Search Results for

December 15, 2025

TRACKER: Cuts to Corporate Enforcement Capacity

This tracker records cuts made by the Trump-Musk administration to enforcement capacity at agencies responsible for overseeing corporations’ activities and identifying wrongdoing.

“Enforcement capacity” refers to staffing and funding dedicated to monitoring, oversight, investigation, and preparation of cases against corporations for breaking the law. Cuts to and attacks on enforcement capacity can include firings, buyout offers, funding cuts, reorganizations, and other steps the Trump administration has taken to date.

December 11, 2025

Trump Has Already Shattered FEMA Without Eliminating It

The Trump administration doesn’t need to formally eradicate FEMA to destroy it.

November 19, 2025

The Trump Administration Is Quietly Preparing to Bring Back School Segregation

The Trump Administration’s voucher scheme, coupled with potential changes to the Office of Civil Rights, is part of the decades old Republican plan to bring back segregation in schools.

November 14, 2025

Top Trump Official Failed To Disclose Conflicts of Interest for Entire Justice Department Tenure

A Department of Justice official managed to serve in Trump’s administration without disclosing his financial entanglements publicly – and now, only after his departure, can we highlight his conflicts of interest.

October 17, 2025

Tracking the Environmental Harms of Trump Actions

Trump’s second term began with drastic announcements on Day One and has been chaotic every day since. It can be overwhelming to try to keep up with the cuts to environmental funding, rollbacks to critical regulations, and track the thousands of staff across agencies who have been fired from their roles. The purpose of this tracker is to monitor some of the most important tangible increases in pollution and environmental and health harms caused by the Trump administration’s actions.

October 02, 2025

Don’t Listen to Ezra Klein- Annul BigTech & Democrats' Marriage

While supporters of abundance tend to center it on discussions of housing, the Klein-Thompson brand of abundance has always included a healthy dose of techno-optimism.

September 26, 2025

The Tennessee Valley Authority (TVA) In The Trump Era

The Tennessee Valley Authority (TVA) is the largest public provider of power in the United States. It powers over 10 million people in Tennessee as well as Alabama, Georgia, Kentucky, Mississippi, North Carolina, and Virginia.

September 17, 2025

Attrition in the Early Months of the Trump Administration

According to data released in July by the Office of Personnel Management (OPM), March 2025 was, by a large margin, the single worst month for federal hiring since at least October 2004.

September 15, 2025

CNN Allows Sinema Skate Through Recent Tapper Segment

CNN and Jake Tapper invited former Senator Kyrsten Sinema on to discuss crypto and AI. He failed to disclose her conflicts of interest

September 04, 2025

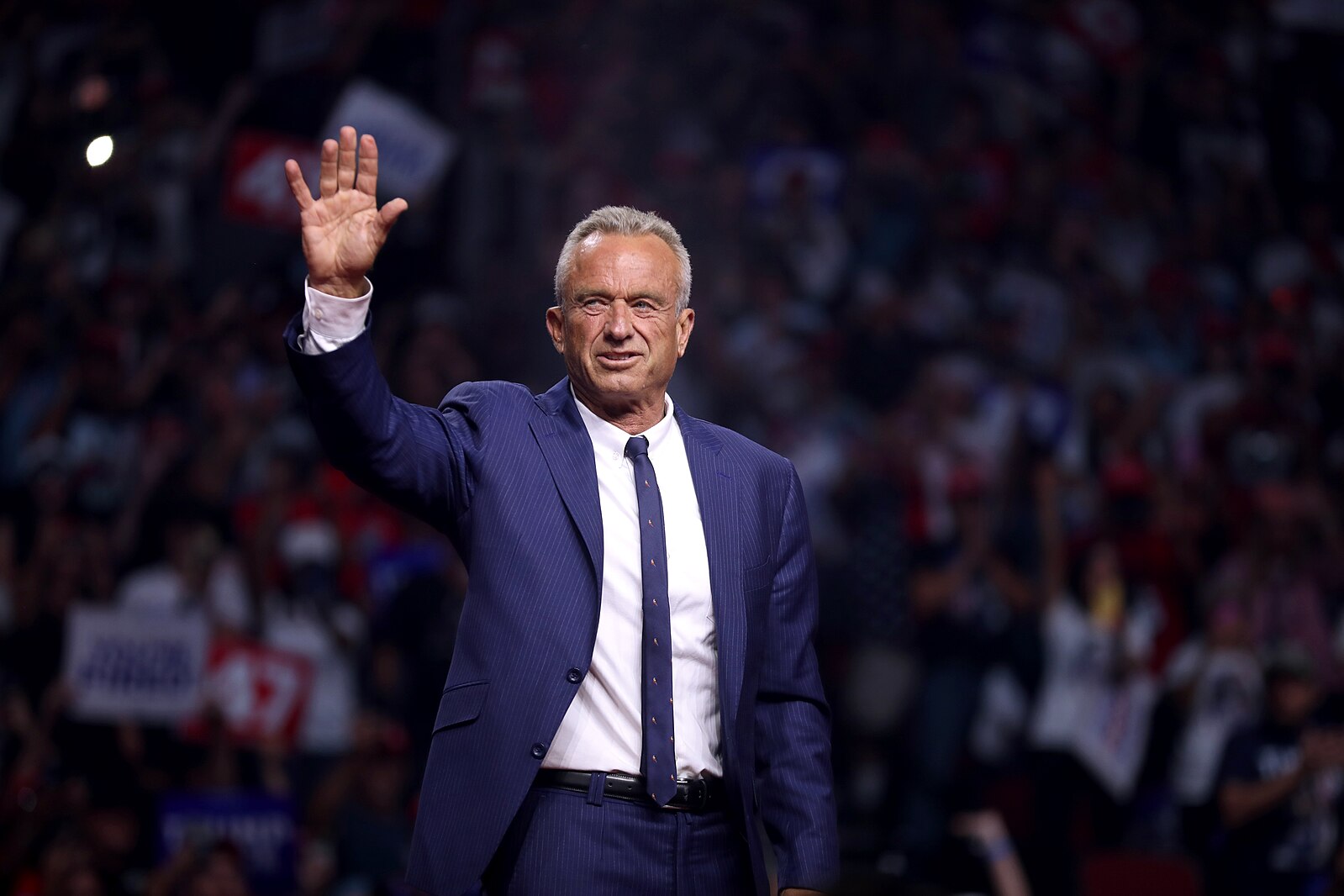

CDC in Chaos: Director Fired, Top Leaders Resign in Protest

HHS fired CDC Director Susan Monarez after she refused to implement vaccine policy changes directed by HHS Secretary Robert F. Kennedy Jr.

August 26, 2025

Oligarchs in the Trump Admin: Jeff Yass

Billionaire Jeff Yass, a GOP mega-donor including $16 million to Trump super PAC MAGA Inc., has influence over education and TikTok policy.

August 20, 2025

Oligarchs and the Trump Admin: John Wu

Since 2020, John Wu has served as president of the crypto company Ava Labs. On April 2, 2025, Ava Labs donated $1 million to MAGA Inc, President Trump’s Super PAC. According to the New York Times, the donation got Wu a spot at a fundraising event just two days later—a “candlelight dinner” featuring Trump as a guest speaker.

August 15, 2025

Oligarchs and the Trump Admin: Ronald Lauder

Ronald Lauder is the President of the World Jewish Congress, heir to Estée Lauder, and a GOP mega donor

Net Worth: 4.8 Billion

August 14, 2025

Oligarchs and the Trump Admin: John Paul “JP” Richardson

JP Richardson is a wealthy crypto mogul who hosted an industry event for Trump. He is also a major Trump donor.