Last month, ProPublica published a jaw-dropping look into the IRS data of well-known billionaires, revealing their meager effective tax rates in detail. The disclosures were met with shock and anger. After all, how could Jeff Bezos, Elon Musk, Michael Bloomberg, and George Soros go years without paying federal income taxes? And how could this possibly be legal? The article, the first in a series from ProPublica, renewed public cries that billionaires should, in fact, pay their fair share.

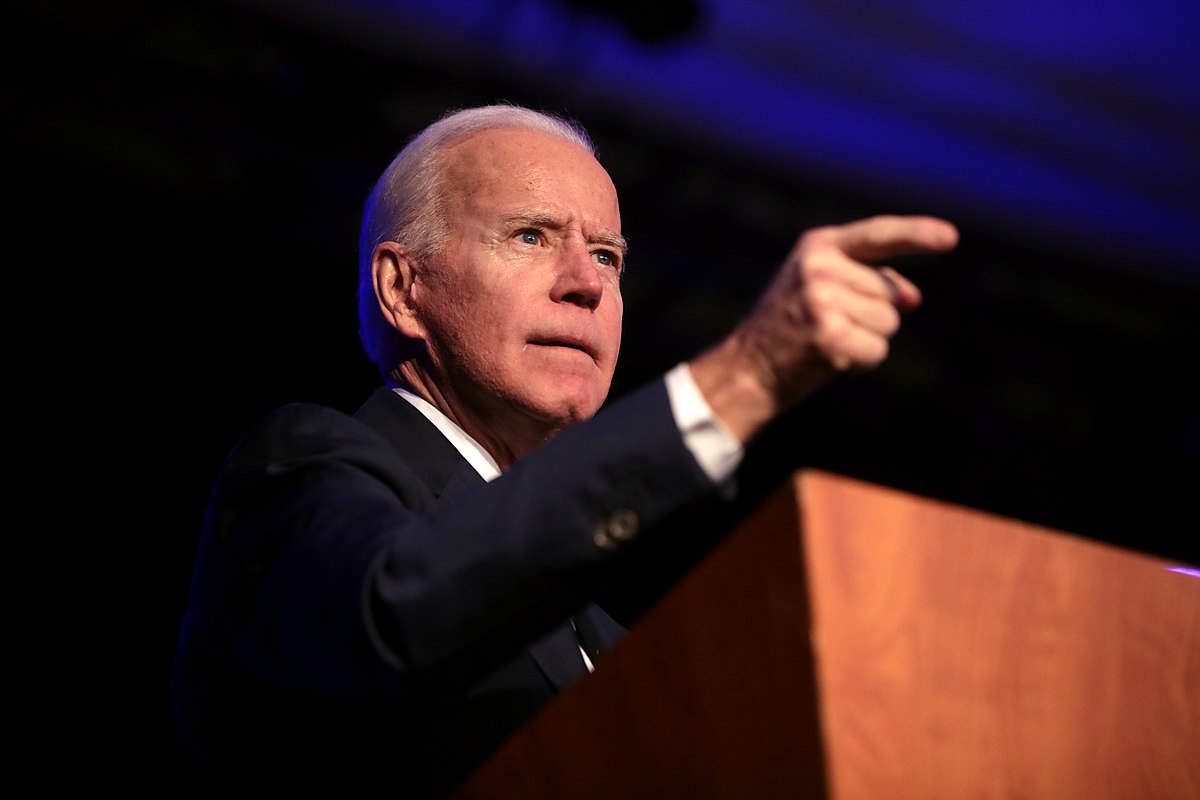

Instead of responding to the public momentum for comprehensive tax reform, some of the most important voices in the Biden administration promised to launch an investigation into ProPublica’s sources while expressing no anger at what they brought to light. Attorney General Merrick Garland, days after the story was published, called finding the source of the leak a “top of [his list]” priority. IRS Commissioner Charles Rettig (a Trump holdover who inexplicably remains in office more than five months into Biden’s term) immediately launched an investigation to find the leaker without indicating any plan to address his agency’s abject failure to tax the ultrarich.

Read the full article on the original site.

Header Image: