Our Blog

April 07, 2022

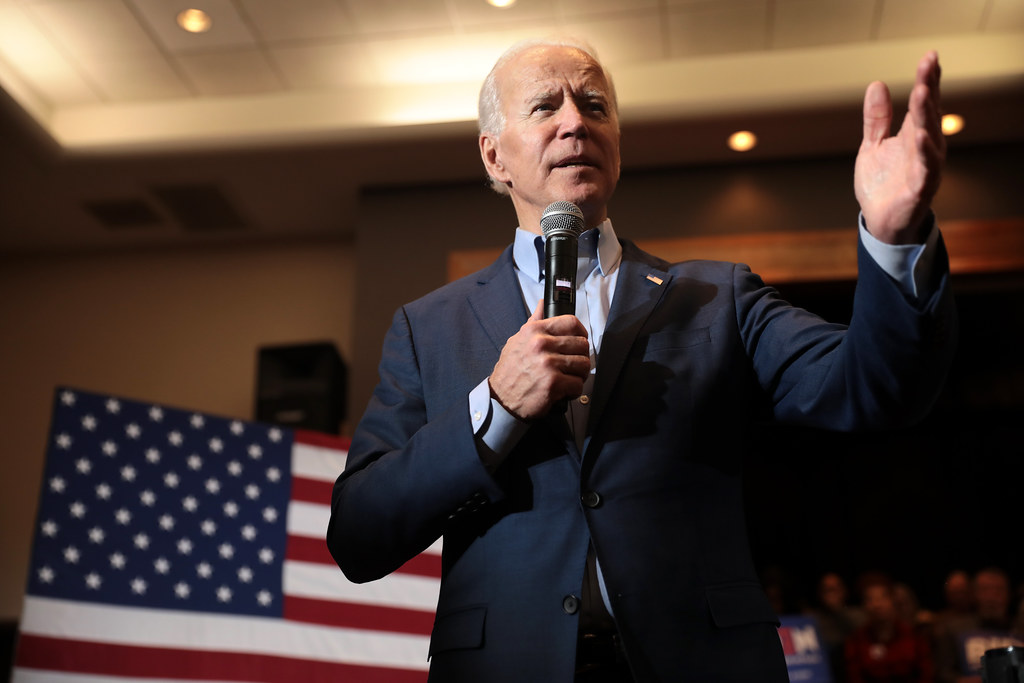

How Biden’s HUD Can Tackle The Housing Crisis

Even without Congress, advocates say there’s a lot that HUD can do to protect tenants and promote affordable housing.

April 06, 2022

Congress Should Heed the Lessons from the Federal Reserve's Ethics Scandals

After a stream of stories throughout the pandemic revealed seemingly rampant congressional insider trading, laughable disclosure practices, and nonexistent enforcement, Congress appears finally to be feeling the pressure to clean up its act. In recent weeks, lawmakers have introduced a flurry of new bills to limit conflicts of interest and help restore public trust in our governing institutions.

As they begin to forge a piece of consensus legislation, they should consider that members of Congress were not the only political leaders to violate public trust throughout the pandemic period. The trading scandals within the Federal Reserve system, for example, revealed material ethical deficiencies that have yet to be satisfactorily addressed. It’s important to recognize that these deficiencies are not unique to the Federal Reserve and that they represent an ongoing threat to public trust in other powerful corners of the executive branch as well. To rebuild that trust in government, lawmakers must learn the lessons of the Federal Reserve scandals and develop fixes for these deficiencies there and elsewhere.

April 06, 2022 | Revolving Door Project Newsletter

Separating Biden World Wheat from Chaff

Measured in positions still awaiting permanent appointments, the first presidential transition is still far from over. Of the 799 positions that the Partnership for Public Service included in its political appointee tracker, 117 still lack a nominee. An additional 161 are empty or being filled in an acting capacity as the nominees for them work their way through an ever more dysfunctional Senate confirmation process.

April 05, 2022

Putting Biden’s Antitrust Budget Increases In Context

The federal government may no longer be operating under the onus of Trump-era austerity, but agencies across the federal government are still far from having the resources they need to quickly and effectively fulfill their responsibilities to the American people. For the most part, President Biden’s proposed FY 2023 budget fails to fill that gap. However, increased funding for antitrust regulation is one of the bright spots in an otherwise uninspired budget. As we have covered in the past, both the Federal Trade Commission (FTC) and the Department of Justice’s Antitrust Division (ATR) saw staffing levels stagnate and budget allocations that did not keep pace with inflation or GDP growth.

April 04, 2022 | The American Prospect

The Corporate Past Of Jeffrey Zients

Over the span of two decades, the health care companies that Zients controlled, invested in, and helped oversee were forced to pay tens of millions of dollars to settle allegations of Medicare and Medicaid fraud. They have also been accused of surprise-billing practices and even medical malpractice.

March 31, 2022

Letter to the Center for Judicial Ethics on Big Tech Creating Expert Conflicts of Interest

We are a diverse coalition of advocacy organizations with a strong interest in the fair and neutral application of the law by courts. We write to express our concern about the growing problem of bias and conflicts of interest that arise from Big Tech funding the careers of the legal experts that judges draw on to understand the law and support their decisions. We ask that the Center for Judicial Ethics assist judges to avoid citing to experts and academics with obvious conflicts of interest as they adjudicate the many cases regarding the Big Tech platforms. We further ask that you encourage judges to require comprehensive disclosure by experts hired by Big Tech platforms.

March 30, 2022 | Revolving Door Project Newsletter

Eleanor Eagan Hannah Story Brown

Corporate CrackdownDe-TrumpificationEthics in GovernmentIndependent Agencies

Build Back Cheaper, and Other Failures of the Centrist Imagination

Across the Biden administration, officials have promised (long overdue) accountability for corporate criminals. But talk is cheap. We at the Revolving Door Project are eager to see serious action to back it up. Our latest analysis, released yesterday, shows the administration is falling short of its ambitious rhetoric. We found that it “pursued at least 24 prosecutions and rulemakings to crack down on white-collar crime this winter, but took no action against at least 48 crimes or abuses.” You can read more about those cases in our brand new tracker. Our team will add updates regularly and share a biweekly news round-up with newsletter subscribers.

March 29, 2022

Press Release Congressional OversightCorporate CrackdownDepartment of JusticeExecutive BranchIndependent Agencies

Biden Gave Most Corporate Crimes A Pass This Winter, New Analysis Shows

The Biden administration pursued at least 24 prosecutions and rulemakings to crack down on white-collar crime this winter, but took no action against at least 48 crimes or abuses, a new data set from the Revolving Door Project shows

March 28, 2022

The DOJ Should Follow Its Own Guidance on FOIA Administration

The celebration of Sunshine Week earlier this month underscored the importance of the continued effort to ensure effective administration of the Freedom of Information Act (FOIA) and its central role for open democracy. Passed by Congress in 1966, FOIA allows citizens to request unpublished records and information from the federal government. Watchdog organizations have long relied on records obtained from FOIA requests to hold the government accountable to public interests. But, the system comes with a plethora of flaws that prevents adequate timeliness and transparency. Endless backlogs, increased usage of exemptions, partially redacted documents, and outright denials leave much to be desired in the administration of FOIA today.

March 28, 2022

Dylan Gyauch-Lewis Mekedas Belayneh

Blog Post Anti-MonopolyCongressional OversightCorporate CrackdownExecutive BranchIndependent Agencies

Shipping Cartels Are Spiraling Out Of Control. The Agency Set To Regulate Them Doesn’t See The Problem.

The Federal Maritime Commission’s leaders have no interest in breaking up the shipping conglomerates’ price-gouging which Biden promised the nation.

March 28, 2022

Biden’s Weak Record On White-Collar Crime Is (Partly) Thanks To Congress

When Republicans blockade confirmation hearings, they handcuff the government’s ability to handcuff lawbreaking executives.

March 25, 2022 | Left Anchor

LEFT ANCHOR PODCAST: The Hapless Merrick Garland, with Jeff Hauser

Why is Biden’s attorney general so reluctant to charge Donald Trump and his cronies for their crimes? Revolving Door Project founder and executive director Jeff Hauser joined Prospect managing editor Ryan Cooper on the Left Anchor podcast to discuss.

March 21, 2022

This Federally Owned Public Utility Company Is Run by a Former Fossil Fuel Executive Who Makes $10 Million

The Tennessee Valley Authority could be leading the country toward renewables. Instead, it gets huge chunks of its power generation from coal and methane.

March 16, 2022

To Take Down Corporate Polluters, the DOJ's Environmental Enforcer Needs More Capacity

Overseen by Assistant Attorney General Todd Kim, the Environment and Natural Resources Division (ENRD) is one of seven litigating components of the Department of Justice (DOJ). The ENRD is divided into ten sections, each with its own area of expertise. The Division fulfills a wide range of responsibilities. For instance, the ENRD is tasked with protecting the nation’s natural resources and enforcing U.S. civil and criminal environmental laws, including the Clean Water Act, Clean Air Act, and hazardous waste laws. The Division also handles tribal rights and resources cases. Other responsibilities include, but are not limited to, “facilitating cleaner energy and ensuring marketplace integrity; defending and adjudicating water rights for Federal agencies and Indian Tribes, as well as policies and decisions that support the generation of clean energy on Federal lands and the outer continental shelf; and, promoting international climate justice activities and the advancement of legislative and policy matters related to climate change.”

March 16, 2022 | Revolving Door Project Newsletter

Facing Rising Prices and Falling Political Fortunes, Biden Needs to Go on Offense

With each passing day, Biden and his party appear to be facing ever more severe political headwinds. Inflation remains elevated, with a new variant threatening to further aggravate supply chain problems. Meanwhile, the (warranted) response to the war in Ukraine has specifically pushed gas prices upwards. Add to this that the Federal Reserve appears eager to throw millions out of work to slow the economy and that some of Biden’s outstanding nominations are in peril thanks to his own, uncooperative co-partisans, and things are undoubtedly looking bleak.