The center-left mindset of favoring quantitative analysis and just-so mathematical solutions is particularly myopic when it comes to fossil fuel pollution.

This article was originally published in The American Prospect.

It’s been a bad few weeks for the sort of opinionated center-left pundit who prides themselves on data-driven, hyper-quantitative approaches to solving society’s intractable problems.

In the philanthropic world, the utilitarian philosophy of Effective Altruism (EA) is in crisis after the implosion of its most famous benefactor, Sam Bankman-Fried, and his cryptocurrency exchange FTX. Bankman-Fried also underwrote some devotees of popularism, the political strategy of poll-testing every talking point and avoiding discussing rights for socially-disadvantaged groups. Popularists, like everyone else in politics, also completely failed to predict the midterm elections.

This has all led to some delicious schadenfreude for critics of both EA and popularism. But it’s useful to look at what so many influential people find appealing about these imperiled micro-philosophies.

Both EA and popularism appeal to a desire for mathematical rigor and objective calculation, whether it’s calculating lives-saved-per-dollar or playing probabilities in politics. In short, they’re exciting to quants. Devotees on the center-left can even seem derisive of qualitative reasoning skills, viewing them as unscientific, unpragmatic, and subjective.

In the most extreme cases, these quants laugh at entire fields of study, from sociology to history to psychology to interdisciplinary studies. (Both Bankman-Fried and popularist Sean McElwee take pride in not reading books.) Their ardor for counter-intuitive, novel ideas closes them off to boring but effective solutions that are really obvious to anyone who values both quantitative and qualitative analysis.

It’s an easy way for centrists to dismiss anyone to their left without needing to engage seriously with their arguments, all while flattering the dismisser as rational, sober-minded, and above all, smart. As journalist Michael Hobbes put it in an evisceration of Freakonomics, a pure distillation of this sort of pop-quant thinking, “the whole problem with this is this overconfidence in quantitative data that is completely stripped of all of its societal context.”

The stakes of this math-obsession problem are big. Well-meaning quants are enormously influential within the Democratic Party on every issue. This includes the most pressing problem of our time: climate change. Unfortunately, their oh-so-clever preferred solutions keep collapsing, as time keeps running out to preserve the basic conditions necessary for a hospitable planet.

Quantish neoliberals tend to buy into the promise of carbon capture technologies, continually overlooking the fact that carbon capture is infeasible at the scale at which it’s baked into climate models, and fails frequently at its current scale too. This reflects a broader problem: if you only trust the numbers, what happens when the numbers are fudged? Nonexistent accounting standards led to FTX’s downfall, and broad extrapolations from limited metrics also explain a lot of the problem with election modelers.

Quants belittle activists for their commitment to the simple imperative of phasing down fossil fuel use, while being seemingly incapable of acknowledging how keeping fossil fuels in use preserves current patterns of environmental racism in the U.S., and disproportionately imperils the world’s most vulnerable nations. They also, ironically, ignore the math that shows renewable energy is cheaper now than fossil fuels.

There’s also the wonkish white whale of the carbon tax—so elegant on paper, but so regressive and politically toxic in practice that it triggered a mass uprising in France. This hasn’t deterred quants from Substack to Harvard to keep on pressing for a policy that’s done nothing but fail for decades.

Another example comes from yet another scandal rocking the world of market-based climate “solutions.” On Monday, an exposé from Bloomberg, the exact opposite of a socialist magazine, showed that the biggest corporate purchasers of carbon offsets were buying “the cheapest and most suspect type of offset—those tied to renewable-energy projects.”

As we wrote in our “Industry Agenda” report on carbon offsets in March, offsets are supposed to fund emissions reductions that would not have happened if not for the offset. (This is called “additionality.”) Since renewable energy is now the cheapest form of energy production, almost all viable solar and wind projects can attract investment on their own without offset purchases. But this also means that offsets which just finance solar and wind projects can be offered at an extremely low price.

Corporate America’s shift toward “net-zero” branding, driven in large part by carbon offsets, has been a major rhetorical weapon for Democratic-aligned opponents of the Green New Deal in recent years. If the free market really were generating its own money-making solution to climate change, the thinking went, then reforming America into an eco-minded social democracy seemed unnecessarily disruptive. But carbon offsets have always seemed like bullshit to…well, anyone who thought cryptocurrency seemed like bullshit. To smell the stink from both of these financialization tools, though, one needs some basic qualitative skepticism.

The carbon offset world lost trust over a decade ago when the UN’s first carbon offset scheme collapsed, and the autopsy reports revealed rot all the way down. Yet this year, at the UN’s climate conference in Egypt, US global climate envoy John Kerry announced a new public-private carbon offset scheme backed by the Rockefeller Foundation and Bezos Earth Fund. It’s based on a scheme that already threatens Indigenous people’s rights in the Amazon rainforest, reinscribing neocolonial patterns in ways that are dismissed as irrelevant to those who hail such “innovative” public-private partnerships as “win-wins.”

Kerry claims his carbon offset scheme will help developing countries raise capital to build renewable energy capacity. But developing countries themselves spent COP27 pushing with remarkable unity for the creation of a “loss and damage” fund, to which high-income, high-polluting companies would contribute money for climate disaster recovery. Though the fund was created at the last minute, there’s no guarantee that rich countries will finance it. Indeed, conservative pundits pounced on this plea with the textbook political example of throwing up math to dodge deeper questions of justice: asking “How are you going to pay for that?”

In short, offsets are rife with market failures, lack independent credibility, and are not particularly welcome to the people they’re supposed to be helping. As UPenn Law professor Shelley Welton writes, net zero pledges largely ignore the social dimensions of climate change as “imbricated with racial and economic justice,” dimensions which “are critical for political legitimacy and durability.” None of their proponents are racing to solve these problems, since they don’t threaten—and in some cases, directly help—the unspoken real reason for the industry’s existence: providing a green sheen for polluting corporations to continue business as usual.

Data wonks on the center-left came out of the woodworks to voice their support in September for Joe Manchin’s failed push to sacrifice democratic input on the energy infrastructure permitting process in favor of electrification at any cost—including new fossil fuel infrastructure projects unconstrained by community objection. These pundits claimed objection to the bureaucratic delays energy projects face, but the one major study into the issue shows the underlying problem isn’t community input or environmental reviews, it’s too little federal agency capacity.

But “Agencies with more employees can finish things faster” isn’t counter-intuitive enough to captivate the quants. And “rebuilding community trust” in government as key to improving the speed and equitability of energy build-out is an insight one can only gain from the kinds of qualitative analysis these data wonks rebuke.

Instead, the quants took Manchin at his word that he was very serious about permitting reform, ignoring how transparently the bill’s aims were securing a future for West Virginian fossil fuel projects over community opposition. As the Prospect’s David Dayen pointed out last week, Manchin’s recent decision to block the confirmation of the Federal Energy Regulatory Commission chair makes it “hard to say he’s a sincere believer in improving transmission build-out, when he’s stalling its biggest champion in the government.”

This isn’t to say that economistic analysis is worthless or should all be scrapped. Far from it: economics is a discipline with a lot to teach us. But it’s not the only discipline, or always the most important or relevant. If you want to govern a society well, you need to be able to think in a lot of different ways and gather a lot of different insights. And experts seeking to shape that governance need to be humble about how much their particular field of expertise can ever know.

It’s ironic that a lot of center-left types are the first to wield “respect the experts” as a weapon against their ideological rivals. We should respect experts, but respect lots of different kinds of experts, and recognize that it’s not impossible for highly informed people to still be wrong. Hopefully the last few weeks have been humbling experiences for the quant crowd. If not, we fear for the future of the planet if they remain the only ones in America’s driver’s seat.

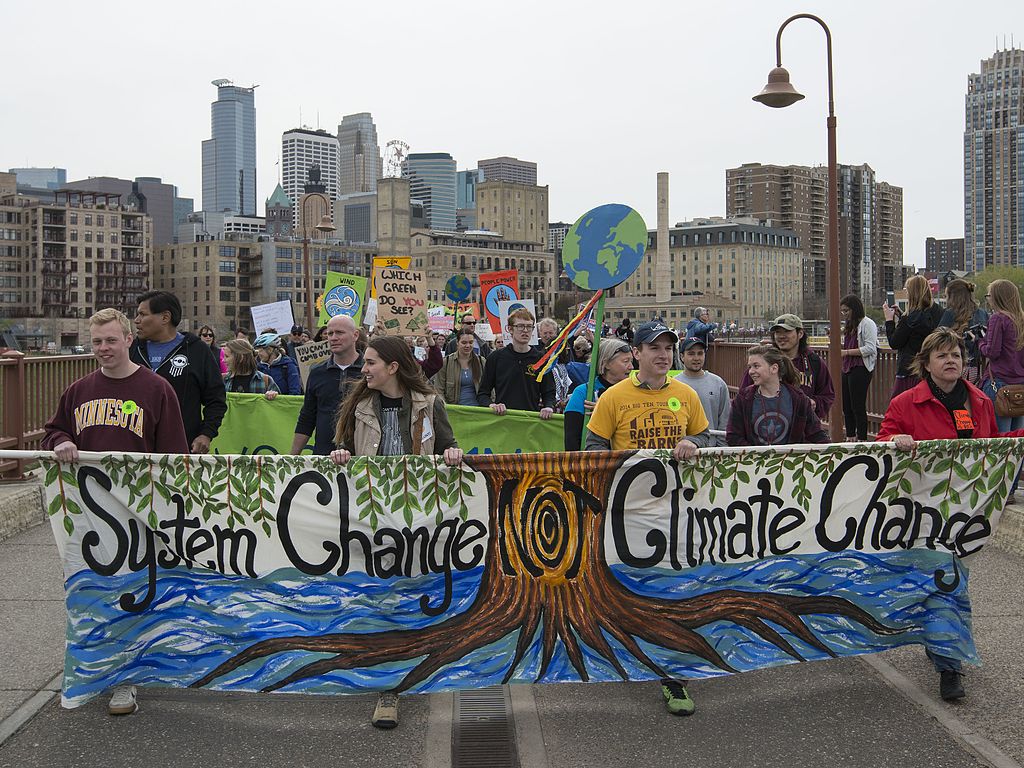

IMAGE: “People’s Climate Solidarity March Minnesota” is licensed under the Creative Commons Attribution 2.0 Generic license.