This article first appeared in our weekly Hackwatch newsletter on media accountability. Subscribe here to get it delivered straight to your inbox every week, and check out our Hackwatch website.

The stock-market show is a TV news institution. Ticker tapes, staccato theme music, brassy anchors, and a constant barrage of jargon are recognizable genre tropes, invoked and parodied for years.

One of the older entries in the genre is “Wall Street Week”, which aired on PBS from 1970 – 2005. In 2014, Anthony Scaramucci of all people briefly revitalized “Wall Street Week” for Fox Business (of course), which may be why Donald Trump tapped Scaramucci to join his presidential transition team in 2016. Fox’s “Wall Street Week” ended in 2017.

Thanks for reading Revolving Door Project Newsletter! Subscribe for free to receive new posts and support my work.Subscribe

But in January 2020, Bloomberg Television brought back “Wall Street Week” as a Friday news roundup and interview show hosted by David Westin, the former president of ABC News. And from the very first episode, Bloomberg’s iteration boasted one particular A-list star: Larry Summers, the neoliberal economist and archetypal revolving door figure.

Almost every Friday for the last three years, Westin has granted Summers 10 minutes of free airtime to opine on the week’s economic trends. He’s introduced as a “Wall Street Week Contributor,” though Westin frequently alludes to his Harvard ties and status as a former Treasury Secretary and National Economic Council Director.

One trend in particular has obsessed Summers for the last two years — inflation, and the Federal Reserve’s response to it. Summers’ opinions on inflation have substantially affected economic policy debate since 2021, leading to magazine features and direct call-outs from the White House. Summers, of course, is an influential figure and highly skilled economist in his own right, but there’s no denying that his weekly TV slot — and the multiple Bloomberg clips and articles per week that just repackage what he said on Westin’s most recent show — greatly contributed to keeping him in the public consciousness. Plenty of economists have written about inflation for the last two years, but none embedded themselves as deeply in Americans’ brains as Summers.

I recently watched almost every Summers interview on “Wall Street Week” over the last two years. Uncovering what Summers argued, and how Westin framed it, offers a lot of insight into how the media trains us to think about the economy. For the first part of this Hack Watch mini-series, we’ll look at the media side: the questions Westin asked, and what they tell us about how discussion is framed.

Westin’s Questions

We have to start with a simple question: what’s the point of giving Larry Summers a weekly slot on “Wall Street Week”?

The most ethically defensible answer is simple: Summers is a prominent macroeconomist, and his analysis of economic trends might be helpful for investors. Particularly now that it’s part of Bloomberg, “Wall Street Week” is largely aimed at financial professionals trying to decide where to park their money. In most other segments of the show, Westin interviews executives and in-house economists at major financial firms about their current money-making strategies.

In that context, it might make sense to interview Summers, at least every now and again. He has a longstanding interest in the financial sector (especially deregulating it). Whatever one thinks of Wall Street, Summers’ analysis of economic data could be useful for Wall Streeters.

But almost all of Summers’ segments since 2021 have ended up drawing on his experience in government to let him offer political punditry. And often, even when Summers himself has wanted to stick strictly to economics, Westin has nudged him in a more explicitly political direction.

The Federal Reserve offers the clearest example of this. Summers made a point initially of not offering direct advice to Fed Chairman Jerome Powell, but this often amounted to a semantic exercise of speaking around the issue, thanks to Westin’s framing of questions.

“Larry, you’ve always been very careful in saying you’re not going to advise the Fed on what it should do, so I’m not going to ask your advice on what it should do from here on out — but I am going to ask you, based on what you know, given the fact that it now recognizes the issue of inflation, and where it is, what you expect over the next few months?” Westin asked on June 18th. There’s no way to answer this question without Summers implicitly stating what he hopes the Fed will do.

As Summers began using his segments week after week to claim that inflation was not transitory, Westin explicitly took his side. After Summers dismissed the arguments of Team Transitory on June 11th, Westin asked “Assuming you’re right, which I do, why aren’t the markets reacting?” A week later, he asks Summers “You warned about the danger of overheating literally the day that President Biden announced his American Rescue Plan. … What’s the one we’re missing? What’s the next one around the corner that we may not be paying enough attention to?”

There might not be anything wrong with Westin making his own views on the issue clear. The so-called “view from nowhere” has deep flaws as a journalistic norm. But the ethical thing would then be for Westin to ensure he’s presenting the opposing view regularly and in good faith, since the causes of inflation were a live, fierce debate at the time.

He had Team Transitory economist Paul Krugman on a handful of times, and MMT economist Stephanie Kelton on exactly once. Contrast this with Summers’ segments every single week, every one of which inevitably has been about the Fed and inflation since Spring 2021.

And if Westin were deliberately choosing to move beyond the view from nowhere, he wouldn’t use hackish verbal tricks to get around expressing his opinion on other matters, when relevant.

“This is a time in Washington that is different from any other in recent history, at least. There’s been a lot of back and forth over some things that people might think are even silly debates. Are we moving toward a more serious Washington?” Westin asked on March 11th, 2022 after the Ukraine invasion. Journalists attributing what almost certainly are their own views to what “some are saying” — or in this case, what “people might think” — is one of the oldest tricks in the book.

It got far worse after December 2021, when Powell was renominated as Chair and the White House stopped using the word “transitory” to describe its inflation strategy. Summers entirely dropped any pretense of avoiding advising the Fed, and Westin gladly obliged. “Given the alarming rate of inflation as you describe it, what would you have the Federal Reserve do?” Westin asked on March 11th. On April 1st, Westin casually opined that jobs numbers seem to show the economy “may be even more overheated than we previously thought,” taking it as a given that the economy was both overheated and by more than previously predicted.

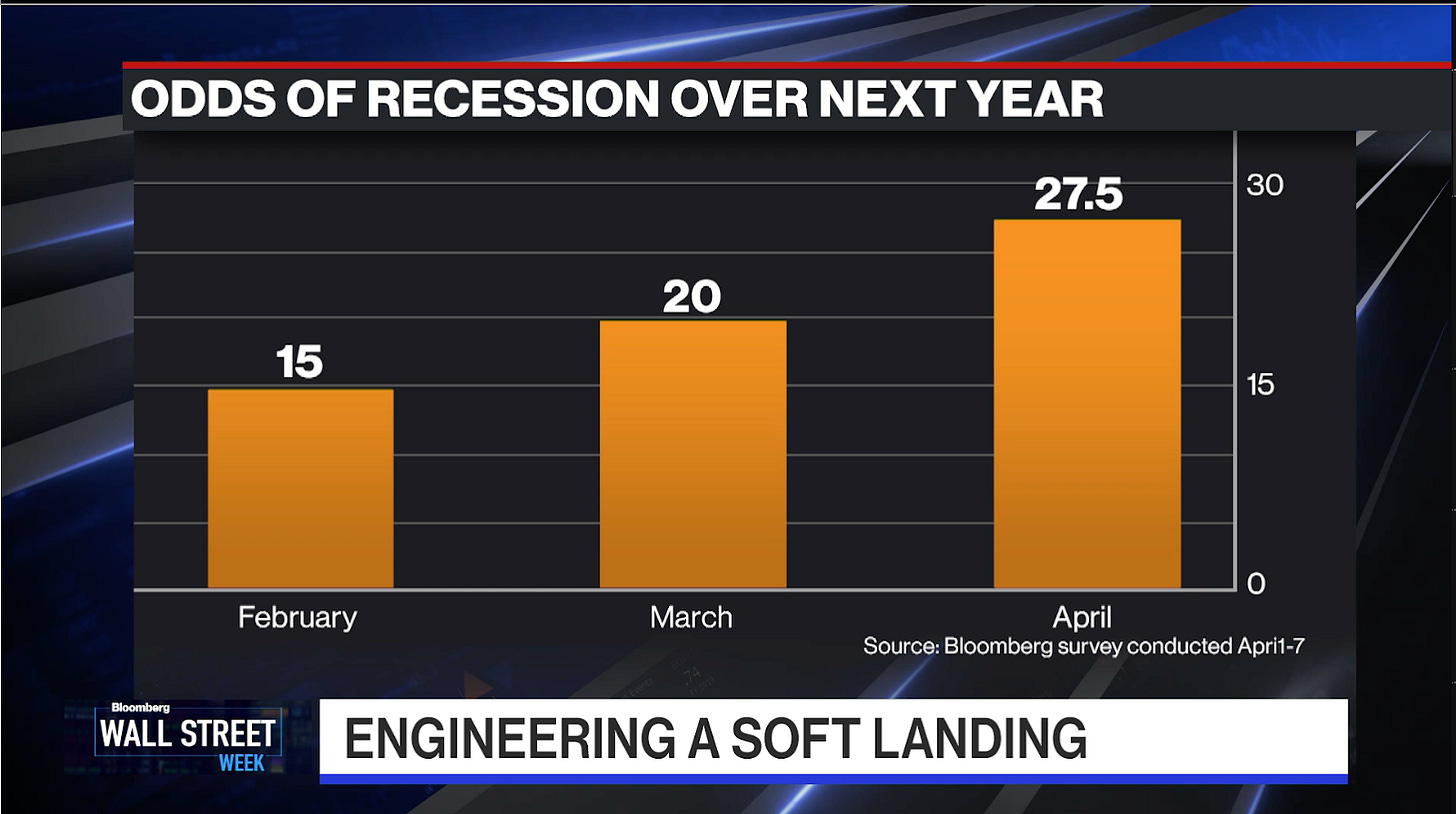

On April 8th, Westin asked Summers to respond to a Bloomberg survey showing “the numbers are going way up” on economists predicting a recession. The program flashed a bar graph with scary-looking increases…until you look at the numbers and axes, and see the survey found just 27.5 percent of economists were predicting a downturn. In other words, the numbers “going way up” showed that about 3 in 4 economists at the time didn’t think the US was headed toward recession.

Then there’s the questions Westin didn’t ask. Over the last two years, he’s frequently prodded Summers to comment on the cryptocurrency market, leading the economist to say crypto was “here to stay” and something which “people who are looking for safety hold wealth in,” similar to “digital gold.” Summers even told Westin that crypto fans should accept regulation to help the industry become “systemic in [its] importance.”

Not once, though, did Westin ask about Summers many ties to the cryptocurrency industry itself. As we’ve written, Summers’ early embrace of crypto firms was a key legitimator of the industry in the eyes of regulators, academics, and the media. It wouldn’t even be unethical or unusual for “Wall Street Week” to host someone with a financial investment talking about that investment. That’s what most of the show’s non-Summers segments are about every week.

It seems that it’s important for “Wall Street Week” to maintain an illusion of Summers as an independent onlooker to events in the news. This is especially notable since Summers himself was sometimes the news topic being discussed. On severaloccasions, Westin let Summers respond to his opponents in the inflation debate on the show. The very premise of these segments ought to indicate that Summers isn’t a mere commentator, but a newsmaker himself who needs independent scrutiny.

For my money, though, Westin’s single most ideological question to Summers over the last two years had nothing directly to do with inflation at all. In a segment about corporate concentration, Westin asked on May 21st, 2021 “As a matter of economics — not morality, economics — is that good or bad or neutral for the economy?”

To claim that one can extricate morality from economics — that one can judge the quality of the economy without first making a moral judgment about what a good economy even means — is about as ideological as it gets. The question of what is “good for the economy” itself inherently bypasses the question of the goals of an economy. Yet I’m sure Westin thought he was being a responsible journalist asking Summers for strictly the facts.

Compare this to Summers’ frequent invocations of “economic science” on the program, which I’ll discuss more in a follow-up newsletter next week. But for now, it’s worth asking: who is David Westin anyway?

David Westin’s Path To The Top

He’s followed a telling path to the top of elite business journalism. In 1997, Westin became President of ABC News. This was his very first job in any newsroom anywhere — he’d been ABC’s lawyer, and later the head of its scripted television division, but had never edited a story, covered an event, or produced a broadcast before he was in charge of overseeing every career reporter in ABC’s lineup. Even as the director of a news channel, Westin reportedly enjoyed jet-setting to Washington and struck up a friendship with the British Ambassador. Westin’s wife, Sherrie Rollins Westin, is also a well-connected Washingtonian who did public relations work for President George H.W. Bush.

After departing ABC in 2010, Westin invested in media companies on Wall Street for a few years before landing his first news-anchor job at Bloomberg. He’s been behind news desks ever since. But this circuitous route to the top means Westin has scant experience with actual shoe-leather reporting — the kind of experience that teaches journalists to be skeptical of the sort of elites with whom Westin associates that too often have cute, clean answers to tough, complex questions.

Moreover, coming to broadcast journalism from the business side before the reporting side may incline Westin to see his partnership with Summers through a more cynical lens. The idealistic explanation for why Larry Summers deserves a weekly Bloomberg TV slot is that he’s a brilliant economist (which is contestable) who can provide meaningful information to the public. The pessimistic explanation is that he’s someone whom Bloomberg’s target audience will tune in to see.

But Summers has taken Westin’s generosity and run with it, turning his weekly segments into a miseducation bonanza about the basics of the central bank. For more on that, look forward to the next edition of this Hack Watch mini-series.