This article was originally published by The American Prospect.

One of the major themes of the upcoming tax fight is how crammed the time frame is. Between now and the end of 2025, when a number of the Trump tax cuts expire, we have the budget for the next fiscal year (which has only started to get off the ground), the expiration of the Fiscal Responsibility Act, the start of a new Congress, the end of the debt ceiling’s suspension, and whatever threshold policies the next president wants to put forward. And by the time things have started settling down, it’ll be time to get going on the next budget for FY2026.

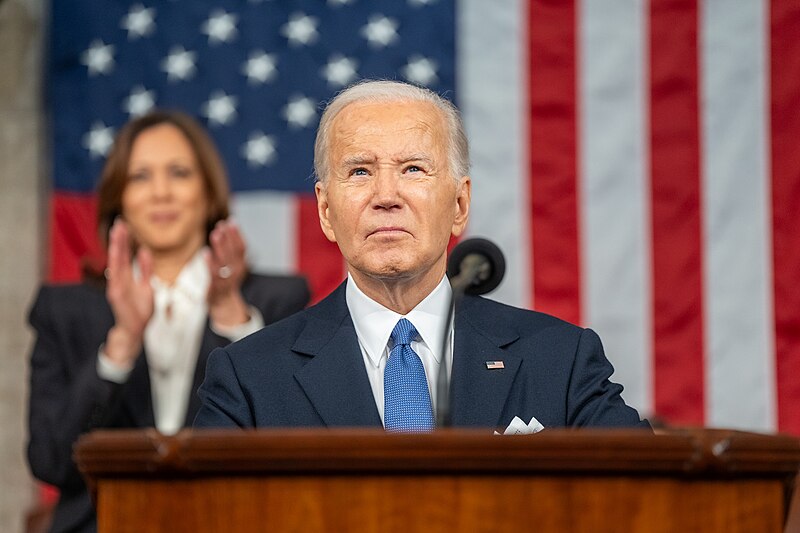

Of those many hurdles, the debt ceiling unfreeze this coming January looms larger than the lack of public attention would suggest. The debt ceiling—an arbitrary and arguably unconstitutional cap on the federal government’s ability to borrow—derailed President Biden’s budget proposal wholesale in 2023. If Biden prevails in November, only to have his agenda dashed to pieces on the rocks of one of the worst budgeting self-restrictions in the world again, that could set the tone for a very bitter second term.

Naturally, this could be moot depending on electoral outcomes, and some may believe that worrying about the debt ceiling rather than the rise of fascism is missing the forest for the trees. But predicting how people will vote in November is immaterial to the fact that, if Biden prevails, progressives need to get ready for this fight. (For what it’s worth, we think President Biden has an opportunity to pull the election out if he leans into cracking down on corporations and publicly fighting unpopular enemies.)

In 2023, there were many proposals about how to deal with the debt ceiling. The trillion-dollar platinum coin was very popular on social media. The past iteration of the fight saw the 14th Amendment gain popularity as a counter to Republicans’ growing reliance on “fiscal obstructionism” by casting doubt on its legality. Since the debt ceiling conflicts with more recently passed appropriations, there’s a colorable argument that the president is duty-bound to ignore it and follow the more recent and explicit legislative direction (this is due to the principle of repeal by implication, which courts are averse to, but which becomes necessary in the case of direct substantive conflicts and no explicit description of the interaction in the newer legislation). There’s also the Dorf-Buchanan line of argument that a de facto line-item veto by the president of some but not all spending is obviously unconstitutional and at odds with explicit Supreme Court precedent.

In other words, there was a lively discussion around ways to avoid bumping the government’s head on the ceiling by just refusing to walk into the room in the first place.

But then, despite growing dissatisfaction with acquiescence to the norm that the debt ceiling was some sort of coherent constitutional mandate rather than an incoherent statutory oddity of dubious real-world applicability, Biden struck a deal with Kevin McCarthy, and the whole discourse fizzled out. While it will undoubtedly rise to the surface again as January draws nearer, we can’t afford to wait. Progressives and Democrats need to be talking about this now, preparing to write briefs to support a position where the president declines to enforce the debt ceiling, leveraging connections in the administration to get the thoughts percolating in the minds of people the White House listens to, and, most importantly, not accepting the battleground that Republicans are waiting to fight on.

Republicans love to use the debt ceiling to take the government hostage and force harmful cuts to discretionary spending. They aren’t shy about it. Limiting the progressive position to “raise or suspend” creates a cycle that gifts Republicans regular opportunities to hijack the federal budget and impose austerity. And that’s really the only thing the debt limit is good for. As a form of cost control, it does not work. As a way of forcing bipartisan cooperation, it does not work. As a way of cultivating fiscal responsibility, it definitely does not work.

Since 1960, there have been 78 debt ceiling increases and only four partisan debt limit hostage-takings that threatened the financial stability of the United States. All of them have been the result of a Republican Speaker of the House trying to extort a Democratic president (Newt Gingrich and Bill Clinton in 1995-1996, John Boehner and Barack Obama in 2011 and 2013, and Kevin McCarthy and Joe Biden in 2023). Democrats have never meaningfully used it as leverage against a Republican president, and whenever the same party controls the House of Representatives and the White House, they just raise the debt ceiling as a matter of course. Interestingly, even under Republicans, the Senate has more consistently preferred financial stability and national security over the theatrics of an extra bargaining piece, though with new Republican leadership coming, that may change.

Not only have Democrats never been able to make use of the debt limit; realistically, they never will. A huge part of what separates Democrats from Republicans is that the Democratic Party wants the government to work; Democrats want social spending programs to be fully funded, welfare to be distributed, and consumer safety regulations enforced. In short, everything the party champions requires a working government. That mindset precludes the type of brinkmanship necessary to leverage the debt ceiling; any threat to allow a default will be immediately seen as empty.

That’s especially true when you factor in that even a temporary shutdown can have serious economic consequences. The first time the United States had its credit downgraded happened when S&P was concerned about the debt ceiling standoff in 2011. The second, and only other, downgrade was in August of 2023 when Fitch cited concerns about “governance issues” (i.e., McCarthy’s brinkmanship). Such downgrades undermine the ability of the government to borrow at favorable rates, making future spending more expensive and jeopardizing the viability of expanding or creating new programs that tackle issues like health care, education, or climate change. The Government Accountability Office reported that just the delay in reaching a deal in 2011 cost the nation more than a billion dollars in additional borrowing costs that year. In the grand scheme of things, that’s not a huge sum for the federal government, but when you do nothing to keep the same thing from playing out repeatedly and consider high and rising interest costs (exacerbated by the Fed keeping rates elevated), it adds up.

Republicans, on the other hand, are (generally) inherently skeptical of government, which makes shutting it down much more philosophically in line with their agenda. When you want to be sending less money out the door, a temporary hard stop does not intuitively complicate everything in your policy agenda.

If January rolls around and we wind up with a Trump White House and Speaker Hakeem Jeffries, there is virtually no chance that a push to raise the debt limit would see any brinkmanship. But if we wind up with a Biden White House and Speaker Mike Johnson, it is all but assured.

Luckily, there are ways around the debt ceiling. To start, Congress could simply repeal it at any point. And if Democrats win the election, they should do it, even if it means overturning the filibuster to do so.

Even if that doesn’t happen, there are plenty of other options. Wonky solutions like minting the coin are on the table, though the most straightforward solution is to simply continue spending and borrowing as normal even after hitting the debt limit. Anything the administration does will wind up in court, and there are some strong legal arguments that progressives and Democrats should be developing for when that time comes.

Put simply, following the debt ceiling is plausibly illegal and unconstitutional. It is illegal because it violates newer and clearer congressional spending policy. And there are good arguments that it is unconstitutional under Article I, Article II, and the 14th Amendment of the Constitution.

Beyond the general principle that newer, more specific legislation should override older, vaguer statutes, consider what a debt ceiling does. Effectively, it is a past Congress stripping away the power of a current or future Congress to borrow and spend as it sees fit, two powers given explicitly to the legislative branch in Article I, Section 8, of the Constitution. Consider if the 118th Congress passed a law that said, “All spending directed by the 119th and 120th Congresses that does not align with the budgetary priorities outlined herein shall be null and void.” That is plainly ridiculous, but it is exactly what the debt ceiling is doing! It was last raised by the 117th Congress and was then a barrier last year to prevent the 118th (current) Congress from fully exercising its constitutional powers. If that were valid, then elections would be meaningless since a current Congress could usurp the ability to legislate from future Congresses at any time.

Similarly, the president’s power to execute the law is muddled by a past Congress instructing them not to enforce a law as directed by a current Congress, arguably in violation of Article II. That is, if Congress instructs the president to spend money on a range of programs and does not provide instructions on how to prioritize spending if the debt ceiling is reached, the president is compelled to choose which spending programs they will continue and those they will defund. Supreme Court precedent and common sense are, coincidentally, aligned that Congress cannot delegate such a power to the president.

Additionally, Section 4 of the 14th Amendment likely renders the debt ceiling illegitimate because it contradicts the mandate that the “validity of the public debt of the United States … shall not be questioned.” And there’s also the argument made by government employees in a lawsuit brought last year that adhering to the debt limit would be illegal because it would be a breach of contract.

There are reasons for skepticism about each of these arguments. Conservative jurists have shown that they have an exceptionally narrow reading of the Reconstruction amendments, where they mostly only apply to the unique circumstances of the post–Civil War era (even though that defeats the point of enshrining these provisions in the Constitution). And a Supreme Court decision authored by Neil Gorsuch in Epic Systems v. Lewis shows that the Court is willing to ignore the basic tenet that newer laws should be given deference when they conflict with older statutes.

Are there other problems with these arguments? Almost certainly. Do you see any? Good! The entire point is not for everyone to listen to me because I have the answers. I don’t, I’m not a constitutional lawyer, and I don’t hold the president’s ear. What I do know is that the last debt ceiling showdown ended in a subpar deal that only looks worse in retrospect, and that right now we are waiting for the unfreeze and hoping that Biden can snatch victory from the jaws of default.

That did not work last time. Given the stakes of the tax fight next year, including the best chance in a generation to overhaul a broken system that is better at helping billionaires write off their private jets than helping support the general public, this time needs to be different.