The bankers! Won’t somebody please think of the bankers?

That’s Wall Street’s reaction this week to the State of the Union Address, in which President Biden highlighted his administration’s work to crack down on “junk fees”. A good portion of this work has come from the Consumer Financial Protection Bureau (CFPB), where Director Rohit Chopra has fought to rein in the most predatory fees that big banks and financial services companies routinely charge their customers.

Last October, the CFPB issued formal guidance warning the banking industry that surprise overdraft and depositor fees – which generated over $15.47 billion in revenue for big banks in 2019 – were likely illegal. The Bureau has also fined two big banks – Regions and Wells Fargo – for repeatedly hitting customers with these fees.

This month, the CFPB expanded its junk fee crackdown by proposing a rule to curb excessive late fees charged by credit card companies, which cost American families $12 billion each year. If finalized, the rule would reduce late fees to $8 in most cases (down from their current high of $41), cap late fees at 25% of the required minimum payment (current rules allow companies to charge as much as 100% of the minimum payment owed), and end an automatic inflation adjustment that has allowed card companies to steadily raise late fees. The CFPB’s rule would close a regulatory loophole in the 2009 CARD Act that allows card companies to avoid scrutiny of whether their late fees met a reasonable and proportional standard.

Industry lobbying groups are not happy about this. Since October, the banking industry’s most well-funded mouthpieces have been issuing alarmist press statements about the Bureau’s junk fee crackdown. And just like the unruly House Republicans whose State of the Union interruptions backfired spectacularly, these shills are looking for a fight on turf enormously favorable to the President. Here are some examples:

- The Independent Community Bankers of America (ICBA) claimed late fees were “clearly disclosed and represent a small portion of the cost of credit cards to customers” and said the term ‘junk fees’ “mischaracterized current practices [that] are appropriate”.

- The Bank Policy Institute called the CFPB’s draft rule a “solution in search of a problem” and griped that its overdraft guidance was “invective-filled improper enforcement”.

- The Credit Union National Association (CUNA) said the credit card fee rule would hurt small credit unions and called overdraft fees “an essential lifeline” for its members.

- Bill Hulse, vice president of the Chamber of Commerce’s Center for Capital Markets Competitiveness (CCMC), slammed the credit card fee rule as “red tape” that would increase costs and reduce choices for consumers, and defended late fees on the basis they “ensure prompt repayment [and] help consumers establish good credit history“

- The American Bankers Association (ABA) called the rule “extreme” and warned it would reduce competition and force credit card companies “to adjust to the new risks [by] raising APRs for all consumers.”

- Consumer Bankers Association (CBA) President Lindsey Johnson, in a widely-mocked video statement, said of the Bureau’s junk fee crackdown: “Look, we get it: Politics is politics. But we’re urging policy makers from across the ideological spectrum to support hardworking Americans during these uncertain times.”

You’ll be shocked to learn that none of these arguments stand up to scrutiny.

- Junk fees are hardly an “essential lifeline” for the banking and credit industry’s survival. Overdraft fees have only existed for 30 years and Wall Street didn’t even come up with them – the concept surfaced in the 1990s, when management consultants convinced Wall Street banks that fees could be a profitable new revenue stream (talk about a “solution in search of a problem!”). The same goes for credit card fees – the penalty amounts were historically low until companies discovered they could be an easy source of profits in the 2000s. Furthermore, many banks and credit unions have recently slashed or eliminated overdraft fees in response to consumer backlash. If these fees are so essential, why haven’t these companies gone out of business yet?

- Far from being “clearly disclosed”, the details of overdraft and credit card late fees are routinely hidden by lenders in lengthy terms of service agreements, meaning consumers have to be tricked into accepting them. As the Daily Show’s Trevor Noah pointed out, these details include the fact that overdraft fees have required customer opt-ins since 2010. Banks also have a track record of manipulating customers’ sequence of transactions to charge more fees.

- Junk fees aren’t “appropriate and small”: lenders are increasingly squeezing them as a revenue source and the costs can add up quickly for consumers. According to watchdog Accountable.US, the top 20 U.S. banks most dependent on junk fees made an average of 41.7% of their 2021 net incomes from junk fees. The CFPB has likewise found evidence of systemic reliance on junk fees by the nation’s leading banks and credit card companies, with Director Chopra noting that 75 percent of current credit card late fees have no functional purpose beyond padding companies’ profits. These fees – as high as $36 for overdrafts and $41 for missed credit card payments – add up for hard-working Americans, more than half of whom don’t have enough savings to cover a $1000 emergency. For cardholders who live paycheck to paycheck and may miss paying their bills by a day or two, these repeated fees can trap them in a vicious cycle of debt.

- Far from helping consumers thrive, overdraft and credit card late fees punish the most vulnerable and marginalized Americans. According to Accountable, the top 20 U.S. banks that are most dependent on overdraft fees disproportionately target lower-income consumers through their branch locations. The CFPB has likewise found a pattern of banks using junk fees to prey on the poor: almost 80% of overdraft fee revenue comes from just 9% of accounts, with a median balance of $350, while credit card late fees disproportionately burden low-income and Black consumers.

- As for the claims that the banking and credit industries are already competitive, and that eliminating junk fees would just lead to higher prices? Big Business is giving away the game here: if leading banks and lenders have such unchecked market power that they can hike prices and consumers can’t turn to a lower-cost competitor, that’s a great argument for antitrust enforcement. Indeed, the banking and credit card industries today are highly consolidated and anti-competitive thanks to a wave of mergers, leaving consumers and small businesses with fewer choices and higher costs.

Here’s something else you should know: the groups decrying the CFPB’s junk fee crackdown don’t give a damn about consumers and have a proud history of ripping off everyday Americans. The CBA and Bank Policy Institute represent the largest banks in America – many of whom have repeatedly engaged in wide-spread fraud and discrimination against their customers. The ABA (whose confidential membership list likely overlaps with CBA and BPI’s) brags openly about its decades of lobbying against the separation of commercial and investment banking – one of the primary causes of the devastating 2008 financial crisis. The Chamber of Commerce’s CEO sits on the board of a company that has repeatedly cheated consumers, while its Capital Markets Competitiveness Center was founded to fight post-Enron anti-fraud laws and is staffed almost entirely by former bank lobbyists and Republican staffers.

The CBA, Chamber, and ABA are also all currently trying to get the federal courts to declare the CFPB’s funding structure unconstitutional, a decision that – if upheld by the Supreme Court – would gut vital consumer protections and threaten social safety net programs like Medicare and food stamps.

As we’ve argued before, President Biden should be picking more fights with these corporate con-artists to draw a sharp contrast between what he stands for and what his opponents stand for. Instead of letting the industry’s propaganda go unchallenged in the press, the Biden administration should fight back in public and directly rebut their arguments. The President has grown increasingly comfortable with taking the fight to Republicans in his speeches and on social media, so why not take the fight to the Big Banks as well? Across party lines, voters are inclined to agree with him – they overwhelmingly back the CFPB and hate the business lobby.

Biden could direct Press Secretary Karine Jean-Pierre to rebuke the industry’s attacks on the CFPB during the daily press briefing. He could tell new Chief of Staff Jeff Zients to carry on Ron Klain’s tradition of slamming the administration’s opponents on Twitter. As he’s done before for student debt, MAGA extremism, and the infrastructure law, Biden himself could use the bully pulpit to deliver a prime-time speech or cut a direct-to-camera video calling the business lobby’s defenses of junk fees what they really are: a bunch of malarkey.

Picking very public and necessary fights with industry lobbyists like this will not only give the CFPB some much-needed backup, but also get more voters to pay attention to the administration’s junk fee crackdown and how ordinary Americans stand to benefit from it. Corporate lobbyists seem to believe the public will buy their laughable talking points and are publicly raring for a fight. Biden should give them that fight – and make sure it goes 15 rounds, because every news cycle generated about Biden’s junk fee crackdown is a compelling argument for his reelection.

A full-throated corporate crackdown is good politics and good policy. As Biden said himself, “Americans are tired of being played for suckers.”

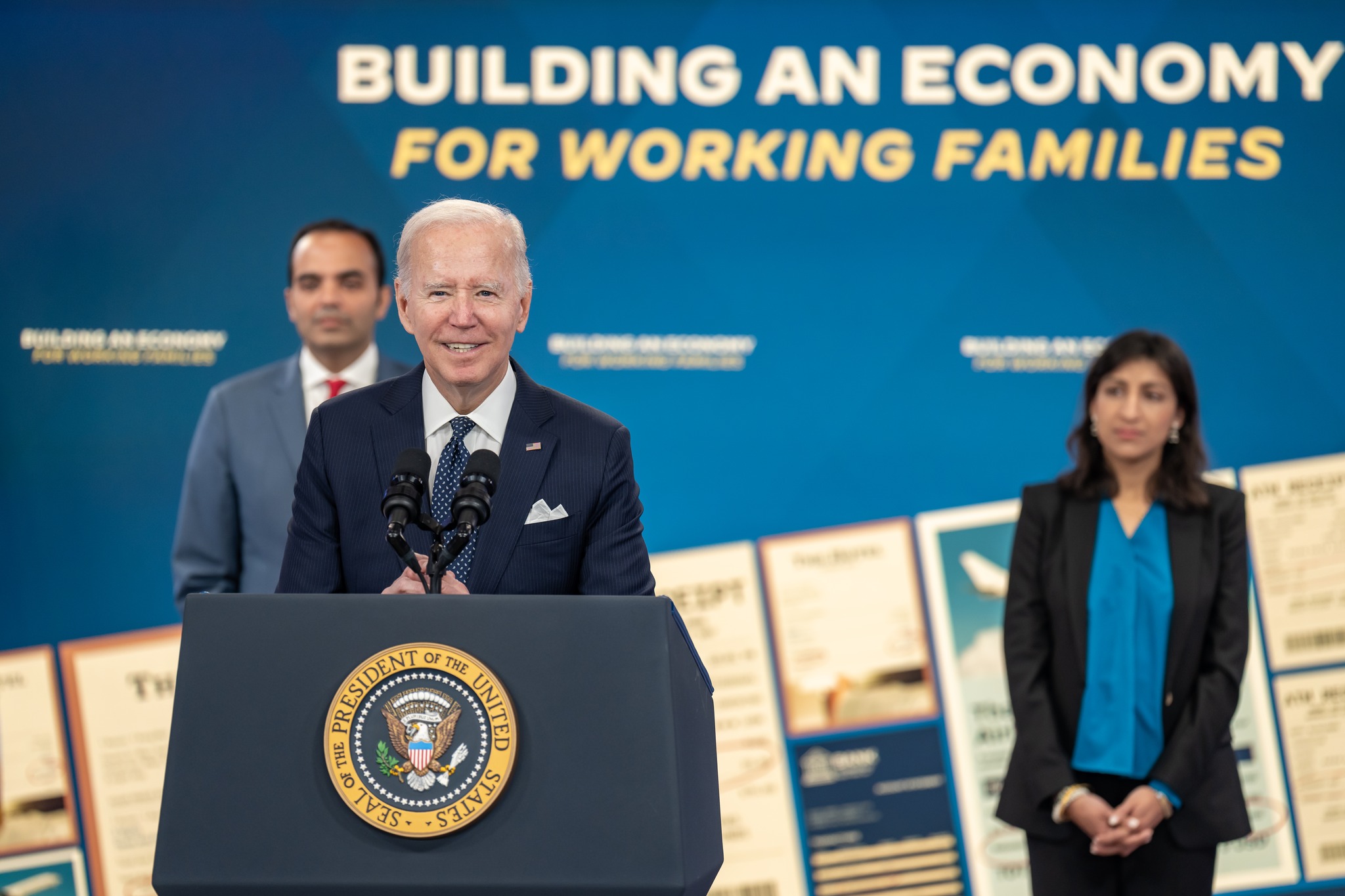

IMAGE CREDIT: The White House, 10/26/22