Search Results for

February 01, 2021 | The Intercept

Robinhood Is A Perfect Example Of Fintech's Insidious Power

Fintech is neither inherently good nor bad; rather, like any technology, its potential impact on society is closely tied to the policy decisions guiding its use — and the next four years could define how much the fintech industry is able to shape the financial system. Left to their own devices, fintech firms could swindle average people through ill-advised day-trading or high-interest loans, usher new systemic risks into the financial system, and develop traceable, privately owned currencies with the potential to replace cash.

January 26, 2021

13 Questions Which Fintech-Tied Appointees Must Be Able To Answer

Lately, fintech-funded individuals like Michael Barr have been rumored for powerful financial regulatory positions, despite the fact that this would leave them in charge of decisions directly affecting the firms they advised.

January 13, 2021 | CODEPINK

WEBINAR: Joe Biden’s BlackRock Cabinet Picks

Our Max Moran joined CODEPINK Campaign Organizer Nancy Mancias to discuss investment management giant BlackRock’s role in influencing President-elect Biden’s executive branch personnel choices.

January 12, 2021

Gary Gensler Would Lead An Un-Captured SEC To New Climate Regs

Gensler’s first order of business at the SEC will be to reverse Trump’s deregulatory agenda and rebuild the agency’s capacity to police American stock-trading. But this should only be a starting point: SEC activity was insufficient even under Obama, and issues linked to the financial system, from climate change to inequality, have worsened in the four intervening years.

January 11, 2021 | Sludge

BlackRock Alum Who Developed Neoliberal Policies for Obama Will Be Harris’ Chief Economist

Michael Pyle, Vice President Harris’ incoming chief economist, is the latest member of BlackRock’s “shadow government” to be hired by the Biden-Harris administration. His record working for austerity advocate Peter Orzsag and TPP-proponent Lael Brainard should be a major red flag.

January 05, 2021

Biden's Shadow Transition Director Aided Corporations At Home And Abroad

Gitenstein’s time as Romanian ambassador earned him a walk-on role in Romanian historian and totalitarianism expert Florin Abraham’s post-World War II history of his country.

December 18, 2020

Tech In Transition Tracker

Use this ongoing tracker to monitor the ties to Big Tech from individuals on the agency review teams, individuals who have been officially designated as nominees, and others who we suspect are jockeying for posts right now.

December 17, 2020 | The American Prospect

Does Jeffrey Zients Have the Private-Sector Experience We Want in Government?

In an age of financialization and monopoly, ‘private-sector experience’ too often translates into those who successfully plunder for profit. Jeffrey Zients epitomizes that trend.

December 15, 2020

Exposing Big Oil's Payoffs To Corrupt World Leaders Falls To...The SEC?

Environmentalists and foreign policy activists shouldn’t overlook appointments to agencies outside of their usual portfolios.

December 15, 2020 | Washington Post

Businesspeople Aren't Bad — But Rigging The System Is

It is a telling misunderstanding of the revolving-door critique to equate Jeffrey D. Zients’s private-sector history with that of all businesses. Mr. Zients is not a wealthy and respected businessman because he made a particularly good widget or displayed unusual managerial skill.

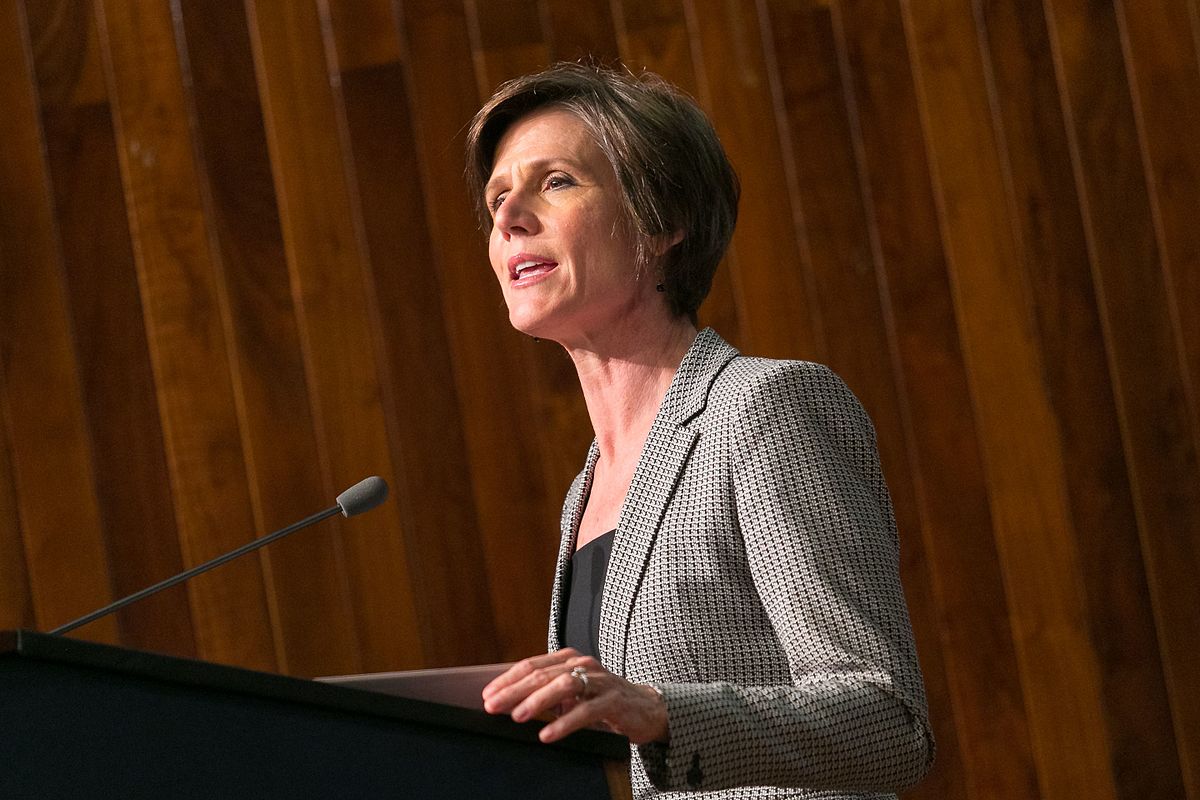

December 07, 2020

Sally Yates' Record of Ignoring The Innocent And Protecting The Guilty

Sally Yates, an anti-Trump #Resistance icon, spent her last year in Obama’s Justice department refusing to act on a high-profile clemency initiative, prompting a furious resignation letter from Obama’s pardon attorney. After her famous firing in the early Trump days, Yates went to work for BigLaw firm King & Spalding’s “Special Matters and Government Investigations” practice, which is BigLawspeak for “teaching corporate America which laws they can violate without DOJ filing suit, and how to tamp down on suits which they do file.”

December 02, 2020

How Does Any Decent Person Consider Gina Raimondo For A Cabinet Position?

It would be a disaster for Raimondo to receive any spot in the incoming Biden administration. (Term limits prevent her from running for re-election.) But it’s especially horrifying — and frankly, stupefying — to consider Raimondo for HHS in the year 2020.

December 02, 2020

Important Economic Policy Jobs Which Remain Unannounced

These positions will dictate whether a Biden administration’s worker, regulatory, and enforcement agendas succeed, fail, or are smothered before they are even initiated

December 01, 2020

It Will Take Years To Recover From Trump's Historic Corruption

His lawlessness, cravenness, and wanton destruction of our economy and planet have been ably documented by dedicated journalists — yet surely, there is still more corruption and social devastation that was simply never reported or found while Trump was in office.

November 24, 2020

Brian Deese's Policy Record Hurt The Most Vulnerable

From 2008 – 2016, Brian Deese rose from a law student to a Presidential advisor on fiscal policy, climate change, and trade. Deese’s personal geniality and intelligent demeanor drove this rise — but a review of his policy positions reveals a history of backing wildly incorrect conventional wisdom convivial to the powers that be.