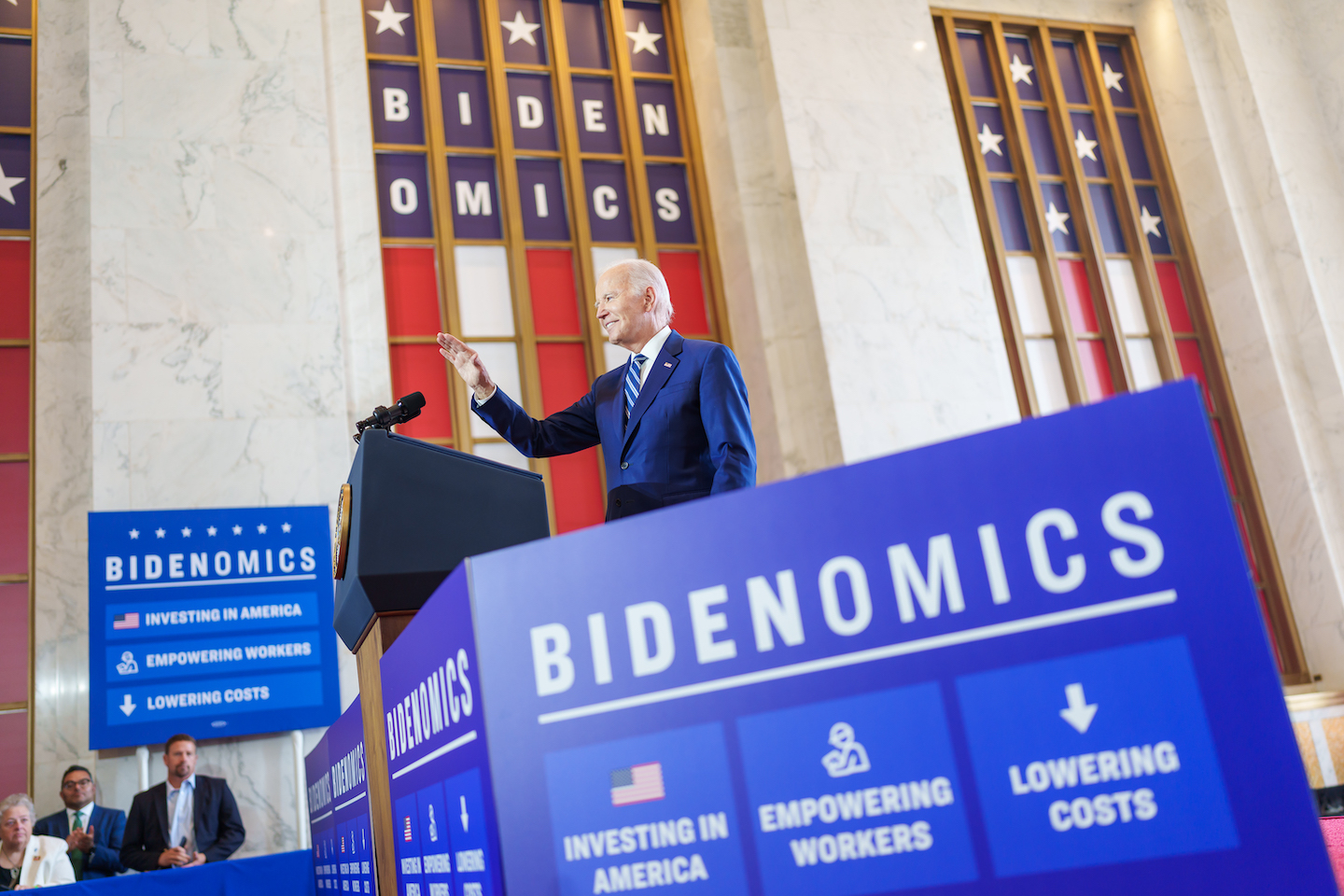

The above photo is a work of the U.S. federal government and in the public domain.

This newsletter was originally published on our Substack. Read and subscribe here.

Last week, President Biden visited Chicago to tout the accomplishments of “Bidenomics”—a term he has decided to reclaim from conservative media pundits—in a major economic policy speech, before attending a fundraiser hosted by Illinois governor and noted billionaire J.B. Pritzker. While Biden traveled from the newly renovated Old Post Office to the JW Marriott for these events, outside, dense smog from Canadian wildfires blocked out the sun and temporarily earned Chicago the distinction of worst air quality in the world.

Against this visual backdrop, Biden’s lukewarm rhetoric on corporate accountability stood out even more starkly than usual. His speech focused on his “economic vision for this country: [to grow] the economy from the middle out and the bottom up instead of just the top down.” In this vision, according to Biden, “everybody does well. The poor have a ladder up, and the wealthy still do well. We all do well.” Biden’s rhetoric plays into classic tropes about a rising tide lifting all boats, as he boasts about economic growth across industries under his watch, suggesting that “the poor” and “the wealthy” are on the same team in wanting the American economy to grow, while reassuring business leaders that “I want [corporations] to do well.”

The main approach to corporate accountability that Biden touched on hinged on superficial notions of fairness: that corporations should “pay their fair share” of taxes, through returning to higher tax rates on billionaires and large corporations. This economic vision can only be a comprehensive one in a rosy parallel reality where corporate profits aren’t reliant on, for example, relative impunity for cheating and outright stealing from workers and the public. Or wealth achieved by risking the safety of workers and consumers alike to reward executives and shareholders. For instance, despite boasting in his Chicago speech about several climate commitments, including investment in renewables and rejoining the Paris Climate Accords, Biden doesn’t address the ways that growing a US economy that still relies on fossil fuels will worsen climate-fueled disasters, or any of the other tensions between corporations succeeding and everyone else doing well.

Indeed, climate denialism hasn’t funded itself. Many corporations know well that they can only do well by ratcheting up the planet’s pain.

The blanket of wildfire smoke outside should have been a somber reminder that creating an economic and social reality which works for the majority of people will take far more than adjusted corporate tax rates. A broader crackdown on corporate abuses is long overdue. In reality, the companies that Biden lightly chastises for not “pay[ing] their fair share” of taxes are actively contributing to the climate crisis, and have significantly more to answer for than tax evasion (though that’s certainly a problem too). Recent studies have tied the Canadian wildfires to unusually hot and dry air, and found that “37 per cent of the total burned forest area in Western Canada and the United States between 1986-2021 can be traced back to 88 major fossil fuel producers and cement manufacturers.” As Kate Aronoff wrote for The Guardian in June,

“Saudi Aramco sits at the top of that list…followed by Chevron, ExxonMobil, Gazprom and BP… ExxonMobil chief executive Darren Woods enjoyed a 52% pay bump last year amid record profits; his employees’ pay fell by 9%. Shareholders who just rejected calls for Exxon and Chevron to set more stringent climate goals got fat payouts, too, of about $30m at each company. Still more galling is the fact that top executives at Exxon, Chevron, BP, Shell, Total and Eni got $15m worth of bonuses for meeting their own woefully inadequate climate targets.”

It should be clear to anyone paying attention that “the wealthy” and “the poor” are not on the same side of battles against corporate exploitation of people and the planet. And it’s not just executive-employee pay gaps and shareholder payouts that the president’s Bidenomics speech failed to address; the haze of wildfire smoke that shrouded his Chicago visit should have driven home the increasing health risks that workers without office jobs and air purifiers during this climate emergency will be more and more exposed to.

In fact, many, many people do understand this, which is part of the reason that cracking down on corporate abuses polls so well, as we’ve written about regularly. Beyond tax law, the main policy priorities Biden explicitly outlined were reducing inflation, lowering prescription drug prices, and tackling junk fees. These kinds of tweaks to our economic system, while important, don’t address the massive power imbalance between corporations and the public, in the way that the whole-of-government corporate crackdown effort we’re calling for would.

What’s more, pointing out clear corporate villains and promising accountability makes for much more compelling narratives during campaign season than touting wonky policy priorities that are siloed off from one another. Biden couldn’t even get through condemning junk fees without making an unfunny reference to a bank president who had a yacht named “Overdraft” (you know, like the fees). The joke did earn laughter from the audience, who apparently found the shamelessness of this story of elite excess funny enough to overlook the horrifying reminder of how unafraid of accountability someone would have to be to so clearly acknowledge that their wealth came from extracting excessive fees from poor people.

In a political climate where corporate wrongdoing isn’t routinely named and shamed by those with the power to do something about it, abuses and corruption are becoming more shameless by the minute. Last week, the Financial Times reported that Trump’s top banking regulator, former Federal Reserve vice-chair Randal Quarles, and former Silicon Valley Bank (SVB) risk officer Vivek Tyagi have joined forces to launch a bank called Currency Reserve. We’ve covered the collapse of SVB (and the ridiculously blatant lies and corruption of its leadership team) at length, as have many other outlets since the bank’s collapse, which should make this FT headline more of a punchline than a news item.

Promising that corporations will pay more taxes, while lacing speeches with reassurances for corporate executives and effusive thank-yous to wealthy campaign donors, will not convince people that a second Biden term will shift the playing field that privileges corporations and the wealthy over the majority of us. Biden must do more to show the public that he’s ready to crack down on corporate abuses. That means picking visible fights with specific corporate villains with a hope of generating a spectacle—not papering over the very real differences between even the mildest version of Bidenomics and the views of so many CEOs and billionaires. These fights would not be picked just in an effort to win re-election, but as part of a concrete effort on behalf of the health of the American people.

Want more? Check out some of the pieces that we have published or contributed research or thoughts to in the last week:

RDP Asks FTC IG To Investigate Ethics Officer Who Pushed Khan To Recuse While Owning Meta Stock

Hack Watch: The Dangerous Cult Of The Entrepreneurial “Innovator”

Right-Wing Activists, Not Asian Americans, Killed Affirmative Action

RDP Calls On Microsoft/Activision Judge Who Disclosed Son’s Employment At Microsoft To Recuse

WaPo: Watchdog group calls on judge to recuse in FTC-Microsoft case

TAP: Lina Khan Haters Took a Premature Victory Lap

NYPost: Amazon poaching Federal Trade Commission officials before antitrust lawsuit

ChannelNews: Amazon Hiring Ex-FTC Staffers Ahead Of Antitrust Lawsuit

WSJ: Ethics Official Owned Meta Stock While Recommending FTC Chair Recuse Herself From Meta Case

Law360: FTC Faces Skeptical Judge As Microsoft Merger Hearing Ends

Politico Playbook PM: The right prevails in final SCOTUS rulings