June 10, 2021 | American Prospect

Jerome Powell Went Easy On Wall Street

Just as a president shouldn’t only be judged on whether or not they started a war, Fed chairs shouldn’t only be judged on whether they raised or lowered interest rates. That’s their most salient power, but they have other, more complex ways of affecting our lives. Financial regulation is one of the most important of these, and it’s one on which current Fed chairman Jerome Powell has failed badly.

June 02, 2021

Working Paper: New Federal Reserve Governors Must Deploy All of the Institution’s Tools to Advance the Public Interest

Over the course of the next eight months, Biden will have the opportunity to reshape the Federal Reserve Board of Governors with nominations for up to four of its seven seats, including the positions of Vice Chair of Supervision, Vice Chair, and Chair (listed in the order they will become vacant). In choosing nominees for these posts, it will be essential that Biden consider the full weight of the Federal Reserve’s immense power and select individuals who are ready and willing to deploy every ounce of it to advance the public interest.

May 13, 2021 | The American Prospect

Max Moran Dorothy Slater Zena Wolf

Op-Ed 2020 Election/TransitionClimate and EnvironmentEthics in GovernmentFinancial Regulation

Plumbing The Depths At The SEC

Progressives have generally seen Gary Gensler, the newly confirmed chair of the Securities and Exchange Commission (SEC), as a loyal advocate for the public interest. His tenure at the Commodity Futures Trading Commission (CFTC) was one of the few bright spots in Barack Obama’s financial regulatory regime. But in April, Gensler named Alex Oh to be his director of enforcement, before she resigned a week later amid negative media attention. Before joining the SEC, Oh had directly facilitated an ExxonMobil executive’s obstinate deposition testimony (reportedly read off an attorney-drafted script) in the face of plaintiff objections—and the case itself centered on accusations of torture, rape, and murder by ExxonMobil-hired guards in an Indonesian village.

May 05, 2021

Bust Up Corruption And Protect The Public: Clean House At The PCAOB

When there actually are odious, greedy bad guys stuffed away in a back-room scheming, it’s pretty good politics to bust it up and take credit for doing so. Just such a racket is happening right now in an obscure corner of the executive branch, and all it would take to end it is some muscle from the President and one of his most-praised appointees.

May 05, 2021 | MarketWatch

5 Compelling Reasons For Biden To Dump Jerome Powell

The Fed is more than monetary policy, and we need to think of the Fed chair’s whole role. Since democratic control of the Fed is exercised primarily through presidential appointments, we must consider Powell’s record holistically. It’s not a good one.

May 03, 2021

Brad Karp Harasses Journalists. Why Are Journalists Quoting Him Uncritically?

Karp’s own “strong ethical code” includes not just mass payoffs to Democratic politicians, as I wrote about last year, but more relevantly, organized intimidation of the press for ever daring to report unflatting facts about Paul, Weiss.

April 28, 2021

Revolver Spotlight: Alex Oh

Last week, SEC Commissioner Gary Gensler named corporate BigLaw partner Alex Oh as Director of Enforcement of the SEC. Oh’s nomination, especially in an agency tasked with holding Big Banks accountable, is deeply concerning given her history working for some of the worst corporate influences. Oh, who has served as a partner at the BigLaw firm Paul Weiss since 2004, has taken on clients with direct conflicts of interest including Big Banks, fossil fuel companies, and Big Pharma.

April 28, 2021

SEC's New Enforcement Director, Alex Oh, Is Bad News For Climate

Progressives and climate activists were initially heartened by the prospect of Gary Gensler at the helm of the U.S. Securities and Exchange Commission (SEC), the regulatory powerhouse responsible for regulating coordinating stock trading. And some of Gensler’s initial staffing decisions also inspired plaudits. However, we were shocked when SEC Chairman Gensler announced last week he would appoint veteran Wall Street defense lawyer Alex Oh to lead the SEC’s powerful enforcement division. This appointment is an absolute rejection of progressive values, not to mention climate reality.

April 27, 2021

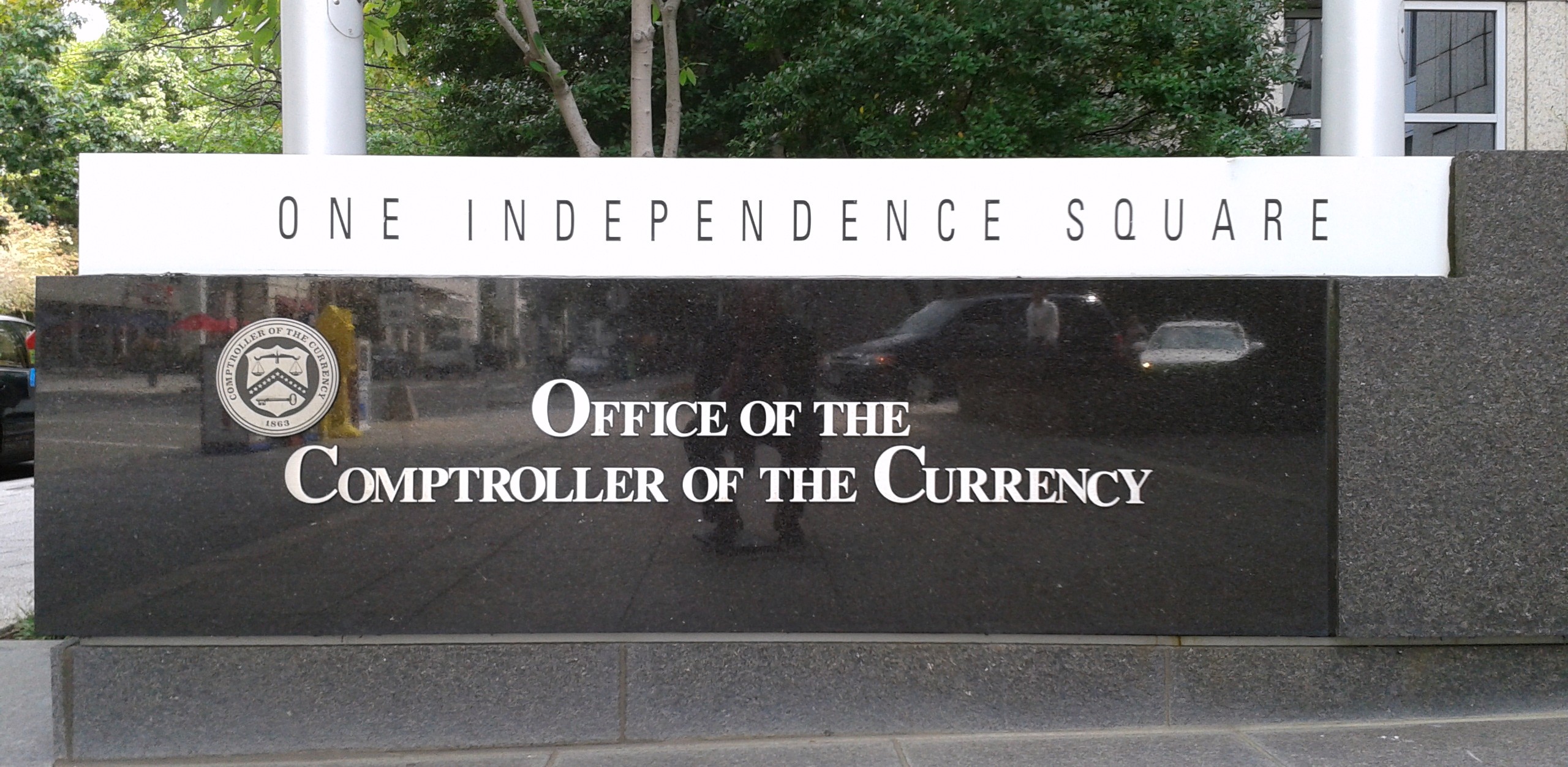

The Longer Trump’s Acting Comptroller Stays, The More Damage He’ll Do

Under Otting and Brooks’ leadership, the OCC rolled out rules contrary to its responsibility to maintain a federal banking system that is safe against systemic risks and provides aid to all customers. Now they’re all out of power — but Acting Comptroller, Blake Paulson, whose ascent was ensured by Brooks and Mnuchin, has demonstrated no desire to change course from the path set by Trump’s lackeys. That is why Biden needs to act quickly and appoint a Comptroller who recognizes the dangerous precedent set by the Trump administration.

April 22, 2021

Delaware Connections Run Deep As DuPont Family's Darla Pomeroy Heads To Treasury

Darla Pomeroy, who is married to an heir to the DuPont family fortune, was just named Senior Advisor to the Office of Domestic Finance at the US Treasury. While her record does not show any familiarity with financial regulatory policy, it reveals instead a history of a powerful corporation highly influential in Delaware placing a close ally in the administration.

April 22, 2021

Wall Street Lawyer Leading Wall Street Oversight Unsettles Allies Of Gensler

“Oh has chosen to spend over 20 years reinforcing a corrupt status quo in corporate America, in which the largest companies systematically evade democratic accountability. No one so comfortable with the breakdown in the rule of law over corporate America should be entrusted with responsibility for implementing long-overdue accountability on Wall Street.”

April 19, 2021

In Latest Disappointment From Yellen, John Morton Is Treasury's New Climate Counselor

The U.S. Treasury Department announced today that John Morton would be appointed as its first Climate “Counselor,” tasked with organizing financial-related climate work across the executive branch’s financial regulators.

April 02, 2021 | The American Prospect

Dorothy Slater Eleanor Eagan Max Moran

Op-Ed Climate and EnvironmentExecutive BranchFinancial RegulationLarry Summers

Janet Yellen's Blind Spot On Regulation

With so many competing priorities, it’s justifiable that Yellen has not given her full attention to every single crisis under her purview. But she can no longer dodge her other big duty: financial policy and Wall Street regulation.

March 18, 2021 | The American Prospect

John Kerry Must Choose: Wall Street Or The Planet

We have every reason to believe Kerry genuinely wants to save the Earth from climate devastation. His problem is that there is no neoliberal path to doing so.

March 16, 2021

Revolver Spotlight: Manny Alvarez

Alvarez only re-entered the regulatory world after six years at Affirm, a fintech e-lender that offers loans up to 30 percent APR under sometimes confusing terms at the point of sale, so consumers rarely have the opportunity to shop around or read the fine print for an informed decision.