November 09, 2023

Toni Aguilar Rosenthal Dorothy Slater

Blog Post Climate and EnvironmentDepartment of Homeland Security

Biden’s Border Wall

The Biden Administration announced last month that it had deemed it “necessary” to waive 26 federal laws, including the Clean Air Act, the Safe Drinking Water Act, the Endangered Species Act, the Native American Graves Protection and Repatriation Act, and the American Indian Religious Freedom Act, amongst others, in order to move forward with the construction of Trump’s infamous border wall along the US-Mexico border. This decision came after Biden vowed during his 2020 campaign that there would “not be another foot of wall constructed” during his presidency.

November 08, 2023 | Revolving Door Project Newsletter

We Can’t Afford Supply Side Liberals’ Climate Strategy

All that this administration has done to make renewables easier and cheaper to build in this country is threatened by the administration’s simultaneous willingness to let U.S. fossil fuel companies continue to extract the massive reserves of oil and gas still in the ground, and, increasingly, to export it abroad. We share one global atmosphere. There is no decarbonizing America—no avoiding climate change reshaping the possibilities for life on this planet—without keeping our massive oil and gas reserves in the ground.

November 01, 2023

Utilities Are Increasingly Passing Premiums for “Certified” Gas Onto Consumers Across The Country

Our recent inquiry into whether utilities around the country are paying premiums for purchasing “certified,” “differentiated,” or “responsibly sourced” natural gas—and if so, whether they are passing on those higher prices to customers—has uncovered a significant uptick in utilities seeking these gas options and passing on the costs to ratepayers. You can find our research document here.

October 16, 2023

RELEASE: Energy Department’s Embrace Of Fossil Fuel Powered Hydrogen Hubs A Win For Manchin, Loss For Climate

In response to the Energy Department’s announcement Friday that it has selected seven proposed Hydrogen Hubs to allow to enter negotiations for $7 billion in federal funding, the Revolving Door Project released the following statement.

October 11, 2023 | Revolving Door Project Newsletter

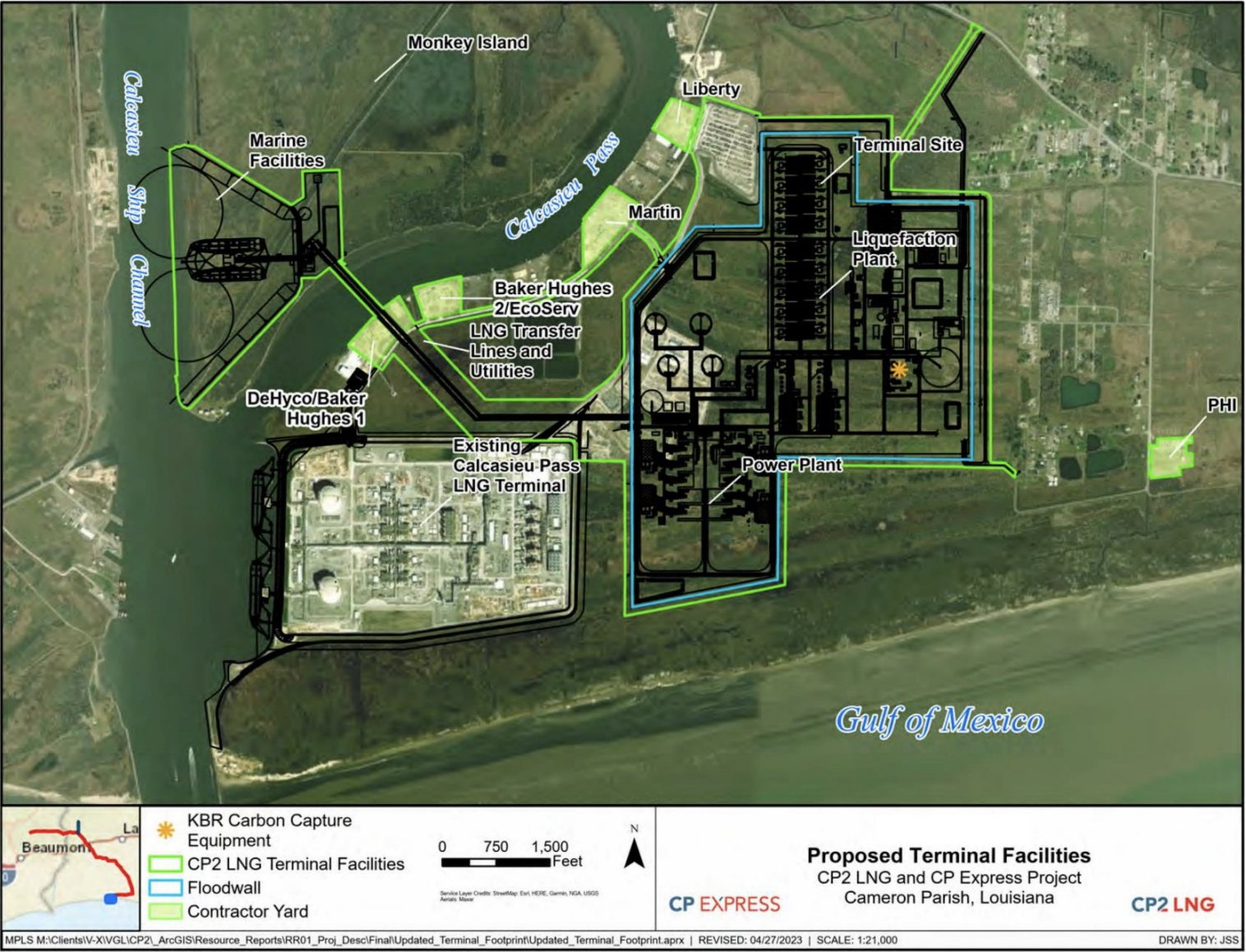

Calcasieu Pass Makes Its Billions From Polluting Louisiana in the Wake of Putin’s War

On Thursday the 19th, the Federal Energy Regulatory Commission is expected to vote on whether to approve Calcasieu Pass 2, a massive long-term natural gas liquefaction and export facility that intends to export 20 million metric tons of planet-warming methane gas a year. Dodging its responsibility so far to consider the full range of consequences of its infrastructure permitting decisions, FERC looks set to greenlight this monstrosity. As this newsletter will explore, not only are the global climate consequences of new gas export infrastructure enormous, but the immediate impacts are keenly felt by the local community inundated with pollution from the original Calcasieu Pass facility.

October 09, 2023 | The American Prospect

America's Pipelines Are a Disaster Waiting to Happen

The underfunded agency overseeing tens of thousands of miles of dangerous pipelines has not had an official leadership for years.

September 27, 2023 | Revolving Door Project Newsletter

New Watchdog Reports Highlight Insufficient EPA Enforcement Ahead Of Shutdown

Corporate greed and emaciated federal regulatory capacity means people are needlessly suffering physically, and sometimes even dying. That’s the upshot of two recent reports from the EPA’s Office of the Inspector General (OIG). These reports illustrate the concerning state of environmental regulation and enforcement in regards to water quality and refinery emissions.

September 20, 2023

Thousands March Worldwide to End Fossil Fuels, as Biden Continues to Shirk His Responsibility to Address Climate Change

On Sunday, an estimated 75,000 people marched in Manhattan, demanding that President Biden end the era of fossil fuels and take immediate action to address climate change.

September 18, 2023 | The American Prospect

The Federal Reserve Could Be a Powerful Weapon Against Climate Change

Activists are pushing Fed vice chair Michael Barr and his deputy Kevin Stiroh to force the financial sector to take climate change seriously.

September 18, 2023

RELEASE: White House Should Deepen Its New Recognition of the Environmental Salience of Its Cancer Moonshot Initiative

The White House announced late last week that the Environmental Protection Agency is launching epa.gov/cancer as part of the Biden administration’s Cancer Moonshot efforts, and will share new information about the EPA’s role in leveraging its existing authorities to “accelerate the rate of progress to prevent cancer, including phase-outs of carcinogens, regulatory actions to protect children, workers and overburdened communities, and enforcement actions to ensure pollution is curbed.”

September 06, 2023

Hannah Story Brown Emma Marsano

Press Release Climate and EnvironmentCorporate CrackdownExecutive BranchTreasury Department

RELEASE: As the Hydrogen Industry Vies for Tens of Billions of Federal Dollars, Lax Oversight and Entrenched Fossil Fuel Ties Raise Red Flags

The Revolving Door Project released a new Industry Agenda report today examining the executive branch influence agenda of the rapidly growing “clean” hydrogen industry, which is poised to receive tens of billions of dollars under the Infrastructure Investment and Jobs Act of 2021 and the Inflation Reduction Act of 2022.

August 30, 2023 | Revolving Door Project Newsletter

The Forest Service: In Service of Logging Companies Since 1905

The roughly 35,800 employees of the federal Forest Service, housed within the Department of Agriculture, are responsible for managing 193,000,000 acres of national forests. The mission of the Forest Service is to “sustain the health, diversity, and productivity of the nation’s forests and grasslands to meet the needs of present and future generations.” Yet time and time again, the Forest Service has betrayed this mission in order to service the profit-driven ends of the timber industry, prioritizing commercial timber extraction over recreation and conservation, and ignoring the essential role intact forests play in mitigating our ongoing biodiversity and climate crises.

August 29, 2023

Press Release: Revolving Door Project Decries Fed’s Lack Of Action On Climate Risk Mitigation At Jackson Hole Summit, Calls For Immediate Change Of Course

At the conclusion of the Kansas City Fed’s annual Jackson Hole Economic Symposium, Revolving Door Project Senior Researcher Kenny Stancil and Research Assistant Henry Burke released the following statement: