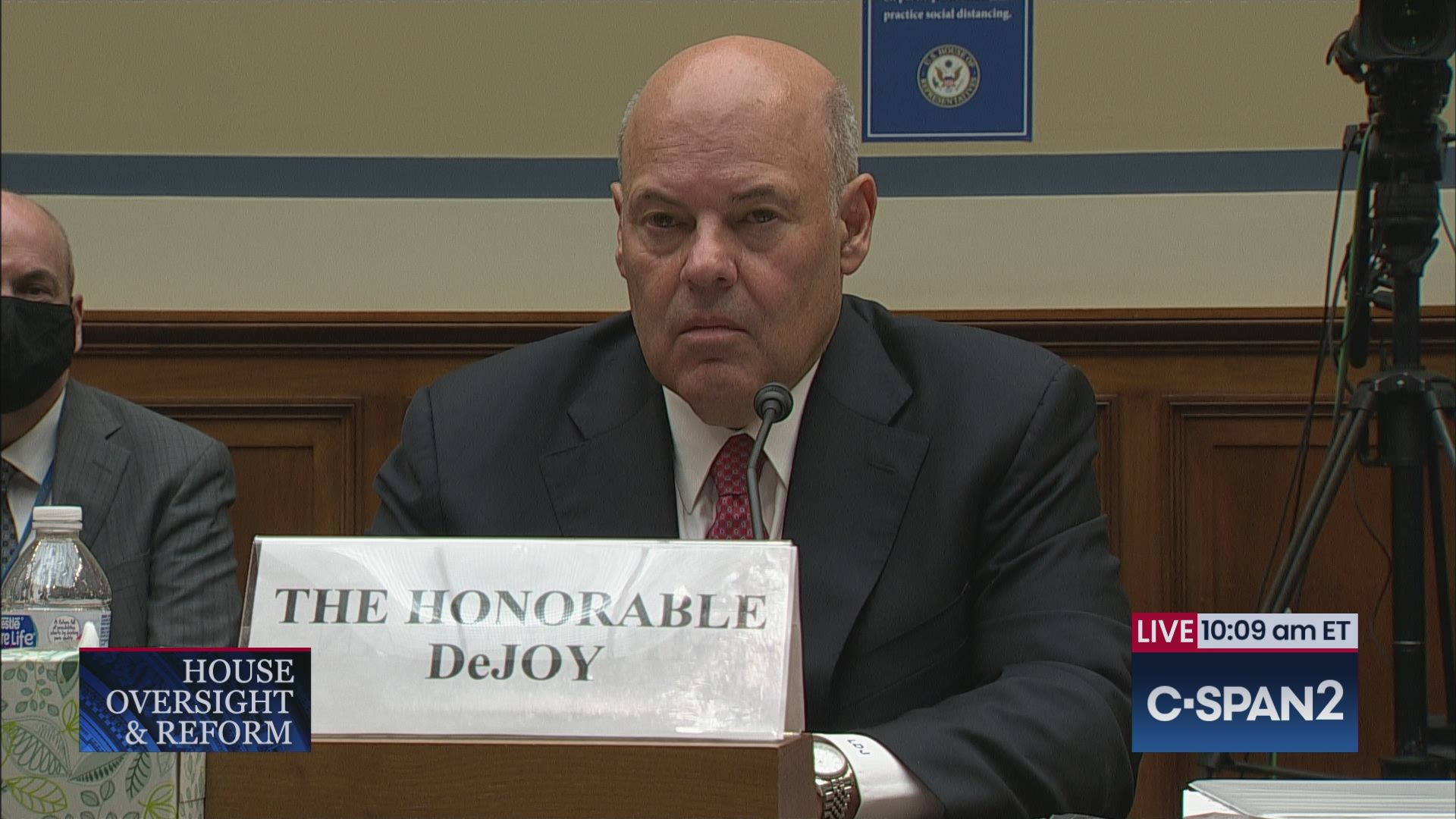

Need yet another reason for why Postmaster General Louis DeJoy should be fired? Look no further than his stubborn resistance to public postal banking and endless loyalty to Wall Street.

In their new study on postal banking, researchers Terri Friedline and Ameya Pawar found that offering free public checking accounts through the United States Postal Service could provide a financial lifeline for millions of Americans. Examining nationwide census tract-level data on post office retail locations and bank and credit union branches, Friedline and Pawar have assembled a groundbreaking map of America’s “banking desert’ communities (that is, census tracts which do not have a private community bank or credit union branch). According to their study, of all the census tracts in America containing a post office, 24% have no private banking options whatsoever. The share of unbanked tracts per state varies across the country, with Arizona, Alaska, New Mexico, and California being among the most underbanked states. Providing free bank accounts at post offices to customers in completely unbanked tracts — a partial restoration of a service offered by USPS from 1910 to 1967 — is estimated by Friedline and Pawar to directly benefit at least 21 million people.

The benefits of postal banking for many American families cannot be overstated. According to the FDIC, over 7.1 million Americans lack a bank account and an additional 24.2 million are forced to rely on payday lenders or other predatory financial institutions in their daily lives. As a result, millions are struggling to build credit, acquire loans, and receive government assistance during a once-in-a-century pandemic. Public banking, which Friedline and Pawar’s research finds would be best administered through USPS, would directly address this widespread financial insecurity. Their study also finds that postal banking would disproportionately benefit Black and Indigenous people, echoing research by scholars like Mehrsa Baradaran on racial discrimination by private lenders.

The Friedline-Pawar study adds further evidence to support Congressional Democrats’ recent push to restore postal banking in America. In the last Congress, Senators Kirsten Gillibrand and Bernie Sanders introduced the Postal Banking Act, a bill which would enable USPS to provide small dollar loans, remittance services, and other basic financial services at its retail locations. This past April, Gillibrand and Sanders joined Congresswoman Alexandria Ocasio-Cortez and over 30 House Democrats in calling on Congress to appropriate $6 million for postal banking pilot programs in rural and low-income urban neighborhoods where banking services are scarce or unaffordable. Citing the program’s potential to erode the influence of predatory lenders and DeJoy’s tenure at USPS, Congressman Bill Pascrell put it succinctly: “The current post office leadership has failed miserably and must be replaced to begin the work of rebuilding our beloved Post Office. But postal banking is essential to that rebuilding, [it] must be part of American’s future.”

These groundbreaking findings also come as DeJoy, who is forging ahead with a widely-criticized 10-year restructuring plan for USPS, wages a stealth campaign against public postal banking. Last August, DeJoy reportedly began talks with JPMorgan Chase to install ATMs in post offices across the country, a proposal that would effectively grant the Wall Street giant an exclusive right to provide banking services to postal customers. Senator Sherrod Brown, a proponent of public postal banking, blasted DeJoy’s rumored plan as “another attempt for big banks and corporations to privatize our public infrastructure so their shareholders gain while working families suffer.” Former Labor Secretary Robert Reich and The American Prospect’s David Dayen echoed Brown, warning that DeJoy’s privatization scheme would rip off consumers and fail to help the unbanked. Nearly a year later, DeJoy has again snubbed proponents of postal banking by excluding the proposal from his 10-year overhaul plan for the agency.

The past success and future promise of postal banking add to the already-plentiful grounds for DeJoy’s dismissal. From his delay-ridden privatization plan for the agency (the Washington Post has a useful tool to calculate how DeJoy’s plan would affect your zip code), to a lawsuit over his shady contracting of USPS fleet construction, to the FBI’s criminal probe of his illegal straw donor scheme, there is no shortage of reasons for DeJoy to be fired.

The challenge, as I’ve written on this blog before, is that those with the actual power to fire DeJoy remain solidly in his corner. Despite Biden’s addition of three DeJoy critics to the USPS Board of Governors, Democratic Board Chairman Ron Bloom and Democratic Governor Donald Moak have joined with the Board’s four Republicans to keep DeJoy in his job and advance his destructive plans for the agency. While this de-facto 6-3 conservative majority is frustrating, it is by no means permanent. As I wrote last month, short of firing all incumbent board members outright for dereliction of duty (as Bill Pascrell has suggested), Biden is legally entitled to fire and replace Bloom at any time due to his holdover status. Biden could also name a replacement for Republican Governor John Barger (whose term expires this December) and send both nominees to the Senate for an expeditious confirmation. Barring any unexpected developments, this would ensure a public interest-minded majority on the USPS Board by January 2022 and all but guarantee the end of DeJoy’s destructive tenure.

If Biden wishes to rescue millions from predatory payday lenders (and save a beloved public institution along the way), he must do everything in his power to fire Louis DeJoy.