In October of 2021, the Federal Reserve was embroiled in scandal. The heads of the Boston and Dallas Feds resigned following personal trading scandals that raised concerns about conflicts of interest and lax ethics guidelines. Further reports of potentially inappropriate trading by Chair Jerome Powell and Vice Chair Clarida rocketed across the business media due to these officials’ immense access to sensitive financial information and influence on monetary policy. Despite their decidedly questionable profiteering off pandemic panic, Powell and Clarida have since had their reputations effectively laundered by the media in a whitewashing effort that has attempted to clear them of all wrongdoing. To make matters worse, the Fed’s FOIA office is doing everything in its power to prevent internal documents relating to the scandals from reaching the light of day.

Just because Powell and Clarida may not have violated the Fed’s vague and inadequate ethics rules (themselves not updated since the 1990s until the recent public outrage) does not mean that they did nothing wrong. In fact, the Federal Reserve’s own Inspector General report acknowledged that Clarida made unaccounted-for trades and that Powell traded during a restricted period. Yet, he deemed these transgressions to be inadvertent oversights that didn’t amount to rule breaking. Such an inept, and inadequate, conclusion is impossible to separate from the fact that the Fed’s Inspector General is unique relative to its peers in that the IG serves at the leisure of the Board and is therefore neither independent nor truly reliable. The public deserves to have answers regarding (and accountability for) the gross lack of ethics that seems to pervade the Fed and to assess whether the IG’s purported “clearing” of Powell and Clarida was actually a justified one.

To that end, between October of 2021 and January of 2022, RDP filed four Freedom of Information Act (FOIA) requests specific to these scandals. We filed two additional FOIA requests seeking general guidance and communications between the Federal Reserve’s Legal Division, staff members, and the Office of Government Ethics. In doing so, we sought to shed light on some of the internal communications between top Fed officials, ethics advisors, and public relations teams in relation to the ethics crisis.

Nothing about public policy, mind you. We did not inquire about bank regulation or monetary policy, or whether the United States should have a central bank digital currency. We asked for the guidance being shared ostensibly to keep the Bank on the ethical straight and narrow and worthy of the public’s trust.

Nor were these requests merely a shot in the dark. The New York Times reported that the Fed’s ethics office had in fact issued guidance to staff. In a March 2020 email, the ethics office advised officials to refrain from unnecessary trading for several months as it would give the appearance of insider trading. The OIG report released last month confirms the existence of this email, as well another email dated April 30, 2020 announcing the end of the voluntary blackout period.

Unfortunately, the vast majority of the documents that fall under the scope of these requests—including the ones we know to exist and totalling hundreds of pages—continue to be arbitrarily withheld from the Revolving Door Project, without a legitimate justification from the Fed FOIA office as to why. Further, in another apparent bucking of the letter of the law, and despite a nearly unlimited budget (the Fed literally prints money and sets its own budget! Any shortfall in FOIA staff is a conscious choice), the Fed FOIA office routinely failed to meet its statutorily imposed 20 business day expected response time. In its repeated failing to even offer interim communication justifying its delay, the Fed’s FOIA office has utterly disappointed its responsibilities to the public, and further absconded its onus to maintain basic compliance with the law.

Congress created the Freedom of Information Act to empower public access to the federal government, and to allow the public to actually hold the federal government accountable. The Fed has disappointed this responsibility through its abuse of FOIA exemption clauses and its failure to adhere to basic statutorily-mandated timelines. This bad-faith repudiation of process and policy is a deliberate evasion of the accountability that the Revolving Door Project—and the rest of the public—are entitled to under the law. Further, this abuse represents an ongoing crisis of ethics, or the lack thereof, which continues to define the culture of the Fed. You don’t have to take our word for it—we have receipts, showing each act of obfuscation by the Fed throughout the FOIA process.

Trading Scandal Requests

As the trading scandal was unfolding in October 2021, RDP issued the following FOIA seeking communications between Director of Communications Michelle Smith and ethics officials from Federal Reserve’s legal team:

- FOIA-2022-00103/Appeal No. APP-2022-00031: All records reflecting communications, including emails, email attachments, text messages, messages on messaging platforms (such as Slack, GChat or Google Hangouts, Lync, Skype, or WhatsApp), telephone call logs, calendar invitations, calendar entries, meeting notices, meeting agendas, informational material, draft legislation, talking points, any handwritten or electronic notes taken during any oral communications, summaries of any oral communications, or other materials between Director of Communications Michelle Smith and Cary Williams or any employee of the Federal Reserve’s Legal Division who has responsibility over ethics matters [between March 1, 2020, and October 19, 2021].

On January 10, 2022, in light of the New York Times reporting on Clarida and Powell’s questionable trades, RDP submitted three additional FOIAs to the Fed. The new reporting raised questions about the veracity of the Fed’s initial claim that Clarida’s constituted merely a “pre-planned rebalancing” of his stock portfolio, so we submitted requests keyword searches in several channels for communications that included “rebalance” “rebalancing,” and/or “preplanned.” Our theory? If rebalancing was “pre-planned,” there should be documentary evidence. And if it was not pre-planned, any staff claiming it was pre-planned was engaged in a cover-up.

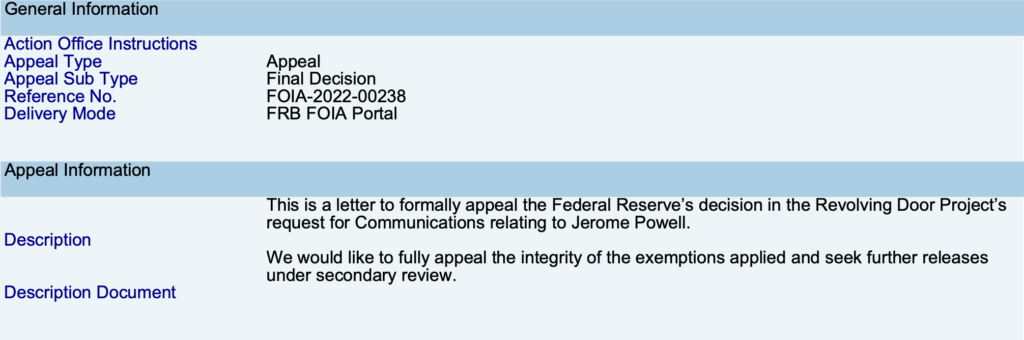

- FOIA-2022-00238/APP-2022-00028: All records reflecting communications […] to or from Jerome Powell, Richard Clarida, and/or Michelle Smith that include the word “rebalance” “rebalancing” and/or “preplanned.” (Date Range for Record Search: From 09/05/2021 To 01/10/2022)

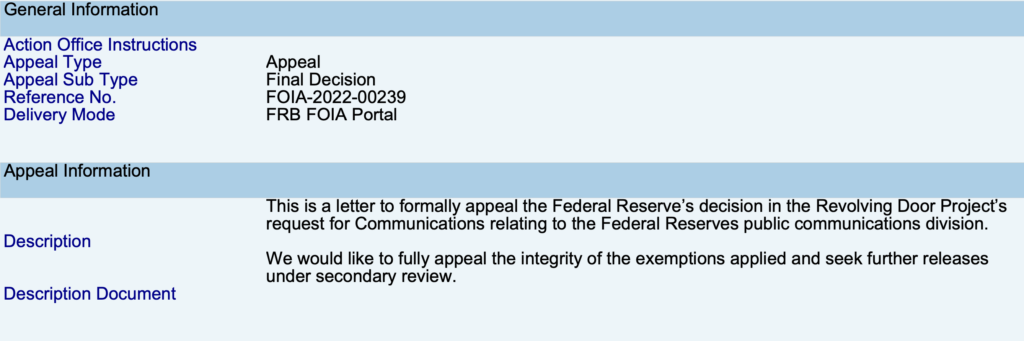

- FOIA-2022-00239/APP-2022-00029: All records reflecting communications […] to or from any employee of the Federal Reserve’s Public Affairs Division that include the word “rebalance” “rebalancing” and/or “preplanned.” (Date Range for Record Search: From 09/01/2021 To 01/10/2022)

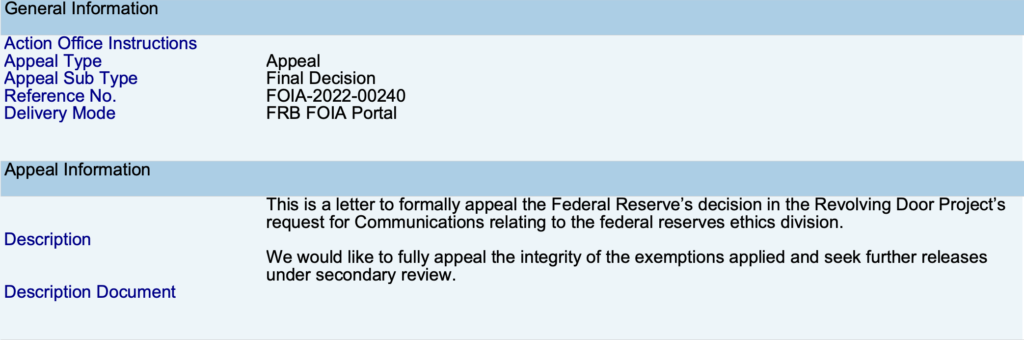

- FOIA-2022-00240/APP-2022-00030: All records reflecting communications […] to or from any employee of the Federal Reserve’s Ethics Division that include the word “rebalance” “rebalancing” and/or “preplanned.” (Date Range for Record Search: From 09/01/2021 To 01/10/2022)

These are clearly three distinct requests that, while seeking the same key words, are requesting such communications of three distinct sets of people. The first seeks to uncover any communications among the leaders of the Fed: Chair Powell, Vice Chair Clarida, and Powell’s chief of staff (as well as Communications Director) Michelle Smith. The second seeks communications from the Public Affairs Division to gain insight about the internal discussions regarding their response to the public’s concerns. Lastly, the third request seeks any consultation or advice from the Ethics Division about Clarida’s trades.

Apparently, these distinctions were not clear, nor was responding to our requests a priority for the FOIA office. After nearly four months of waiting, the agency finally responded in May of 2022:

FOIA-2022-00239-Final-Response-Letter FOIA-2022-00240-Final-Response-LetterFor some incomprehensible reason, the FOIA office decided, as noted in a footnote, to limit the search to “communications containing one of the terms specified in your request in the context of former Vice Chair Clarida’s personal financial transactions.” Of the documents that this limited search produced, FOIA officers withheld 310/388 responsive pages. Of the documents that FOIA officers finally released, the vast majority were already publicly available on the Office of Governmental Ethics’s website, and many were duplicated across the Fed’s releases.

Given the woefully inadequate nature of the responses, we appealed these decisions in June of 2022:

As you can see, we challenged the exemptions and hoped the appeals board would release more documents upon further review. Now, we at RDP are not lawyers—we’re a research and news organization with limited resources available to expend on extensive legal arguments refuting a department with a multi-million dollar budget. Unbeknownst to us (or logic), we erred in our appeal by not merely challenging everything that was withheld, but also explicitly challenging the institution’s weirdly limiting interpretation of our request (which was only noted in a footnote). After 74 business days—far surpassing the 20 day deadline required by law—the Fed denied our appeals in full.

We’ve since submitted a new request combining the originals, but excluding mention of Clarida. As of this writing, we have yet to receive a full response, and have thus far only received a letter extending the office’s response deadline. That extended deadline—February 2, 2024—has also now passed.

Requests for Ethics Guidance

As with our trading scandal-related FOIAs, we were similarly given the run-around on our requests regarding the Fed’s general ethics guidance—this time with nearly two years of radio silence. On October 6, 2021 and December 10, 2021, respectively, we filed the following FOIAs:

- FOIA-2022-00041/APP-2024-00002: A copy of every memo or other communication containing ethics guidance that the Federal Reserve’s Legal Division issued to all Federal Reserve staff between February 1, 2020 and October 1, 2020. (Date Range for Record Search: From 02/01/2020 To 10/01/2020)

- FOIA-2023-00336/APP-2024-00001: All communications from February 15, 2020 to December 10, 2021 between employees of the Federal Reserve’s Legal Division and employees of the Office of Government Ethics, excluding: routine communications relating to the generation or substantive review of nominee/new entrant, annual, and termination (but not transaction) Financial Disclosure reports; records relating to training materials; communications sent to the Federal Reserve as part of a mass communication to all or most agency ethics offices; records relating to OGE program inspections and reviews; and materials related to OGE presentations/panel discussions. (Date Range for Record Search: From 2/15/2020 To 12/10/2021)

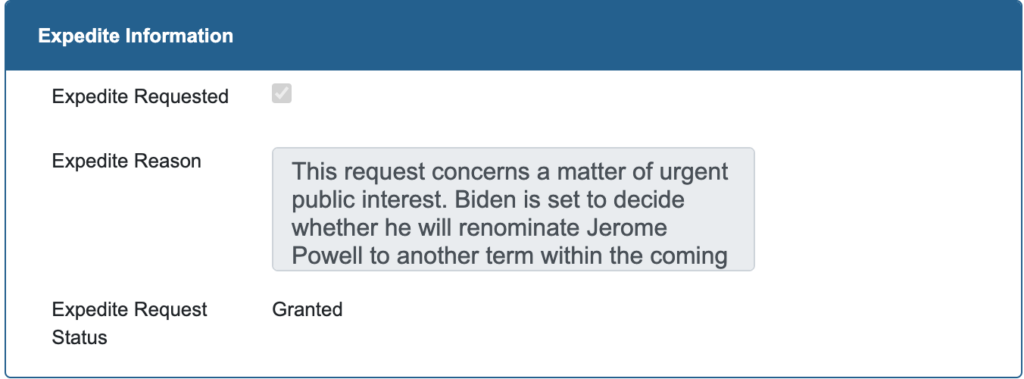

We requested expedited status for the first filing, noting, “Biden is set to decide whether he will renominate Jerome Powell to another term within the coming weeks. The recent ethics scandals among Fed leaders is a significant factor in that decision.” The agency granted our request.

Despite this granting, we did not receive a response for either FOIA request until September 7, 2023. Apparently it took the Fed nearly two years to locate two and six responsive documents, respectively, and to ultimately determine that they should be withheld in full.

Once again, we appealed this withholding. This time, we enlisted some helpful lawyer friends to craft an appeal with more legal justification for our challenges. After two extensions, the Fed issued final responses to our appeals on January 5, 2024. We won the first appeal in full and the second in part. This would have been exciting news given the time and effort we expended on these and our other Fed FOIAs. However, as you’ll see below, the responsive documents were: two pages of vague ethics guidance blog-type posts, and four pages of emails scheduling a phone call between Fed legal counsel, Cary Williams, and an OGE advisor.

APP-2024-00002-Responsive-docsThese documents never should have been withheld, let alone required a two year process of locating, reviewing, appealing, and more reviewing. RDP merely wants to know what type of ethical guidance the top Fed officials received prior to and during the trading scandals. By the OIG’s own admission, this documentation of ethics guidance exists, yet the FOIA office is either inexplicably ommitting them, or withholding under a shoddy application of deliberative process privilege.

We, and the rest of the public, have been left in the dark for years while Powell continues his disastrous leadership of the Board. It’s a disgrace that such a vital institution has been allowed to self-police in the face of serious allegations and then obscure the contents of the investigative process behind FOIA exemptions and redactions. The OIG reports do little to rectify the public’s concern. Rather than approach the investigation objectively, they seem intent on providing justifications and assumptions of good-faith for every trade that should not have occurred. Without a truly independent investigation—and a FOIA office that follows procedure and releases documents that should be public—there will be no accountability for, or public knowledge of, the disgraceful pandemic-era conduct by the top brass of the Fed.

The above photo of Fed Chair Jerome Powell is a work of the U.S. federal government and in the public domain.