapse last year robbed thousands of their hard-earned savings—also stand to benefit from a weakened CFPB. Chopra’s efforts to bring fintechs more directly under the agency’s regulatory purview will likely be dropped by Bessent. Continued underregulation of fintechs would be a gift to venture capitalists like Marc Andreesen, a close ally of the Trump administration whose private equity firm heavily invested in Synapse. Scott Kupor, Trump’s nominee for Director of the Office of Personnel Management, is a managing partner at Andreessen Horowitz.

- Elon Musk: The billionaire oligarch, and special government employee, has already voiced his intention to “delete” the CFPB, and now has one less obstacle to overcome. Although Bessent reaffirmed the CFPB’s congressionally authorized authority in written testimony to the Senate, his willingness to give Musk operational control over the Treasury’s payment system (under direct order from Trump) should cast doubts over any supposed commitments to the law. In fact, as Nathan Tankus recently reported, Bessent understands his loyalties to ultimately lie with Trump above all else:

Where Is The Opposition?

Democrats who expected Bessent to moderate Trump’s worst impulses (because he is well dressed and went to an Ivy? Ridiculous!) have been immediately proven wrong. But the lackluster response on their part hasn’t dissuaded the public from mobilizing against the Trump administration’s illegal behavior.

The Alliance for Retired Americans, the American Federation of Government Employees, and the Service Employees International Union recently filed a lawsuit against Musk alleging that his payment system takeover violated federal privacy laws.

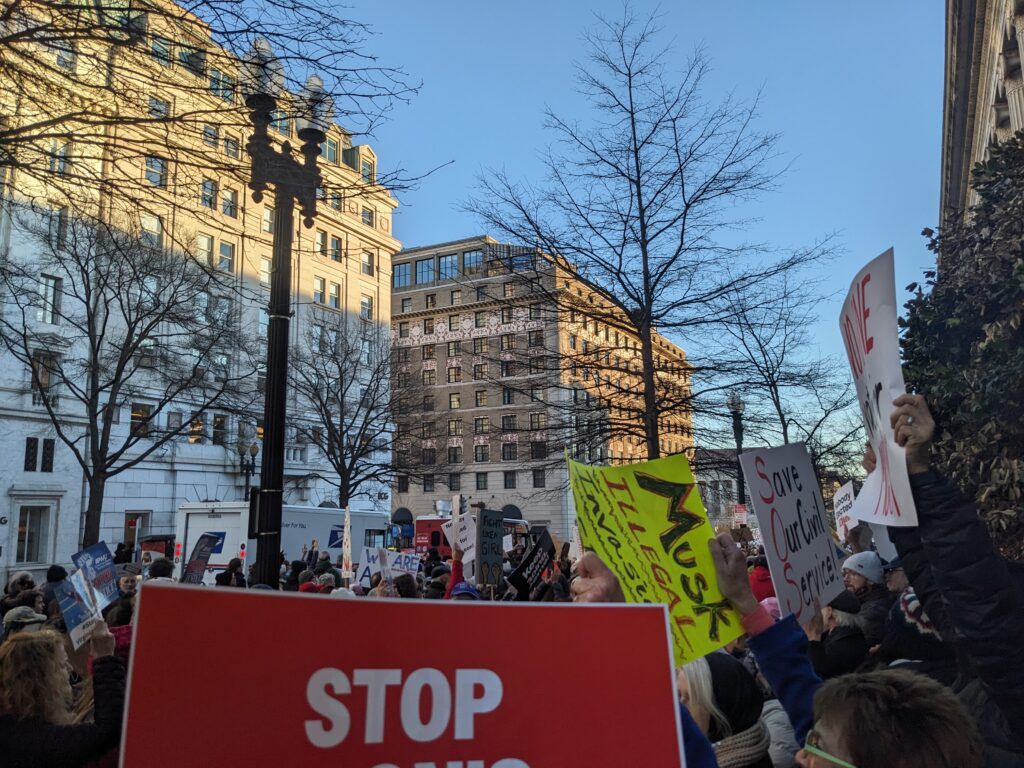

And on Tuesday night, protestors gathered outside the Treasury Department building demanding an end to Musk’s illegal actions. Our Founder and Executive Director, Jeff Hauser, was in attendance and took a few photos:

Jeff reports: “The energy was great, and the many Members of Congress in attendance seemed to have some of the energy that has generally been missing under Trump 2.0. As I wrote two weeks ago, the Trump 1.0 Resistance was a GOOD thing—it’s energy was not misplaced, it was instead squandered by Pelosi, Biden, and especially Garland’s zeal to turn the page and overlook just how bad Trump 1.0 had been.

What my family and I experienced Tuesday night was the beginning of a return to that spirit—and humane minded protests on behalf of immigrants in Los Angeles and elsewhere suggests this country still has some fighting spirit. More like this, please!”

Make no mistake, Chopra’s CFPB was already pursuing an “agenda to lower costs for the American people.” Tapping Bessent—a billionaire hedge fund investor—to lead a corporate watchdog agency is allowing a fox to guard a henhouse.

Want more? Check out some of the pieces that we have published or contributed research or thoughts to in the last week:

RELEASE: Treasury Secretary Scott Bessent’s Support for Elon Musk Warrants Impeachment

One Of The 20-Somethings Running The Government Is Beholden To Sam Altman’s OpenAI

Trump Fires Consumer Financial Protection Bureau Head Who Drew Wall Street’s Ire

Judicial Notice (02.02.25): You’re (All) Fired

Firing Director Chopra Is A Win For Corporate Criminals

Corruption Calendar Week Two: Trump Moves To Gut Exec Branch And Make Way For Loyalists