This article originally appeared in The American Prospect. Read it on its original site.

On Tuesday, the Supreme Court will hear oral arguments in Consumer Financial Protection Bureau v. Community Financial Services Association of America, a lawsuit filed by predatory payday lenders seeking to strike down the Consumer Financial Protection Bureau’s (CFPB) independent funding mechanism—and by extension, the Bureau itself. The case, in which the agency is appealing a far-right Fifth Circuit Court of Appeals ruling last October, could have catastrophic impacts if the Roberts Court sides with the payday lender plaintiffs. As the Prospect’s David Dayen has noted, the Fifth Circuit’s ruling “threatens the functioning of daily life,” as its radical interpretation of the Constitution’s Appropriations Clause would gut not only the CFPB (triggering a 2008-like mortgage market meltdown), but also many other regulatory agencies and federal programs without traditional appropriations—including Medicare, Social Security, and the Federal Reserve.

An obvious backdrop to this high-stakes case is the mounting ethics scandals of the Court’s conservative justices. Take Justice Samuel Alito, for example. Hedge fund billionaire Paul Singer—who took Alito on a luxury Alaska fishing trip—holds at least $90 million in financial companies overseen by the CFPB. Alito has thus far failed to recuse himself from the case.

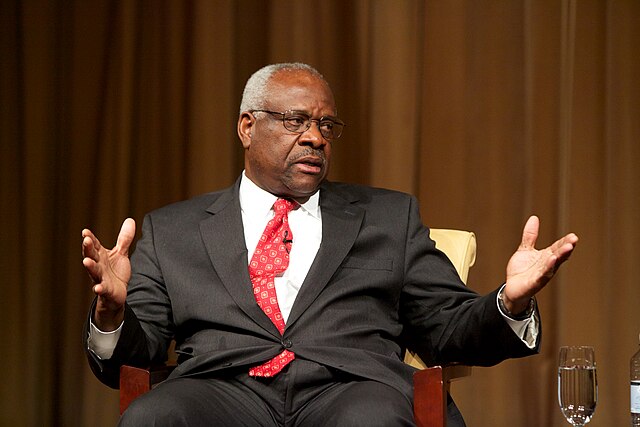

The ethics conflicts are even worse for Justice Clarence Thomas, who has also failed to recuse. According to ProPublica, Thomas has secretly attended at least two donor events for conservative billionaire Charles Koch’s political advocacy organization and is seen as a “fundraising draw” for the Koch network. Americans for Prosperity Foundation, one of the Koch empire’s many advocacy arms, has filed an amicus brief in CFPB v. CFSA calling the Bureau a “threat [to] liberty” and “mockery of the separation of powers.” Another anti-CFPB amicus filer in the case is none other than John Eastman, a former Thomas law clerk who is currently facing disbarment proceedings and a criminal indictment for trying to help Donald Trump overturn the 2020 election results. Eastman has previously tried to leverage his connections with Thomas to his benefit, corresponding with Thomas’s wife Ginni (a notably unhinged electoral-fraud conspiracy theorist) in the run-up to the January 6, 2021, attack on the Capitol.

Even Thomas’s most well-known benefactor, Dallas-based developer Harlan Crow, has much to gain from a favorable outcome in the CFPB v. CFSA case. Crow and his real estate empire are among the most prominent backers of the National Multifamily Housing Council, a landlord lobbying group that has mobilized industry opposition to the Bureau’s scrutiny of the tenant screening industry.

On top of all these egregious violations of elementary judicial ethics, our research revealed another ethics controversy surrounding Thomas and CFPB v. CFSA that has thus far escaped close scrutiny. It concerns Thomas’s central role in the Horatio Alger Association, an exclusive circle of wealthy business elites that gave Thomas lavish undisclosed gifts. In return, Thomas has granted the Alger Association rare annual private use of the Supreme Court chambers for its new-member induction ceremony—an event that Thomas personally hosts every year. The Alger Association has publicly promoted the Thomas-hosted Supreme Court ceremony in its fundraising materials, an act frowned upon by Court officials. According to a review of the Alger Association’s members conducted by the Revolving Door Project, at least 18 Alger members have either previously expressed an interest in weakening the CFPB or stand to gain from the Court gutting the Bureau. These wealthy elites span multiple sectors overseen by the CFPB and include some of its most prominent recurring opponents.

Among them is Alger Association President Gregory Abel, a top executive at Berkshire Hathaway who has been named by Berkshire CEO Warren Buffett as his eventual successor. Abel was inducted into the Alger Association at a Thomas-hosted Supreme Court ceremony in 2018 and plays an active role in the organization’s leadership, serving as a “class coordinator” that provides “invaluable networking support” to Alger members. Berkshire Hathaway, which may soon be led by Abel, would likely welcome a weakened CFPB. In 2022, the CFPB and Department of Justice secured a $22 million settlement from Berkshire subsidiary Trident Mortgage for illegally redlining majority-minority neighborhoods in Philadelphia. This was not the first time a Berkshire subsidiary attracted scrutiny for violating consumer protection laws: In 2016, several Democratic lawmakers called upon the CFPB to investigate Berkshire mobile home subsidiary Clayton Homes for discriminatory lending and collection practices (the Department of Housing and Urban Development opened a fair-housing investigation into the company in 2018).

Another Alger member whose subsidiary has run afoul of the CFPB is John Canning, co-founder of private equity firm Madison Dearborn Partners. Canning’s firm announced its acquisition of fintech company MoneyGram in February 2022 in a $1.8 billion deal. Two months later, the CFPB and New York attorney general sued MoneyGram—which they labeled a “repeat offender” of consumer protection laws—for failing to process customers’ remittance payments and disputes in a timely manner. MoneyGram has shown little sign of mending its ways since the acquisition was completed earlier this year. In recent court filings, the company has openly cited the Fifth Circuit’s ruling against the CFPB’s funding structure in an attempt to dismiss the Bureau’s ongoing enforcement case against it.

Former U.S. Chamber of Commerce CEO and current board member Tom Donohue is a strident opponent of the CFPB, dating back to before it even existed. He is a current Alger member whose group has filed an amicus supporting the payday lenders. Under Donohue, the Chamber lobbied against the CFPB’s creation in the 2010 Dodd-Frank law and consistently supported what the payday lenders will argue on Tuesday: that the Bureau’s independent funding mechanism should be struck down and its annual budget should instead be approved by Congress. The latter argument is particularly compelling for fans of deregulation, as the House of Representatives is currently controlled by industry-bankrolled Republicans who have promised to defund it. Under both Donohue and his successor Suzanne Clark (a board member at CFPB repeat offender TransUnion), the Chamber of Commerce has also opposed many of the CFPB’s consumer protection regulatory initiatives, including efforts to rein in arbitration clauses and credit card junk fees. Earlier this month, the group notched its own victory against the CFPB when a district court judge upheld its lawsuit challenging the Bureau’s crackdown on discrimination in consumer financial markets.

Then there are the many Wall Street executives who fill out the Alger Association’s ranks—all of whom would likely love to see the CFPB weakened. These include current and former bankers like Bharat Masrani of TD Bank (fined over $97 million by the CFPB in 2020 for illegal overdraft fees), Brian Lamb of JPMorgan Chase (a repeat offender fined multiple times for illegal mortgage kickbacks, inaccurate account screening, and illegal robo-signing), Josue Robles of USAA (fined over $15 million in 2019 for mishandling fund transfers and customer accounts), and the recently investigated T. Denny Sanford of First Premier Bank (which previously sued the CFPB for cracking down on excessive credit card fees). Many of these banks are active members of the Consumer Bankers Association, an industry lobbying group that has opposed the CFPB’s crackdown on banking junk fees.

Their contempt for consumer protection is shared by other prominent business leaders who are also in the Alger Association. David Wilson, CEO of one of the largest car dealerships in the country, is a member of several industry trade groups that have opposed the CFPB’s auto lending guidance and called for changes to its funding structure. J. Ronald Terwilliger is the chairman emeritus of Harlan Crow’s family real estate company and has given over $16,000 to the landlord lobbying group NMHC since 1989. Home Depot founder and Republican mega-donor Bernie Marcus has actively supported challenges to the Biden administration’s student debt relief plan and has claimed the Dodd-Frank law hurts small businesses. Insider-trading hedge fund tycoon and president of the Alger Endowment Fund Leon Cooperman, best known for crying about Elizabeth Warren’s wealth tax on national television, has previously held stakes in a student loan servicer that was sued by the CFPB.

Perhaps least shy about expressing his hatred for the CFPB is Phil Gramm, the former Texas senator and co-author of the 1999 financial deregulation law that partly repealed the Glass-Steagall Act of 1933, and helped cause the 2008 financial crisis. Unashamed after helping blow up the global economy, Gramm (who revolved out of Congress to become a banker) has testified before Congress criticizing the CFPB’s leadership structure and funding mechanism. With occasional assistance from monopoly apologist and ex-FTC commissioner Christine Wilson, Gramm has also repeatedly attacked CFPB Director Rohit Chopra from the Wall Street Journal editorial page.

The corporate elites and right-wing ideologues who populate the Alger Association’s membership roster clearly have a lot to gain from gutting the CFPB. Clarence Thomas has enjoyed the comically elitist connections and lavish undisclosed gifts of the Alger Association for over 30 years. Are we really to believe that Thomas never once discussed issues of financial regulation and corporate law enforcement during decades of hobnobbing with America’s top bankers, investors, and lenders behind closed doors? Please. The fact that Thomas did not fully disclose his Alger activities and gifts from the very beginning, or the other Caligula-esque largesse he has received from other billionaire patrons—all while carefully constructing an aw-shucks persona as a guy who prefers to hang out in Walmart parking lots in his RV—speaks for itself.

Though we at the Revolving Door Project called for Thomas’s and Alito’s recusal from this case in light of these ethics scandals, the Court’s well-established contempt for accountability and integrity offers little hope they will heed our advice. Should both of them persist in hearing CFPB v. CFSA on Tuesday despite their glaring conflicts of interest, the case for their impeachment and for rebalancing the Court to create an ethical majority will become even stronger.

The humorist Will Rogers once noted that “America has the best politicians money can buy.” It appears that we have the best judges too.