Sometimes it’s not a lack of education. It’s just fraud.

Last Friday, former FDIC Chair Sheila Bair decided to offer her two cents on the broader conversation surrounding the recent sentencing of Sam Bankman-Fried . Her takeaway from SBF’s trial and conviction on seven counts of fraud and conspiracy? We need financial literacy classes for children.

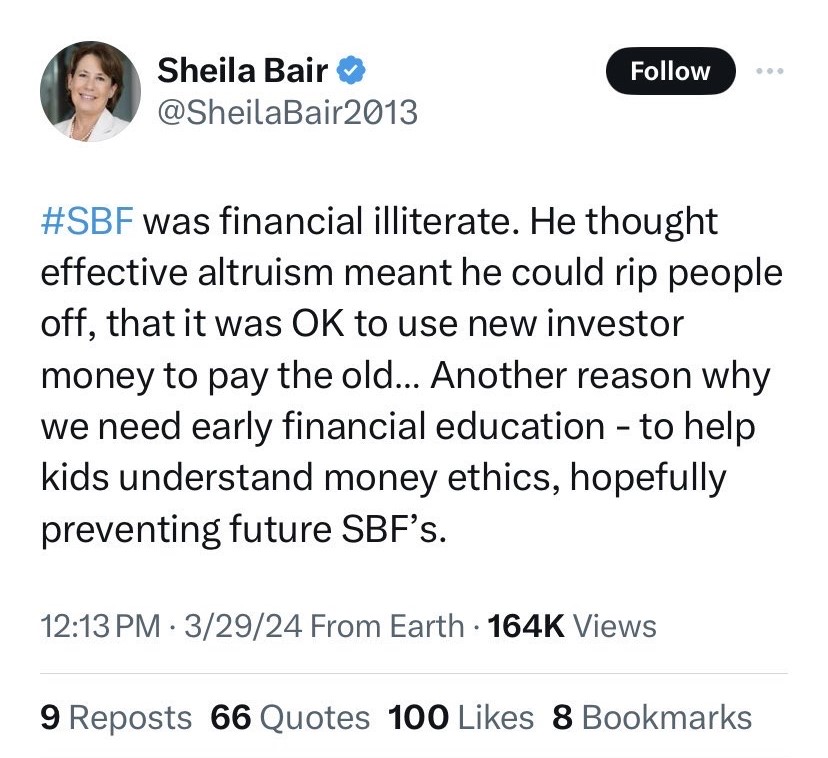

In her post, Bair said “#SBF was financial[ly] illiterate. He thought effective altruism meant he could rip people off, that it was OK to use new investor money to pay the old… Another reason why we need early financial education – to help kids understand money ethics, hopefully preventing future SBF’s.”

The claim that SBF required both more financial and more ethical instruction is perhaps the funniest possible claim someone can have about him specifically. Sam Bankman-Fried was undoubtedly exposed more to issues of finance and ethics than nearly any of his peers. In the years before starting FTX, SBF was a trader at Jane Street Capital, a major investment trading firm. It was there where he learned many of the skills needed to trade. I highly doubt that a semester of instruction on financial literacy as a child would’ve taught SBF more than his years at a $15 billion trading firm did not. But Jane Street was not the only source of financial education for SBF. His father, Joseph Bankman, literally wrote the book on tax law while teaching business law at Stanford University. While Bankman may have brought a basic understanding of finances to SBF’s life, that still leaves Bair’s other concern: ethics. Funnily enough, SBF’s other parent, his mother Barbara Fried, was also a tenured professor at Stanford Law, where she researched philosophy and ethics in addition to occasionally teaching courses relevant to financial law. In fact, Fried, much like her son, has taken an interest in Effective Altruism (EA) and has produced academic work on the subject.

Despite this, Bair seems to believe the entire FTX fiasco could have been avoided with some remedial ethics instruction. Rather than understanding that Bankman-Fried’s espoused ethics of effective altruism was nothing more than a convenient narrative to bolster his public image (which he has admitted was just a publicity stunt), Bair seems to believe that it was EA that led to his downfall. This, clearly, could only have been prevented by adding a week of ethics instruction to an already crowded high school civics curriculum.

While I applaud the novelty of Bair’s takeaway from the billion dollar fraud that was FTX, it does reveal something that should be concerning to those invested in seeing consequences for corporate criminals. It’s not just the media who is sympathetic to white collar criminals like SBF, but government regulators too. While Bair hasn’t been in government since 2011, having an influential former public servant come away from the FTX fiasco believing that what Sam Bankman-Fried lacked was financial and ethical education is extremely concerning. If someone like her can fall for SBF’s claims that he never knew that what he was doing was illegal, and that what he was doing was right, who knows how many other influential policy voices — and current regulators— could too.

What we should take away from the FTX fiasco now that the trial is over is ways in which we can prevent the next one. A crucial part of that is having regulators who are skeptical of the claims of wunderkinds or other supposed geniuses. All too often the innovation is nothing more than a willingness to commit financial crimes. Enron, Therano,s and FTX are all great examples of this, not to mention Madoff and more. As one meta-review of the Great Financial Crisis concludes, “Overall, a consistent narrative based on substantial research indicates that conflicts of interest, misreporting, and fraud were focal features of the financial crisis.”

When given the benefit of the doubt by regulators and business leaders these criminals are able to expand their reach and harm more people. Bair–far less swayed in office by bankers than her counterparts of both political parties–should certainly know better. But if even Bair is willing to grant the privileged such benefit of the doubt we can only imagine how often other financial regulators fall for fraudsters’ assertions of innocence or ignorance.

It can be scary to confront the fact that there are those who knowingly and willingly break the law. But concocting new and convoluted reasons why the crimes took place does nothing to address the harm or crack down on the corporations likely to spawn the next white-collar criminal. We must confront the reality of SBF’s financial crimes head on. This was not something that resulted from a lack of education or understanding. This was a result of one man deliberately violating financial laws. Regulators (and former regulators) shouldn’t be so gullible they fall for the self-professed naivete of white-collar criminals.