Our Blog

May 28, 2021

How the DOJ Can Federally Document Every Fatal Case of Police Misconduct

The Arrest-Related Deaths (ARD) program — a federal tracking system to document cases of police homicide amid other manners of death emanating from the arrest process & the police interaction at large — held massive potential to further police oversight goals. Not only does re-establishing the ARD program require no legislation, but a template for a revised ARD program has been underway for over 6 years. The pilot study reconstructing the ARD’s methodology yielded a blueprint mapping out how the relaunched ARD program could operate by a hybrid system of open-source media mining and law enforcement agency surveying. Reactivating the ARD program in its contemporary version is one of the easiest & speediest proposals that the Biden administration & Garland’s DOJ can actualize on the matter of criminal justice reform — so, why aren’t they?

May 27, 2021 | The American Prospect

Justice Department Shot Through With Corporate Influence

The U.S. government is involved in hundreds of court cases each year, most of which are not followed closely. But the baseline assumption is that the government is defending the public interest and holding criminals accountable, even when most aren’t watching. Unfortunately, in Merrick Garland’s Justice Department, that is not uniformly the case. Key acting officials, drawn from the halls of corporate power, are riddled with conflicts of interest that are already affecting their ability to protect the public. If the Justice Department is to serve all Americans rather than bolster individual fortunes and entrench corporate power, Merrick Garland must stop elevating corporate attorneys who have gotten rich fighting on corporate America’s behalf.

May 21, 2021

Revolver Spotlight: Brian Netter

Brian Netter, a corporate attorney who represented big business in wage theft cases and litigated against workers who sued companies for mismanaging their retirement funds, was just appointed to the Department of Justice.

May 20, 2021

What Biden & Garland’s DOJ Must Do to Monitor & Curb Police Misconduct

Policing, anti-black, anti-immigrant, ableist, and capitalist at its core, was designed to be outside of the scope of the law. The deployment of federal law enforcement officers in unmarked vans to abduct and detain Black Lives Matter protestors in Portland, Oregan during last summer’s national uprising over police killings demonstrates the extreme nature of rogue American policing. Police prerogative power, as the expression of the state’s legalized violence to enforce public docility at its will, is embedded in US governance. Couple that with qualified immunity, police contracts & unions, police bill of rights, and whatnot, law enforcement are shielded from disciplinary actions.

May 19, 2021

Revolver Spotlight: Ellisen Turner

If appointed, Turner would be a transparent and flagrant case study in the workings of the revolving door, which means he would be right in line with the IP orthodoxy PTO has upheld.

May 19, 2021

Biden Hired State Dept. Official From Eugene Scalia's Law Firm, New Report Shows

As the report explores, Gibson Dunn’s ties to the Republican Party run back to the Reagan era.

May 18, 2021

Executive Branch Financial Disclosures

The Revolving Door Project will be tracking these disclosures and flagging important revelations revealed by the OGE to ensure high level political appointees are not financially beholden to special interests they may regulate in government.

May 17, 2021

Revolver Spotlight: Howard Shelanski

Shelanski, Obama’s second OIRA administrator, now represents monopolies like Facebook and Tyson Foods. His regulatory skepticism and disdain for the emerging antitrust movement would make him a disastrous pick for any role in the Biden administration.

May 17, 2021

Revolver Spotlight: Kevin Rhodes

When choosing the next PTO director, the Biden administration should rule out those who have a history of prioritizing profits and corporate interests over public health and safety. One such individual is Kevin Rhodes, an ally of Big Pharma who has vigorously defended efforts to keep drug prices high. His current employer, 3M, has abused its monopoly on the military earplug market to sell overpriced and faulty products to veterans. This should be immediately disqualifying for any future PTO director. Here are a few of the most alarming aspects of Kevin Rhodes’s career:

May 13, 2021

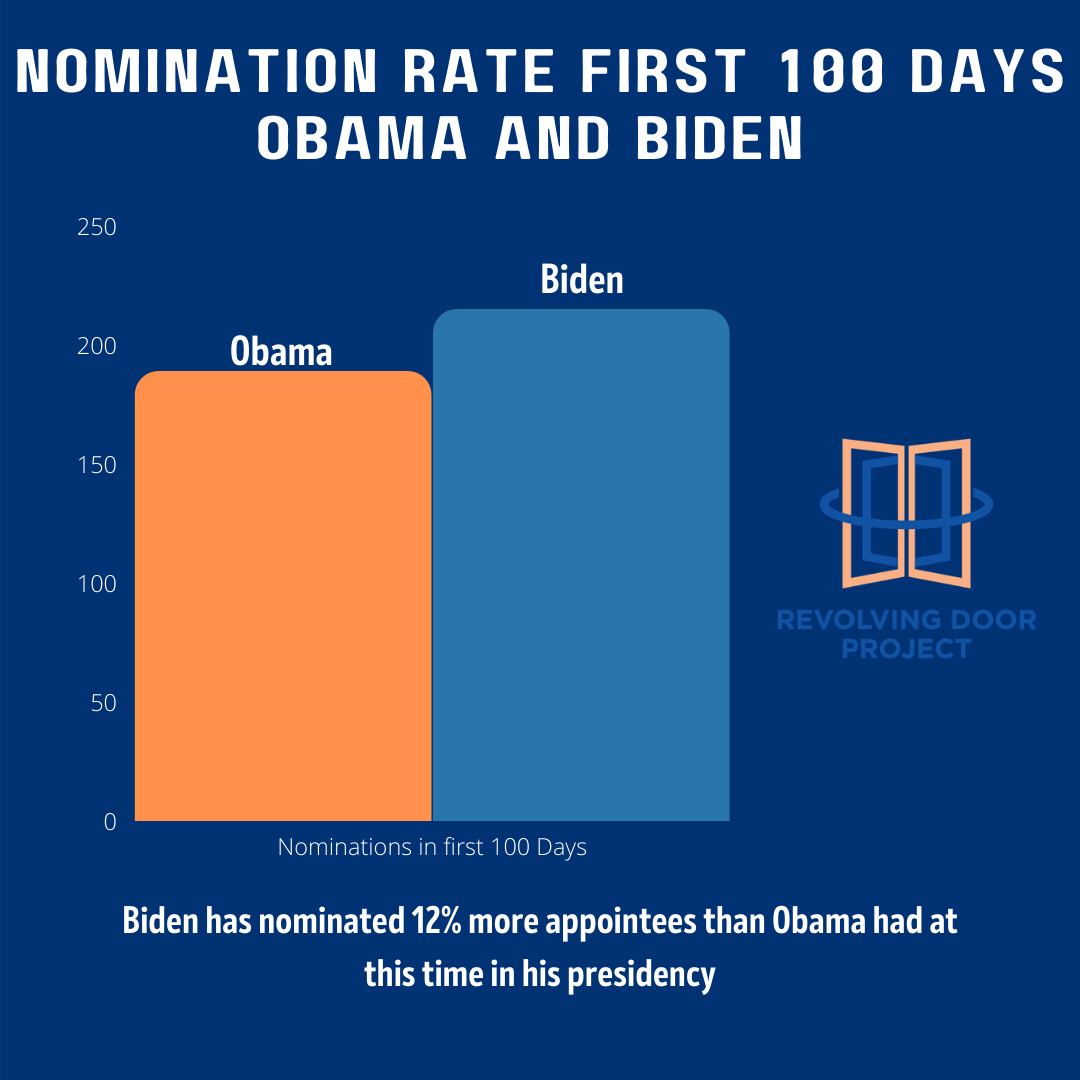

100 Days in Office and Biden is Outpacing Obama

Presidents are only as effective as the administrations they assemble. FDR’s “brain trust,” for example, drove his effective first term. As President Biden seeks to surpass his predecessors’ accomplishments and become the most effective president of the past 60 years, the staff with whom he surrounds himself are essential. For over a thousand members of his team, Senate confirmation stands between them and the critical task ahead, making it crucial that Biden quickly make nominations to get these senior leaders working towards his vision as soon as possible. As the traditional post-New Deal metric of how a young administration is performing, the 100th day in office is a chance to look back on the Biden administration’s progress thus far and compare it to the Obama administration.

May 13, 2021

The Difference Between Public Interest And Corporate Lobbyists

Representatives of corporate interests often twist the spirit and the intent behind calls for ethics in government. Under the guise of keeping lobbyists out of an administration, big business rails against even the suggestion that working people get a voice in government. They do this by falsely conflating public interest lobbyists and corporate lobbyists.

May 13, 2021 | The American Prospect

Max Moran Dorothy Slater Zena Wolf

Op-Ed 2020 Election/TransitionClimate and EnvironmentEthics in GovernmentFinancial Regulation

Plumbing The Depths At The SEC

Progressives have generally seen Gary Gensler, the newly confirmed chair of the Securities and Exchange Commission (SEC), as a loyal advocate for the public interest. His tenure at the Commodity Futures Trading Commission (CFTC) was one of the few bright spots in Barack Obama’s financial regulatory regime. But in April, Gensler named Alex Oh to be his director of enforcement, before she resigned a week later amid negative media attention. Before joining the SEC, Oh had directly facilitated an ExxonMobil executive’s obstinate deposition testimony (reportedly read off an attorney-drafted script) in the face of plaintiff objections—and the case itself centered on accusations of torture, rape, and murder by ExxonMobil-hired guards in an Indonesian village.

May 11, 2021

Garland's DOJ Needs To Prioritize Fixing Our Broken Immigration Court System

Two recent pieces from The Hill and the New York Times have called much-needed attention to the dismal state of immigration courts in this country. Merrick Garland’s Department of Justice (DOJ), which oversees the immigration court system, has thus far failed to root out white supremacy and adequately staff the system, leaving hundreds of thousands of migrants in precarious legal–and physical–positions.

May 10, 2021

Can An Appointee Loyal To BigLaw Be Trusted To Oversee The Army Corps Of Engineers?

President Biden announced last week the appointment of Michael Connor to be the Assistant Secretary of the Army for Civil Works within the Department of Defense, making him responsible for the entire Army Corps of Engineers.

May 10, 2021 | Independent Media Institute

The Tattered Insider Histories Of Our Possible Future Ambassadors

According to the Washington Post, Biden is finally getting around to scratching the backs of his friends and allies. This carries weight in D.C. gossip circles, given how well-connected Biden is there. So who made the cut?