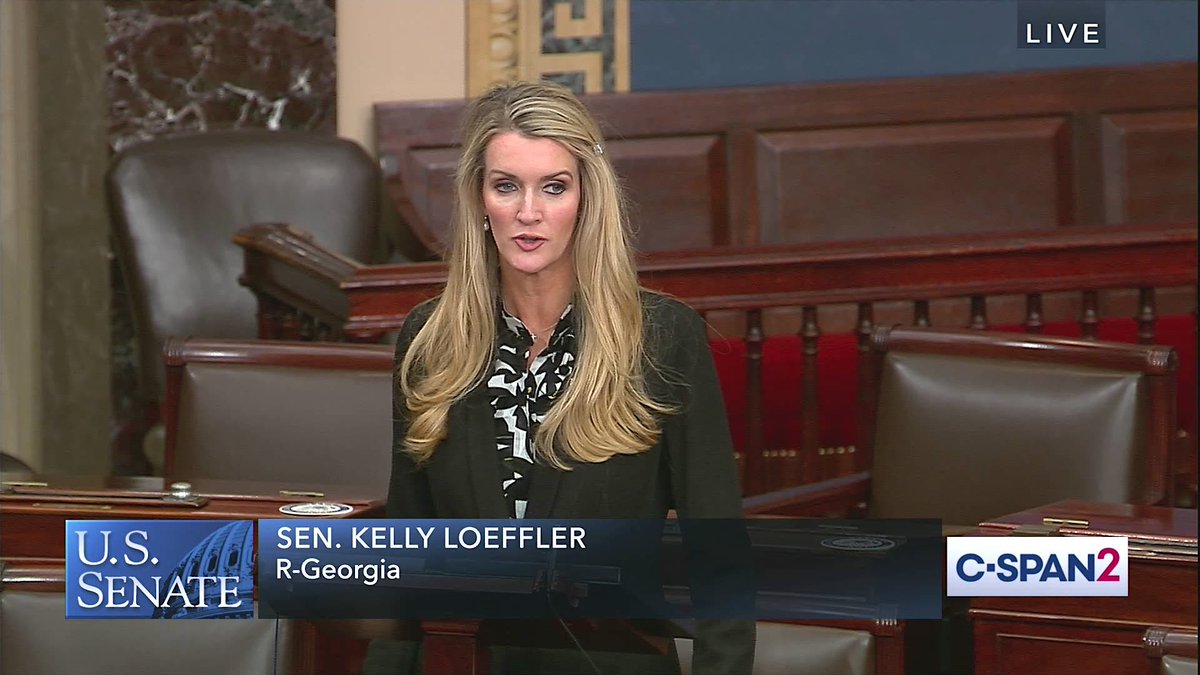

Today, the Demand Progress Education Fund and Revolving Door Project submitted a complaint to the Securities and Exchange Commission (SEC) requesting that the agency investigate Senator Kelly Loeffler for insider trading.

See the text of the complaint below:

Dear Securities and Exchange Commission Officer:

We are writing to submit a complaint regarding the behavior of Senator Kelly Loeffler. We have cause to believe that Senator Loeffler may have completed transactions on the basis of non-public information she received in her capacity as a member of the United States Senate. If so, Senator Loeffler would be in violation of the Stop Trading on Congressional Knowledge Act of 2012, which was written to “prohibit Members of Congress and employees of Congress from using nonpublic information derived from their official positions for personal benefit.” We sincerely hope that your agency will fully investigate this troubling episode.

Starting January 24 through mid-February, Senator Kelly Loeffler sold “stock jointly owned with her husband worth between $1,275,000 and $3,100,000,” in 29 separate transactions. She also purchased between $200,000 and $500,000 in stock for the company Oracle and for a teleworking software company called Citrix. Additionally, on February 26, her husband, Jeffrey Sprecher, sold $3.5 million in shares of ICE, the Intercontinental Exchange, the company for which he is CEO.

Loeffler’s first sale was initiated on the same day that she attended a closed door briefing on the coronavirus outbreak. Soon after Loeffler’s series of transactions concluded, the stock market began a sharp decline that has largely continued unabated. Over the course of the past month, the market has lost approximately 30% of its value.

The timing and circumstances of Senator Loeffler’s actions suggests that she had and made use of non-public information to avoid significant financial losses that she would have incurred had she held on to the stocks. In addition, the original source of the information provided to Senator Loeffler may have originated with businesses listed on the stock exchange.

The legislative and executive branches of the federal government will be making decisions with massive economic impact in the coming weeks and months of response to the COVID-10 pandemic. It is up to the SEC to assure the public that these decisions will not be made with an eye toward personal economic gain.

Sincerely,

Jeff Hauser

Executive Director,

Revolving Door Project at the Center for Economic Policy and Research (CEPR)

1611 Connecticut Ave, Suite 400

Washington, DC 20009

David Segal

Executive Director

Demand Progress Education Fund

1201 Connecticut Ave

Washington, DC 20036