FOR IMMEDIATE RELEASE

Contact: Max Moran, [email protected]

Recent coverage of the debate over upcoming appointments to the Federal Reserve Board of Governors has taken as a given that Biden can affect an about-face on the Fed’s regulatory policy without replacing Chair Jerome Powell. As we detail in a new memo, this is wrong.

The argument in favor of Powell ignores the simple math. With the current Vice Chair of Supervision Randal Quarles indicating that he may stay on the board as a member after his term as Vice Chair expires in October. Biden reappointing Powell would surely encourage Powell’s compatriot Quarles to stay to help defend his deregulatory legacy secure in his longstanding working relationship with the Chair. Thus reappointing Powell risks handing Trump appointees the majority for all of Biden’s term, making it exceedingly unlikely the Fed would reverse Trump-era deregulation after having just completed it, let alone advance regulation to meet the urgent needs of this decade around climate finance.

The argument in favor of discounting Powell’s deregulatory record ignores power dynamics within the Fed. No matter whether or not Quarles stays, Powell’s reappointment will severely limit the scope of regulatory action. The Chair, through their control of the institution and the staff, sets the agenda. That “means that Biden’s Vice Chair of Supervision will not be able to restore regulatory safeguards or develop new ones without Powell’s approval. Given Powell’s record, it would be foolish to count on it.”

In short, to unlock all of the Federal Reserve’s powers, Biden must appoint a new Fed Chair. As Max Moran details in a new blog, there is no shortage of fantastic candidates who will defend full employment monetary policy and deploy the Fed’s formidable financial regulatory tools to tackle racial and economic inequality, climate change, and corporate power. These candidates include Lisa Cook, Sarah Bloom Raskin, William Spriggs, and current Fed governor Lael Brainard.

###

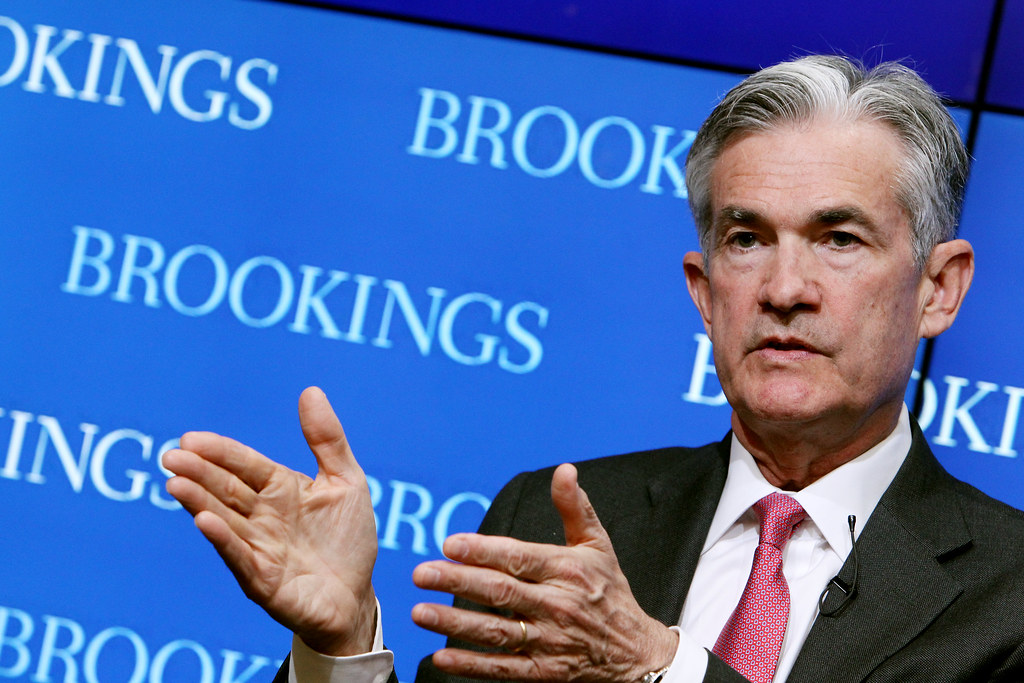

PHOTO CREDIT: “Governor Jerome Powell speaks at Brookings panel, ‘Are there structural issues in U.S. bond markets?'” byBrookingsInst is licensed under CC BY-NC-ND 2.0