If you’ve been following the news lately, you’ve probably heard of Harlan Crow.

The Republican mega-donor (and Nazi memorabilia collector) has for years enjoyed a grossly unethical friendship with Supreme Court Justice Clarence Thomas. According to ProPublica, Crow has taken Thomas on luxury vacations, paid for Thomas’ grandnephew’s tuition, bankrolled Ginni Thomas’ political projects, and bought several real estate properties from Thomas’ family (including his mother’s house!). In return, Thomas has often ruled in Crow’s favor in cases where Crow’s business interests have come before the Court.

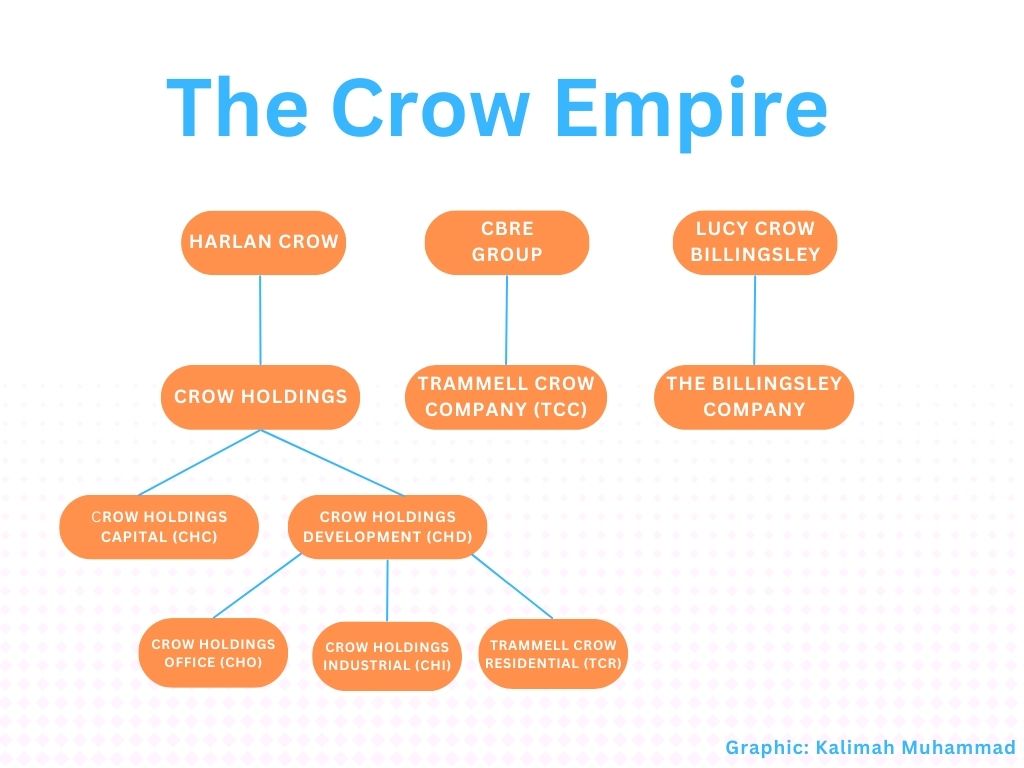

Harlan Crow’s position as heir to the massive real estate empire founded by his father Trammell (who was once described by Forbes as the “largest landlord in America”) has gotten somewhat lost in the coverage of the Thomas scandals. But it is quietly one of the most significant ways Crow exerts influence over our economy, our democracy, and – yes – our judiciary.

The Revolving Door Project is tracking Harlan Crow’s ties to the National Multifamily Housing Council (NMHC) – a developer and corporate landlord lobbying group that was led by Crow Holdings executive Ken Valach from 2022 to 2024. This blog will be regularly updated as new information comes to light.

NMHC is a landlord lobbying group that represents nearly 2,000 abusive private equity firms, developers, banks, and real estate software companies.

- NMHC has over 2,000 dues-paying member firms hailing from the private equity, banking, tenant screening, development, and property management software industries.

- A searchable list of NMHC member firms is available here. The list was compiled by the Revolving Door Project in June 2023 from NMHC’s previously-public member directory, which was mysteriously set to “members-only” viewing status by NMHC some time thereafter.

- NMHC’s members include gigantic private equity landlords regularly cited for rent-gouging and excessive fees, poor property maintenance, punitive evictions, and tenant abuse. These include Greystar, Starwood Capital, Blackstone, AvalonBay Communities, Mid-America Apartment Communities, and Tricon Residential.

- Some of the biggest banks in America – including those whose reckless and fraudulent behavior led to the devastating subprime mortgage crisis – are dues-paying NMHC members. These include JPMorgan Chase, Bank of America, Wells Fargo, Goldman Sachs.

- Tech company RealPage, which is currently under investigation by the Justice Department for helping its corporate landlord clients coordinate exorbitant rent hikes, is a dues-paying member of NMHC’s Board of Directors. Five RealPage subsidiary divisions are also dues-paying members of NMHC’s Advisory Committee.

- Several tenant-screening and credit reporting companies that have mishandled consumer data or violated consumer protection laws are dues-paying NMHC members. These include TransUnion, Experian, Appfolio, and Saferent.

- Kushner Companies, the family real estate firm of Trump son-in-law and former White House advisor Jared Kushner, is a dues-paying member of NMHC’s Board of Directors.

NMHC was recently chaired by Crow Holdings executive Ken Valach and includes several Crow-managed or Crow-linked companies as dues-paying members.

- Crow Holdings, founded by Harlan Crow’s father Trammell in 1948, is the Crow family’s privately-held real estate company, managing over $29 billion in assets.

- Harlan Crow is the current Chairman of the Board of Crow Holdings and was formerly its CEO.

- Crow Holdings consists of four subsidiaries:

- Crow Holdings Capital (CHC) – the private equity investment management arm of Crow Holdings

- Trammell Crow Residential (TCR) – the multifamily/apartment arm of Crow Holdings

- Crow Holdings Industrial (CHI) – the industrial warehouse/facilities developer arm of Crow Holdings

- Crow Holdings Office (CHO) – the office development arm of Crow Holdings

- (TCR, CHI, and CHO are collectively known as Crow Holdings Development, or CHD).

- According to the Private Equity Stakeholder Project, Crow Holdings was one of the largest asset managers that filed to evict residents while the CDC’s pandemic eviction moratorium was in effect, with 122 filings from September 2020 to July 2021.

- Crow Holdings and RealPage have been in a “strategic partnership” since 2019. According to early RealPage critic James Martin Nelson, Harlan Crow himself was one of the originators of RealPage in the late 1990s.

- TCR was sued by the New York Attorney General’s office in 2010 for failing to ensure disability accommodations in its 795-unit Atlantic Point Apartments property. TCR settled the lawsuit the following year, agreeing to retrofits and to pay $75,000 in restitution to tenants.

- TCR paid a $14,000 penalty to OSHA in 2009 over safety violations at a Broomfield, Colorado multifamily construction site.

- Ken Valach, a Crow Holdings executive, has served as the elected chair of NMHC from January 2022 to January 2024. He was formerly NMHC’s Vice Chair from 2020 to 2022.

- Valach is currently CEO of three Crow Holdings subsidiaries: CHI, CHO, and TCR.

- Crow Holdings subsidiaries TCR and CHC are both dues-paying NMHC members.

- TCR is part of NMHC’s Executive Committee – its highest membership tier with annual dues of $21,500. It was ranked the fifth-largest developer and seventh-largest builder in America by NMHC in 2023.

- CHC is part of NMHC’s Board of Directors – its middle membership tier with annual dues of $10,000 to $16,500.

- The Trammell Crow Company (TCC), a separate Dallas-based development firm founded by Harlan’s father Trammell and sold to real estate giant CBRE in 2006, is also a dues-paying member of NMHC.

- Though TCC is unaffiliated with Crow Holdings and is no longer managed by the Crow family, it is among the many companies from which Harlan Crow inherited his father’s fortune. Harlan Crow also served as TCC’s Dallas Office Building Development Operations Manager from 1978 to 1986, when he was credited with saving the company from bankruptcy.

- TCC Senior Vice President Yewande Fapohunda was a featured speaker at NMHC’s Spring 2022 Board Of Directors meeting. TCC Managing Director Joel Behrens is also an NMHC member.

- From 2008 to 2009, TCC evicted tenants from a 47-unit apartment complex it had acquired in Santa Monica, California – seeking to replace the building with luxury condos. Though TCC’s development plan was later scuttled, the site was later sold for $70 million to a private investor.

- TCC agreed to pay $250,000 to the Colorado Attorney General’s Office in a 2020 settlement over the company’s involvement in a bid-rigging scheme to expand the Colorado Convention Center.

- The Billingsley Company, a Dallas-based development and property management company co-founded and owned by Harlan Crow’s sister Lucy Crow Billingsley, is a dues-paying NMHC member.

- The Billingsley Company boasts a portfolio of “over 10,000 multifamily units” and was ranked as both a top developer and top builder by NMHC in 2018.

- The Billingsley Company received over $3.9 million in PPP loans during the COVID-19.

- According to the Private Equity Stakeholder Project, Billingsley Company filed at least 19 evictions in 2021 while the federal eviction moratorium was still in effect.

- Lucy Billingsley said of landlords facing public criticism during the pandemic, “landlord is almost a bad word, but when you’re one, it really wears your heart.”

NMHC has spent millions fighting for a pro-corporate, anti-tenant agenda – including securing lucrative corporate tax breaks and defeating rent control and eviction protections.

- Rent control: NMHC has vehemently opposed rent stabilization proposals and anti-rent gouging laws in California, New York, Oregon, and Minnesota.

- In 2018, NMHC’s PAC spent $50,000 to defeat a California ballot initiative to lift statewide restrictions on municipal rent control.

- NMHC, through the American Legislative Exchange Council (ALEC), influenced the passage of state-level bans on municipal rent control in the 1980s and 1990s.

- NMHC has frequently made the false or misleading claims that rent control restricts affordable housing supply, has high administrative costs, and benefits high-income households. (Rent control policy experts Fran Quigley and Mark Paul have rebutted these claims at length.)

- Evictions: NMHC repeatedly lobbied to overturn the CDC’s pandemic eviction moratorium and opposed legislative efforts to extend it.

- NMHC also opposed retroactive cancellation of pandemic rental debt and supported Republican legislation to roll back federal oversight of the eviction process.

- Corporate Tax Breaks: NMHC lobbied for and secured billions in lucrative corporate tax breaks in the 2017 Tax Cuts and Jobs Act and 2020 CARES Act, including the pass-through tax break, business interest deduction, carried interest and like-kind loopholes, and a doubling of the estate tax exclusion.

- Fair Housing: NMHC opposes fair housing and anti-discrimination measures, including HUD’s Affirmatively Furthering Fair Housing (AFFH) and Disparate Impact proposed rules, despite publicly pledging its support for racial justice during the George Floyd protests.

- Section 8: NMHC opposes tenant protection and affordability reforms to the Section 8 Housing Voucher program, including banning landlord discrimination against voucher holders (“source of income discrimination”) and using small-area fair market rents to improve voucher accuracy and purchasing power.

- Lobbying: Since 2019, NMHC has spent over $4 million annually lobbying Congress and the federal executive branch, making it the second-highest annual lobbying spender in the real estate sector behind the National Association of Realtors.

NMHC has strongly opposed efforts by the tenant-led Homes Guarantee campaign to secure robust federal tenant protections and rent regulations from the Biden Administration.

- NMHC lobbied the Biden Administration against signing a tenant-backed executive order to institute robust federal rent regulations and tenant protections, convincing Biden to instead issue a watered-down, industry-friendly plan in January 2023 that touted NMHC’s own voluntary affordability pledges and was widely seen by tenant organizers as a disappointment.

- NMHC still publicly complained about Biden’s January 2023 renter protection plan (the industry-preferred alternative to an executive order!) for pursuing potentially “duplicative and onerous regulations” and extending support for a Renters Bill of Rights.

- NMHC later boasted that its lobbying efforts had “mitigated the worst policy outcomes, including calls for an Executive Order on national rent control.”

- NMHC has mobilized its members to submit industry-friendly public comments against the CFPB’s tenant screening RFI and FHFA’s tenant protection RFI – two potentially meaningful actions for tenants that were first announced in Biden’s January 2023 renter protection plan.

- After Homes Guarantee campaign leaders met with NMHC leadership during a June 2023 rally outside NMHC’s D.C. headquarters, NMHC chief lobbyist Cindy Chetti released (per sources close to the campaign) an extremely misleading statement claiming that tenant organizers had endorsed NMHC’s developer-friendly tax credit pet projects.

Clarence Thomas has regularly taken NMHC’s side and refused to recuse himself from Supreme Court (SCOTUS) cases involving the Crow Empire’s business interests.

- 2005 TCR Lawsuit: Clarence Thomas has previously participated in Crow-involved cases that have come before the Supreme Court. According to Bloomberg, Thomas refused to recuse himself from hearing a 2005 appeal from an architecture firm that was suing TCR for $25 million. The Court (Thomas included) denied the plaintiffs’ petition.

- Eviction Moratorium: Throughout 2020 and 2021, NMHC and Crow Holdings (a pandemic evictor) loudly called for the Supreme Court to strike down the CDC’s eviction moratorium. The Court initially upheld the moratorium in June 2021 before striking it down two months later. Clarence Thomas voted to strike it down both times. According to Lever News, Crow Holdings routinely told its investors in 2020 and 2021 financial filings that the eviction moratorium was a direct threat to its profits. At the time of the moratorium ruling, Ken Valach was serving as NMHC’s Vice Chair.

- Clean Water Act: A longtime opponent of the Obama-era Waters of the United States (WOTUS) rule, NMHC filed an amicus brief in Sackett v. EPA (2012) urging the Supreme Court to allow plaintiffs to challenge administrative actions taken under the Clean Water Act in court. The Supreme Court unanimously sided with NMHC, teeing up a second case of the same name in 2023 (Sackett II) in which Clarence Thomas cast the deciding vote to gut the Clean Water Act.

- Disparate Impact Case: In 2014, the Supreme Court heardTexas Department of Housing and Community Affairs v. The Inclusive Communities Project Inc, which concerned whether de facto discrimination (“disparate impact”) claims over the distribution of federal housing grants could be supported under the Fair Housing Act. According to Huffpost, NMHC filed an amicus brief in the case denying that disparate impact claims amounted to actual racial discrimination. The Court ultimately ruled 5-4 against NMHC’s position, but limited how and when disparate impact studies could be used. In his Inclusive Communities dissent, Clarence Thomas sided with NMHC’s position, arguing that disparate impact claims should be banned and represented “the triumph […] of assumption over fact.”

- When the Trump administration later sought to gut the Obama HUD’s disparate impact rules, Ken Valach (in his capacity as Crow Holdings CEO) submitted a comment in support of Trump’s rollback.

- Upcoming NY Rent Control Lawsuit: NMHC has bankrolled and filed a joint amicus brief supporting an ongoing landlord lawsuit against New York’s rent stabilization law, arguing that “rent control rules are not only inefficient, but detrimental.” In 2023, the landlord plaintiffs urged SCOTUS to hear an appeal to their case following lower-court defeats. Should SCOTUS decide to hear the appeal, it is unlikely that Clarence Thomas would recuse himself from the case – despite the obvious relevance of the case to Crow Holdings’ profits.

According to a Revolving Door Project analysis of FEC records, Ken Valach, Harlan Crow, and many other Crow Holdings higher-ups have given tens of thousands of dollars to NMHC’s Political Action Committee (NMHC PAC).

- Harlan Crow has given $47,000 to NMHC PAC since 1995.

- Crow hosted two NMHC PAC fundraising events in Fall 2019 to benefit Senators Susan Collins and John Cornyn.

- In an undated advertising brochure aimed at potential PAC donors, NMHC touted a fundraiser at Harlan Crow’s house attended by NMHC members and then-Senate Majority Leader Mitch McConnell.

- Harlan’s late mother Margaret and deceased brother Howard gave a combined $17,500 to NMHC PAC during their lifetimes, while his surviving brother Trammell Jr. (currently under investigation for sex trafficking) has given $5,000 to NMHC PAC.

- Ken Valach has given a jaw-dropping $73,450 to NMHC PAC since 1995.

- Michael Levy, CEO of Crow Holdings, has given $7,500 to NMHC PAC since 2019.

- Peggy Bertsch, Chief Administrative Officer of Crow Holdings Development, has given $8,850 to NMHC PAC since 2012.

- Bertsch is also a current member of NMHC’s Risk Management Working Group.

- Kevin Dinnie, COO of Crow Holdings Development, has given $6,000 to NMHC PAC since 2020.

- Dinnie is also a current member of NMHC’s Membership Engagement Committee and was a speaker at NMHC’s 2020 Optech Conference.

- Dodge Carter, Senior Managing Director of Multifamily at Crow Holdings Capital, has given $9,000 to NMHC PAC since 2014.

- Carter was a speaker at NMHC’s 2018 Houston Conference.

- Steve Bancroft, Senior Managing Director of Multifamily at TCR, has given $18,100 to NMHC PAC since 2011.

- Jim Berardinelli, Managing Director of Multifamily at TCR, has given $4,500 to NMHC PAC since 2017.

- Berardinelli’s Crow Holdings bio mentions he is a member of NMHC.

- Matt Enzler, Senior Managing Director of Multifamily at TCR, has given $9,750 to NMHC PAC since 2011.

- Enzler’s Crow Holdings bio mentions that he is “actively involved” in NMHC.

- Anne Raymond, a member of the Crow Holdings Board of Directors, has given $6,000 to NMHC PAC since 2012.

- Raymond is slated to speak at NMHC’s 2023 “Women In Multifamily” Virtual Event.

- Mark Gibson, a member of the Crow Holdings Board of Directors, has given $5,000 to NMHC PAC since 2005.

- Gibson was the keynote speaker at NMHC’s 2020 Apartment Strategies Outlook Conference.

- Leonard Wood Sr., a retired TCR Partner and former NMHC Chairman, has given at least $5,350 to NMHC PAC since 1989. His son Leonard Wood Jr. is currently a Senior Managing Director of Multifamily at TCR and has given at least $19,000 to NMHC PAC since 2013.

- Leonard Wood Sr. has previously spoken at NMHC’s Emerging Leaders Events.

- Leonard Wood Jr. was a featured speaker at NMHC’s 2019 Apartment Strategies Outlook Conference and currently sits on NMHC’s Government Affairs & PAC Committee.

- J. Ronald “Ron” Terwilliger, the retired CEO of TCR and a well-known housing philanthropist, has given at least $16,600 to NMHC PAC since 1989.

- Terwilliger is a member of the Horatio Alger Association, an elite club of wealthy and powerful conservatives of which Clarence Thomas is also a longtime member. Thomas has attracted controversy for accepting lavish undisclosed gifts from the Alger Association’s members and holding the group’s annual induction ceremony for new members at the U.S. Supreme Court.

- Laurence Pelosi, Senior Managing Director at Crow Holdings and nephew of former Speaker of the House Nancy Pelosi, has given $4,000 to NMHC PAC since 2021.

- NMHC PAC has given at least $73,500 to Nancy Pelosi and her leadership PAC since 2004.

- Nancy Pelosi was a featured speaker at NMHC’s Fall 2018 Meeting.

- Laurence Pelosi is married to Alexis Pelosi, who is currently serving as Senior Advisor for Climate to HUD Secretary Marcia Fudge.

- Since 2014, NMHC PAC has spent over $2 million each election cycle supporting pro-industry candidates in both parties.

This post was first published on July 21, 2023 and last edited on February 9, 2024. It will be periodically updated with new information.