President Biden’s proposal to cap rents brought the neoliberal hacks and Big Real Estate propagandists out of the woodwork, but that shouldn’t stop Harris from adopting—and expanding—upon what tenants desperately need.

This article first appeared in our weekly Hackwatch newsletter on media accountability. Subscribe here to get it delivered straight to your inbox every week, and check out our Hackwatch website.

In one of his final actions before dropping out of the 2024 race, President Biden announced a major legislative proposal last week to make corporate landlords cap annual rent hikes at 5% or risk losing lucrative federal tax breaks. The Biden plan follows a July 12th announcement from the Federal Housing Finance Agency (FHFA) to condition federal financing on adoption of tenant protections, including 30-day notice for rent hikes. It is unlikely either announcement would have happened if not for tenants across the country rising up—including the grassroots Tenant Union Federation (TUF), which has been urging Biden to take immediate executive action and cap rents in federally financed properties.

Almost immediately, Biden’s legislative proposal was attacked by the real estate lobby and other apologists for unchecked corporate power (including The Washington Post’s resident hack Catherine Rampell, a previous subject of Hackwatch). Sharon Wilson Géno, president of the National Multifamily Housing Council (NMHC), called the rent cap proposal a “farce” that would “impede future development.” The Housing Solutions Coalition, an alliance of industry groups led by NMHC and the National Apartment Association (NAA), asserted such a policy would “hurt renters and communities.” The National Association of Realtors (NAR) alleged Biden’s plan would depress housing supply and “harm the people we need to help the most.”

Longtime Hackwatch readers will know these groups are not the benign-sounding “housing organizations” that outlets like CNN and the Post describe them as; they are well-funded Big Real Estate lobbying groups whose corporate landlord members have a self-serving financial interest in opposing rent regulation. NMHC, for example, represents over 2,000 abusive private equity firms, Wall Street banks, and tech companies—including Greystar, Blackstone, Wells Fargo, RealPage, and Harlan Crow’s real estate empire. NMHC routinely partners with NAA to lobby Congress and state governments against rent stabilization and tenant protection measures and for giant corporate tax cuts (including billions of dollars in lucrative tax breaks in Trump’s 2017 tax law and CARES Act). NAR was the second-biggest federal lobbying spender in 2023, trailing only the Chamber of Commerce, and the single biggest in 2022. It paid $418 million this March to settle lawsuits over its anti-competitive practices (a related probe by the Department of Justice’s Antitrust Division is ongoing).

One particularly outspoken critic of Biden’s proposal is Jay Parsons of property manager Madera Residential, described by the New York Times as a “housing economist.” Speaking to the Times, Parsons called the White House plan’s carve-outs for new housing development an “empty promise.” In further attacks on Twitter, Parsons said Biden’s plan “lacked weight and seriousness” and likened tenant organizers—including TUF’s Tara Raghuveer—to anti-vaxxers (a favorite tactic of his).

Curiously, the Times failed to mention that Parsons is the former long-time chief economist for RealPage, the scandal-plagued tech company facing multiple state Attorney General and class action lawsuits (as well as a possible DOJ civil suit) for apparently orchestrating a massive rent-gouging collusion scheme. Parsons abruptly left the firm in March—just days after Arizona Attorney General Kris Mayes sued RealPage and nine of its landlord clients for illegal price-fixing—and has blocked us on Twitter for pointing out his association with RealPage. As we’ve previously written in this newsletter, not only is Parsons’ “scientific case” against rent control extraordinarily flimsy, but the mainstream press keeps giving him a free pass on his conflicts of interest and blatant reputation-laundering. Raghuveer’s response to Parsons (which is worth reading in full) sums it up perfectly: “Industry sycophants portray themselves as ‘neutral experts’ when they’re actually perpetrators.”

Another rent cap opponent is former Council of Economic Advisers Chair Jason Furman, whose critiques have been amplified by Parsons. Speaking to The Washington Post, Furman alleged that rent control is “about as disgraced as any economic policy in the tool kit” and “will ultimately make our housing supply problems worse, not better.” Furman is the son of the late Jay Furman, a for-profit real estate developer who made millions constructing office buildings and shopping centers as president of RD Management LLC.

Longtime RDP readers will also recognize Furman as a neoliberal hack who has gained notoriety for his lucrative corporate consulting work and laughable defense of Wal-Mart as a “progressive success story.” Like Larry Summers, Furman is another disciple of Robert Rubin whose outspoken criticism of Biden’s progressive economic policy appears to stem from him no longer having a job in Democratic politics. He’s alleged Biden’s American Rescue Plan was “too large” (a claim at odds with his past statements about the Obama era), called student debt forgiveness “reckless” and inflationary (a claim not even Wall Street forecasters agreed with), and defended the Federal Reserve’s counterproductive rate hikes (while dismissing Isabella Weber’s increasingly-vindicated sellers’ inflation theory). Furman’s latest swipe against Biden’s housing policy is yet another cry for attention.

Speaking of attention-seekers, recurring Hackwatch subject Matt Yglesias offered his lengthy criticism of Biden’s rent caps plan on Substack. While taking issue with Biden’s targeting of corporate landlords (which Yglesias called “nonsense”) and his embrace of the concept of rent regulation (“rigid ideology […] a bad idea”), Yglesias dismissed Biden’s plan to condition landlord tax breaks as “meaningless” and “so limited across so many dimensions that it won’t actually do any harm.” Yglesias’ dismissal of corporate landlords’ villainy is particularly at odds with reality, with the RealPage scandal demonstrating that large landlords collectively have the power to raise rents across the board and decrease housing affordability on a massive scale. (To be clear, we agree with TUF’s assessment that Democrats should follow up this historic proposal with even bolder federal action.)

To back up his broader attack on rent control, Yglesias cited some dubious sources we’ve discussed before, including a 2017 paper by ex-Goldman Sachs analyst Rebecca Diamond claiming that San Francisco’s rent control increased rents and reduced available housing. The AIDS Healthcare Foundation has criticized Diamond’s paper for being riddled with flaws and biases, including a skewed dataset, manipulation of mathematical models across different iterations of the study, and burying the paper’s own positive conclusions about rent control (including about the policy’s anti-displacement effects). California renters rights group Tenants Together has also criticized Diamond’s methodology, which ignored landlord-created loopholes in San Francisco’s rent control law, the tech boom’s housing demand shock, the city’s refusal to enforce local laws against short term rental conversions, and other exogenous factors that drove rent increases over the study’s timeframe. Yglesias also lazily cites a research review of rent control funded by NMHC, one of the biggest landlord lobby groups in Washington (lending credibility to questionable sources is on-brand for Matt, who once said Sam Bankman-Fried “is for real”).

As we wrote back in March, the decades-old economic consensus that rent control is a “failed policy” is being increasingly challenged by new evidence that rent control has a negligible impact on supply and delivers effective relief to those who need it most (read Fran Quigley’s fantastic myth-busting Substack piece “Fast, Vast, and Built to Last”). Yes, supply is important—but tenant protections like rent control have an important role to play in mitigating the affordable housing crisis. The climate crisis makes rent control and other tenant protections even more important; in their absence, landlords who make green upgrades will jack up rents and displace low-income households. A growing number of economists have likened the shifting consensus on rent control to the profession’s reversal on the minimum wage in the 1990s, when Nobel Prize winners David Card and Alan Krueger found that higher minimum wages increased living standards for low-wage workers with minimal job loss.

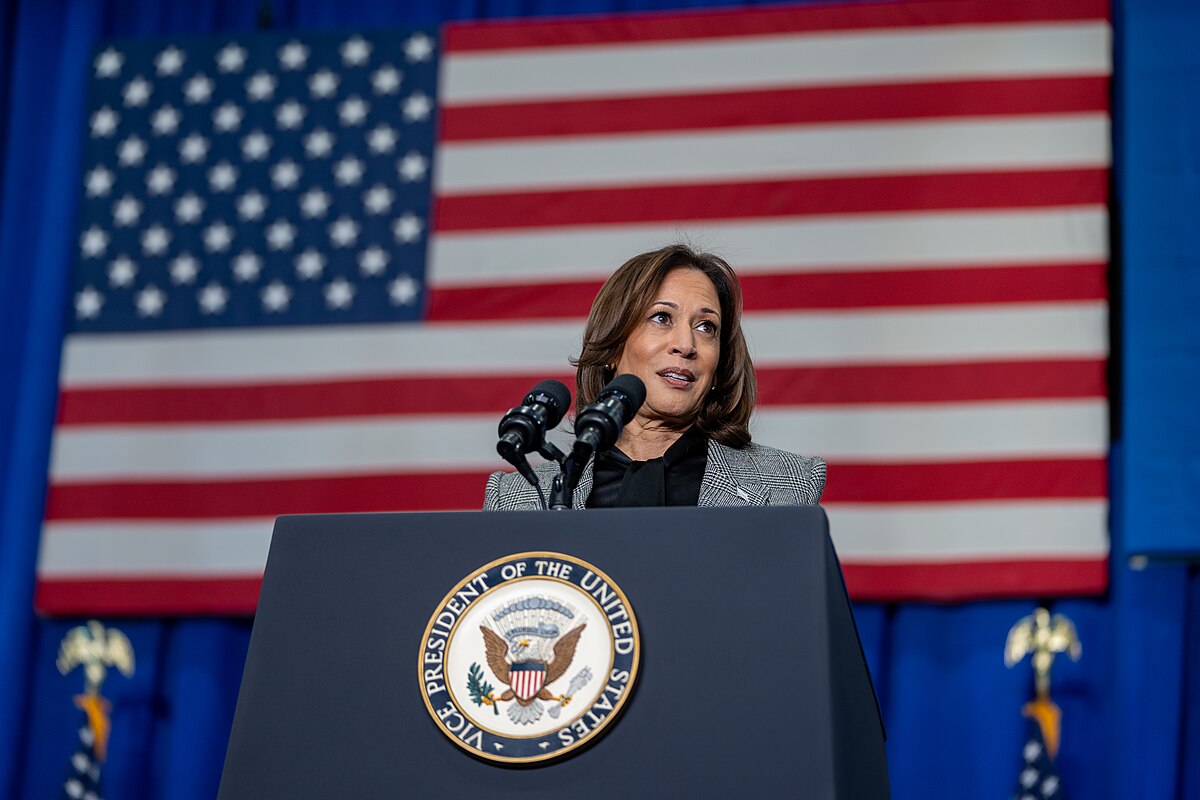

All this is to say that Kamala Harris must finish what Biden has started and ignore Big Real Estate’s hackery on rent regulations. As our Emma Marsano wrote for The New Republic, Harris’ prior experience taking on wrongdoers as California attorney general and a Senate Judiciary Committee member make her well suited to pick fights with corporate villains. Taking on corporate landlords will also make Harris the perfect foil to Trump, a racist landlord who coddled fellow Big Real Estate moguls as President and is banking on Wall Street barons to return him to the White House.

If Harris wants to carry the torch that Biden has passed and win this race, she must embrace a corporate crackdown on rent-gougers. It’s good policy and even better politics.