This article first appeared in our weekly Hack Watch newsletter on media accountability. Subscribe here to get it delivered straight to your inbox every week, and check out our Hack Watch website.

This week, Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra delivered his semi-annual report to Congress. Chopra, as I’ve written before, is a champion for everyday Americans. In just two years on the job, he’s hit repeat-offenders like TransUnion and Wells Fargo with record fines and lawsuits, stopped scammers from preying on veterans and the elderly, and returned $2.6 billion to defrauded consumers. Recently, he’s led the charge against junk fees and spearheaded a rule to root out lending discrimination against women and minority-owned small businesses (the “1071 Rule”).

Corporate predators are furious that Chopra is standing up for the little guy. The Chamber of Commerce – whose CEO and board members have close ties to corporations that Chopra has gone after — has run pricey ads painting Chopra as an “out of control bureaucrat.” Other lobbying groups are trying to kill the Bureau for good by getting the Supreme Court to scrap its funding structure (a radical move that would cause untold chaos). The American Bankers Association (ABA) and Consumer Bankers Association (CBA) (whose members include every Wall Street Bank and credit card company you can think of) have endorsed this legal challenge.

Corporate criminals can also rely on two allies to spread this smear campaign: industry-funded Republican members of Congress, and a passive news media that rarely checks the receipts.

Consider the many Republicans who slammed Chopra’s crackdown on overdraft and late fees this week, all of whom have taken campaign donations from banks that charge junk fees:

- Senate Banking Chair Tim Scott claimed junk fees “encourage financial discipline”. Scott’s top career contributors include the ABA, PNC Bank, Capital One, and American Express.

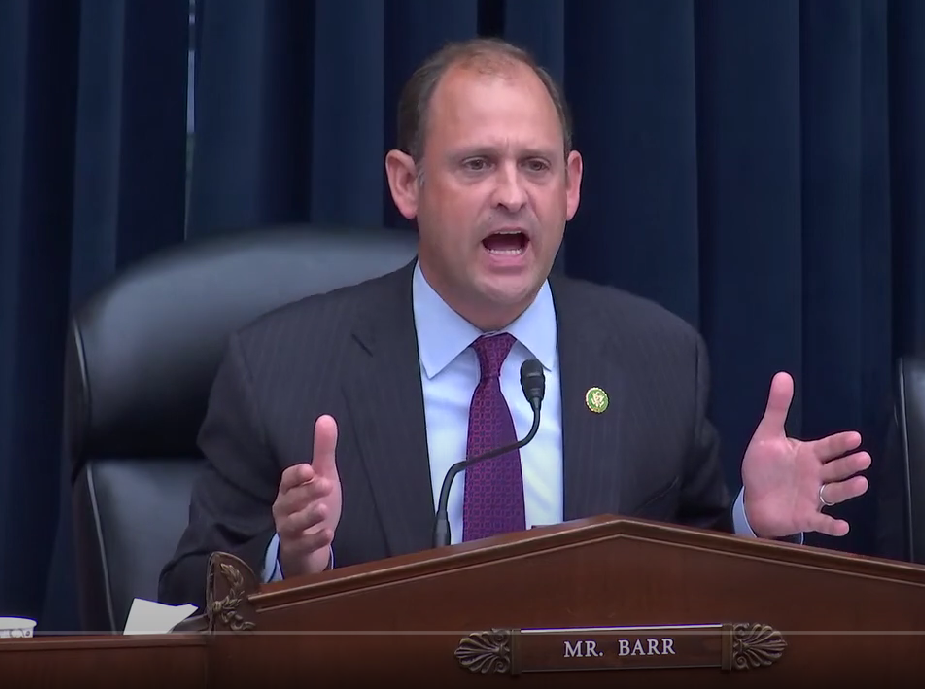

- House Financial Services Chair Andy Barr claimed Chopra’s junk fee crackdown was an attempt to “pander to Americans hung out to dry in Biden’s economy.” Barr’s top career contributors include the ABA, JPMorgan, US Bank, and Bank of America.

- Rep. Ann Wagner asserted that Chopra’s rule to rein in late fees would have “no consumer benefit.” Wagner’s top contributors last cycle included Capital One, Wells Fargo, and the ABA.

- Rep. Blaine Luetkemeyer accused Chopra of coining the term “junk fee” to “extort more money” out of businesses, calling him the “greatest extortionist in the history of this country.” Whether by extortion or sweet exhortation, Luetkemeyer’s top contributors last cycle included the ABA, CBA, US Bank, PNC, and Capital One.

Republicans also grilled Chopra on a recent data leak at the CFPB – an incident that Chopra has responded to by terminating the employee at fault, referring the investigation to the agency’s Inspector General, and strengthening agency data security practices. Would it shock you to learn that these same outraged Republicans have also taken money from companies who have suffered bigger consumer data breaches?

- Sen. Tim Scott argued that the CFPB could no longer be trusted to collect data of any kind after its recent leak. Over his career, Scott has received at least $8,000 from Equifax, $26,000 from Capital One, $18,500 from JPMorgan Chase, and $11,000 from First American Financial.

- Rep. French Hill said of the breach, “how in the world can the citizens trust their government to keep their private information?”. Over his career, Hill has received at least $1500 from Equifax, $40,000 from Capital One, $39,000 from JPMorgan Chase, and $13,000 from First American Financial.

- Rep. Bill Huizenga fumed that CFPB staff hadn’t provided satisfying answers to his data breach questions and accused Chopra of hiding information from House Republicans. Over his career, Huizenga has received at least $57,000 from Capital One, $56,000 from JPMorgan Chase, and $18,000 from First American Financial.

No matter the issue area, Republicans couldn’t resist exposing their own corruption with each attack on the CFPB.

- Rep. Mike Flood applauded the end of the student loan payment pause, singling out loan servicing companies like NelNet as the real victims in the student debt crisis. Flood received $10,000 from NelNet last cycle.

- Rep. Warren Davidson criticized Chopra for scrutinizing the tenant screening industry’s shoddy data-keeping practices, arguing that landlords needed to keep criminals out of their properties. Davidson has received at least $53,000 in career donations from credit reporting agencies and lobby groups that represent the tenant screening industry.

- Rep. Dan Meuser – saying the quiet part out loud – asked Chopra why the Bureau “wasn’t doing a better job of “serving banks […] the clientele you’re supposed to be helping.” Meuser’s slip sheds light on his primary clientele: last cycle, he received tens of thousands from Goldman Sachs, Wells Fargo, UBS, and the ABA.

And then there’s the biggest frauds of them all: Louisiana Senator John Neely Kennedy and Tennessee Congressman Andy Ogles.

- Kennedy accused Chopra of wanting to spy on “small business-women’s sexual preferences” through its 1071 rule, screaming at him, “Who appointed you Pope?”

- Ogles (borrowing a line from transphobic failed DJ Matt Walsh) spent four minutes asking Chopra to define the term “woman” before opining that his agency should “die a painful death [for] abusing its power.”

Both men have some nerve to lecture Chopra about integrity. Kennedy was a loyal Democrat until 2007, when he switched parties and his entire platform to keep his career alive in red Louisiana. When he ran for Senate as a Democrat in 2004, Kennedy boasted about hiring “women and minorities [to] positions of authority” in the State Treasurer’s Office. Today, the Vanderbilt-educated Rhodes Scholar rants about “woke, high-IQ liberals” and speaks in a Foghorn Leghorn-esque drawl he noticeably lacked 20 years ago.

Ogles (who only got elected thanks to racial gerrymandering) is an even more absurd charlatan. Formerly a Koch lobbyist who stopped 30,000 Tennessee veterans from getting healthcare, Ogles might rival George Santos as the most brazen fraudster in Congress. According to Insider, Ogles has repeatedly lied about being a “trained economist” (he took a single economics class in college, for which he received a ‘C’), “successful entrepreneur” (he ran a small travel agency and insurance company, both of which folded within a year), and “former member of law enforcement” (he was a volunteer sheriff’s deputy who was let go for skipping training). Ogles has also failed to file his financial disclosure forms and refuses to say what he did with $25,000 he raised for a children’s burial garden that was never built.

So what reason (besides being scam-artists themselves) do Kennedy and Ogles have to hate Biden’s top scam-buster?

- Kennedy’s top campaign contributors include corporate law firm Latham & Watkins (which has represented TransUnion and advised the private equity buyout of repeat offender MoneyGram) and pyramid scheme poster-child Amway (who Chopra previously scrutinized at the FTC).

- In just one election cycle, Ogles has taken thousands from the ABA, predatory payday lender Advance Financial, Woodforest Financial (a top overdraft fee bank), student loan servicer EdSouth, and at least five major auto dealers.

For anyone who has a minute to run an OpenSecrets search, these members’ conflicts of interest are blindingly obvious. Unfortunately, mainstream reporters don’t seem all that interested in doing that. As I’ve written before, the press routinely treats unhinged Republican criticisms of the CFPB as a valid side of a reasonable debate, failing to connect the dots between industry campaign contributions and GOP policy stances. Consider these recent examples:

- Reuters, 6/13/23: This article opens and closes with Tim Scott’s attacks on the credit card late fee rule, contrasting his perspective with Rohit Chopra’s. The article never mentions Scott’s massive campaign contributions from the credit card industry, despite acknowledging his 2024 presidential campaign and separately referencing how“industry lobbyists’” view junk fees.

- NYT, 6/15/23: This article features Andy Barr’s “pandering” quote on junk fees in order to “both-sides” the issue, describing Barr as a “powerful fee defender” and contrasting his stance with progressive fee critics. Nowhere are Barr’s industry contributions noted.

- CNBC, 3/9/23: Barr, Blaine Luetkemeyer, and Rep. Barry Loudermilk are all quoted slamming Chopra and defending junk fees in a March hearing, with no mention of their campaign donations. American Financial Services Association (AFSA) lobbyist Bill Himpler is also quoted, but no mention is made of AFSA having given tens of thousands to all three Republican Congressmen.

Contrast this lazy reporting to investigative outlets like The Lever and Sludge, who have followed the industry money for their junk fee coverage. This type of reporting is essential – it gives the public valuable context about why the CFPB’s critics say what they say. Like they do with climate change, the mainstream press is again “both-sidesing” an issue where one side has an obvious ulterior financial motive to argue its position – a motive that would erode their credibility if openly acknowledged.

This week’s hearings confirmed once again what anyone paying attention already knows: corporate criminals are puppeteers using campaign cash instead of string, and Congressional Republicans are their marionettes. Ask them about the CFPB and watch their noses grow.

The media should stop taking their lies at face value and follow the money.

This article originally appeared in Hack Watch, our weekly media accountability newsletter. Subscribe here to get it delivered to your inbox every week.

[PHOTO: House Financial Services Committee, 6/14/23]