Our Blog

April 27, 2021

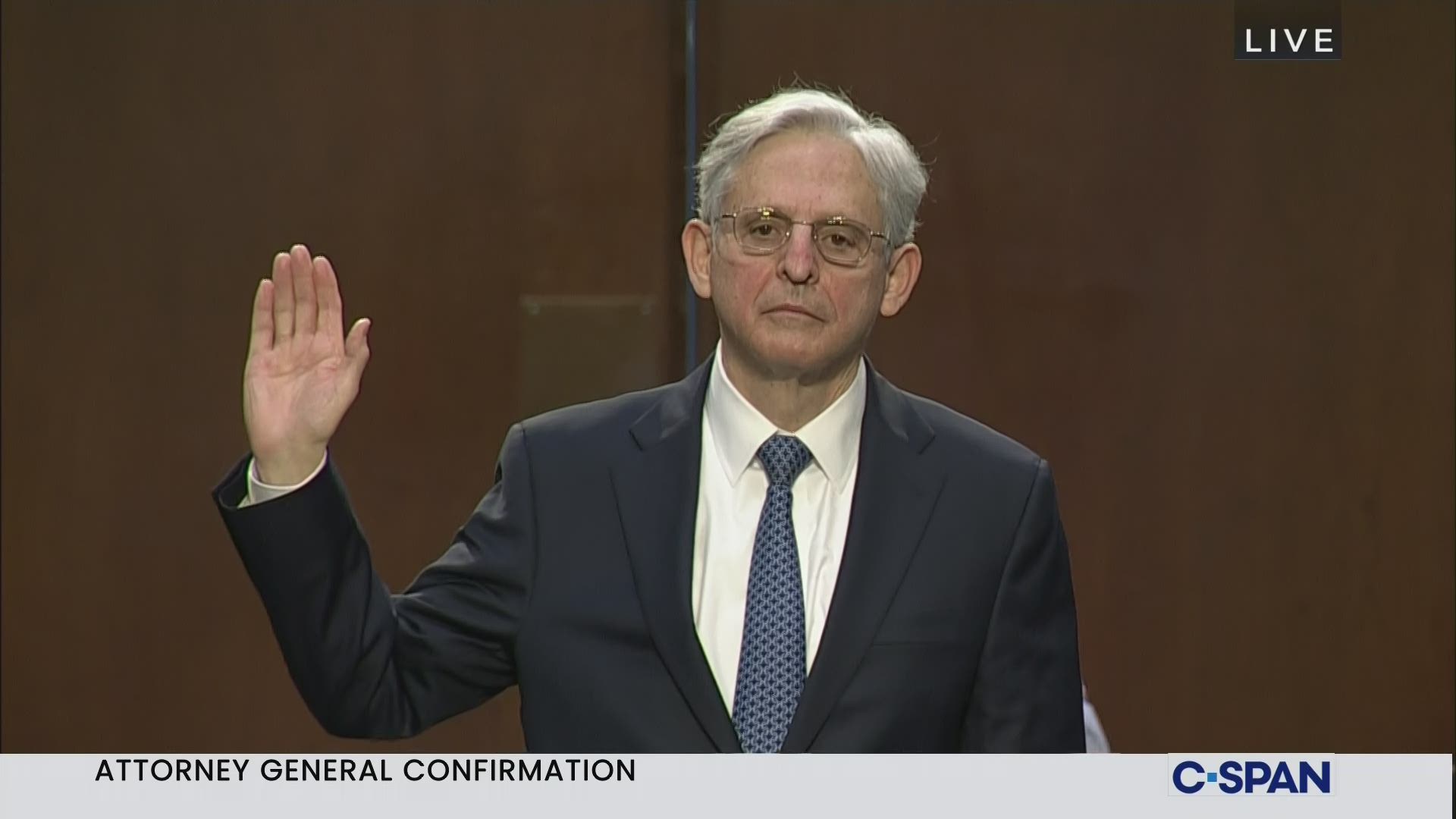

Questions for Joe Biden and Merrick Garland’s Department of Justice

Amid a transition season of bruising battles between progressives and the old guard over Biden’s Cabinet picks, Merrick Garland for Attorney General was one choice that sparked relatively little controversy. Three months into Biden’s presidency, however, Garland is quickly shaping up to be the most consequentially bad Cabinet pick. On any number of important metrics — sweeping out holdovers from the Trump administration and reversing its positions, preventing corporate capture, and acting aggressively to advance the public interest — Garland is failing.

April 27, 2021

The Longer Trump’s Acting Comptroller Stays, The More Damage He’ll Do

Under Otting and Brooks’ leadership, the OCC rolled out rules contrary to its responsibility to maintain a federal banking system that is safe against systemic risks and provides aid to all customers. Now they’re all out of power — but Acting Comptroller, Blake Paulson, whose ascent was ensured by Brooks and Mnuchin, has demonstrated no desire to change course from the path set by Trump’s lackeys. That is why Biden needs to act quickly and appoint a Comptroller who recognizes the dangerous precedent set by the Trump administration.

April 23, 2021 | The American Prospect

Place Human Lives Over Pharma’s Property Rights

The Biden administration is divided over whether to waive trade protections for Big Pharma—with Commerce Secretary Gina Raimondo as a key industry ally.

April 22, 2021

Merrick Garland: A Potential Wolf in Sheep’s Clothing for Criminal Justice Advocates

Last May, as the country first erupted into protests over George Floyd’s murder at the hands of Minneapolis police officer Derek Chauvin, Biden promised that he would deliver “real police reform” if elected president. The country’s eyes are on Minnesota again this week after a police officer in a Minneapolis suburb shot and killed Daunte Wright, sparking a new wave of protests. This time, Biden need no longer speak in hypotheticals; he is President. Will his administration deliver?

April 22, 2021

Delaware Connections Run Deep As DuPont Family's Darla Pomeroy Heads To Treasury

Darla Pomeroy, who is married to an heir to the DuPont family fortune, was just named Senior Advisor to the Office of Domestic Finance at the US Treasury. While her record does not show any familiarity with financial regulatory policy, it reveals instead a history of a powerful corporation highly influential in Delaware placing a close ally in the administration.

April 22, 2021

Wall Street Lawyer Leading Wall Street Oversight Unsettles Allies Of Gensler

“Oh has chosen to spend over 20 years reinforcing a corrupt status quo in corporate America, in which the largest companies systematically evade democratic accountability. No one so comfortable with the breakdown in the rule of law over corporate America should be entrusted with responsibility for implementing long-overdue accountability on Wall Street.”

April 22, 2021

Watchdog Calls For Investigation Into White House's Delay On Covid-19 Workplace Safety Standards

Watchdog calls for an investigation into potential corporate influence behind the White House’s continued delay on Covid-19 workplace safety standards

April 21, 2021

Education Department Must Rein In For-Profit College Industry Mergers And Reclassifications

The Education Department controls almost every aspect of regulating for-profits, from certifying the accrediting agencies to the enforcement of student protections like the gainful employment rule and the borrower defense rule.

April 21, 2021

Watchdog Grades Biden A "B-" On Preventing Corporate Capture Of Executive Branch

“Although the bar is low, Biden has proven to be the least captured and most public-oriented President of any of our lifetimes,” the Revolving Door Project wrote. “That said, Biden’s administration thus far is certainly not spotless.”

April 21, 2021

100 Days In and Biden Still has Trump Holdovers Left to Fire

As the end of his first 100 days nears, Biden has signed into law COVID relief legislation, published his inaugural budget proposal, and begun rolling back some of the damage wrought by the Trump years. On the campaign trail, Biden rightfully described Trump as an “existential threat”.

April 19, 2021

In Latest Disappointment From Yellen, John Morton Is Treasury's New Climate Counselor

The U.S. Treasury Department announced today that John Morton would be appointed as its first Climate “Counselor,” tasked with organizing financial-related climate work across the executive branch’s financial regulators.

April 19, 2021 | The Daily Beast

Silicon Valley’s Favorite Fixer Aims to Stop the Rising Left

But the old guard continues to wield significant power and will be hard pressed to admit defeat, as exemplified by political strategist Bradley Tusk’s continued success. Some might recall Tusk as New York Mayor Bill De Blasio’s biggest critic. Others know him best as Silicon Valley’s favorite political fixer. Teachers’ unions probably remember him comparing them to the NRA. Tusk’s particular brand of politics—lobbying against regulation on behalf of companies he then invests in—in some ways represents the last gasp of corporate control over government that has run rampant since the Reagan era.

April 16, 2021

The Brother Of A Pharma Lobbyist Advises Biden As He Weighs Vaccine IP Waiver

Despite pushback from progressives, Ricchetti has continued to hold a powerful advisory position in the Biden White House. His background in corporate lobbying and strong ties to the pharmaceutical industry are deeply troubling signs as the Biden Administration faces enormously consequential decisions about how to end the COVID-19 pandemic.

April 16, 2021

Break Big Pharma's Stranglehold On COVID-19 Vaccines With Existing Powers, 16 Groups Tell Biden Admin

A coalition of 16 organizations called on Secretary of Commerce Gina Raimondo and COVID-19 Response Coordinator Jeffrey Zients to maximally use the executive branch’s existing powers to end the pharmaceutical industry’s stranglehold on supply on COVID-19 vaccines in an open letter today.

April 15, 2021

Why Is Politico's Ryan Heath Carrying Water For Big Pharma Monopolies?

The world is currently at an inflection point – Western leaders can choose to continue blocking the TRIPS waiver and lock in a cycle of dependence or empower poorer countries to develop generic vaccines and build infrastructure that will safely put the pandemic behind us. Critiques of the TRIPS waiver claim that most poor countries lack the infrastructure to carry out vaccine operations – a paternalistic view that suggests that manufacturing capacity, supply chain management, and logistics are static in nature. The sooner we act, the more time poorer countries have to begin mobilizing resources needed to make generic vaccine development possible.