Search Results for

January 30, 2026

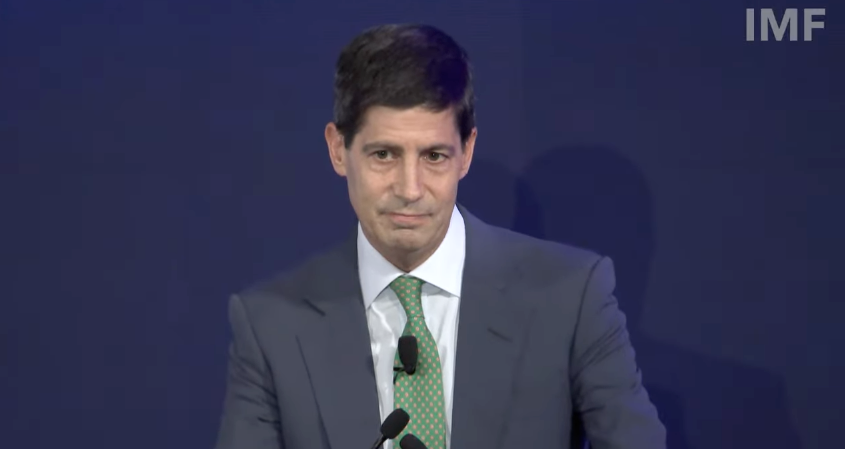

RELEASE: Trump’s New Fed Chair Nominee Kevin Warsh Is a Hack with Ties to Would-Be Greenland Profiteer

Warsh’s record suggests commitment to class and personal self-interest, not a broader dedication to an intellectually consistent view of the public interest.

January 22, 2026 | Dollars & Sense Debrief

PODCAST: RDP's Kenny Stancil Discusses Home Insurance Profiteering on the D&S Debrief

Revolving Door Project senior researcher Kenny Stancil joined Economics for the People to discuss his recently published article, “Forsake Some, Fleece the Rest,” with Dollars & Sense editor Chris Sturr.

January 16, 2026

The Technobabble Defense

How companies cry “innovation” to defend their lawbreaking

December 31, 2025 | Dollars & Sense

Forsake Some, Fleece the Rest

How U.S. Home Insurers Are Responding to Climate Change

December 18, 2025 | The American Prospect

Dylan Gyauch-Lewis Toni Aguilar Rosenthal

Op-Ed Ethics in GovernmentFinancial RegulationRevolving Door

Another Biden Financial Regulator Spins Through the Revolving Door

It’s hard times at the Office of the Comptroller of the Currency (OCC), one of the three principal bank regulators in the country, along with the Federal Deposit Insurance Corporation and the Federal Reserve. All three, plus other financial institution regulators at the National Credit Union Administration and the Consumer Financial Protection Bureau, have been gutted to varying degrees over the first year of Trump 2.0.

December 17, 2025

Newsletter Corporate CrackdownEthics in GovernmentExecutive BranchFinancial RegulationIndependent Agencies

Cutting Crooks Some Slack

The administrative state’s Kafkaesque transmogrification into the mafia state

October 31, 2025 | The American Prospect

Op-Ed BankingConsumer ProtectionEconomic PolicyExecutive BranchFinancial RegulationIndependent Agencies

Making Banking Supervision Suck Again

Willfully blinding bank examiners could send us hurtling to yet another financial crisis.

August 26, 2025

Supreme Court, Jay Powell, & Media Enabled Trump’s Attack on Lisa Cook

Institutions have allowed Trump to attack the Federal Reserve’s Independence. They must stand up for Lisa Cook.

August 20, 2025 | The American Prospect

Henry Burke Dylan Gyauch-Lewis

Op-Ed Anti-MonopolyEconomic MediaEthics in GovernmentExecutive BranchFinancial RegulationFintechTech

What Trump Learned From Silicon Valley

Before DOGE’s lawbreaking spree, there was ‘blitzscaling.’

August 14, 2025

Oligarchs and the Trump Admin: Cameron and Tyler Winklevoss

Tyler and Cameron Winklevoss are billionaires who made their initial fortune from a 2004 lawsuit against Mark Zuckerberg, accusing him of stealing their idea in the creation of Facebook. The Winklevoss twins have since expanded their fortunes through an $11 million purchase of Bitcoin in 2013, founding the venture capital firm Winklevoss Capital, and founding cryptocurrency exchange Gemini. In June 2024, the Winklevoss’ each tweeted an endorsement of Trump’s candidacy and donated $1 million in bitcoin to his campaign.

July 23, 2025 | The American Prospect

Home Insurance Executives Are Raking It In—At Your Expense

Performance-based pay packages incentivize claim denials and other harmful practices.

July 18, 2025 | Watchdog Weekly

Corruption Calendar Week 26: Crypto Week Marks Washington’s Insatiable Appetite For Grift

While the House of Representatives was busy passing three industry-written pieces of legislation which all but ensure crypto’s complete capture of the federal government, Trump netted close to $100 million from sales of his crypto memecoin. There’s no doubt that the favor machine will keep whirring as long as the zeroes keep adding up for Trump and his family.

July 16, 2025 | Citations Needed

PODCAST: Timi Iwayemi Discusses Corporate Self-Regulation and the Fine Art of ‘Preempting’ Public Outrage on Citations Needed

Revolving Door Project’s Timi Iwayemi joined Citations Needed to shed light on corporate efforts to shape laws and regulations in their favor, with a particular focus on the crypto industry’s political influence strategy.

July 14, 2025

Don't Let Home Insurers Fool You. They're More Profitable Than Ever

The industry paints a gloomy picture, but nationwide, property insurers still cleared $25.4 billion in underwriting profit in 2024, and their net investment income surged to $164.3 billion.