February 17, 2021

The Industry Agenda: Fossil Fuel

The fossil fuel industry is one of the most notoriously profit-hungry and planet-destroying sets of corporations to exist today. The “fossil fuel industry” includes oil, gas, (yes, even the “natural” kind), and coal companies, as well as subsidiary companies involved in the extraction processes for these materials: land and off-shore drilling, fracking, and underground and surface mining.

February 16, 2021

How A Little-Known Treasury Position Could Move Mountains For Climate Action

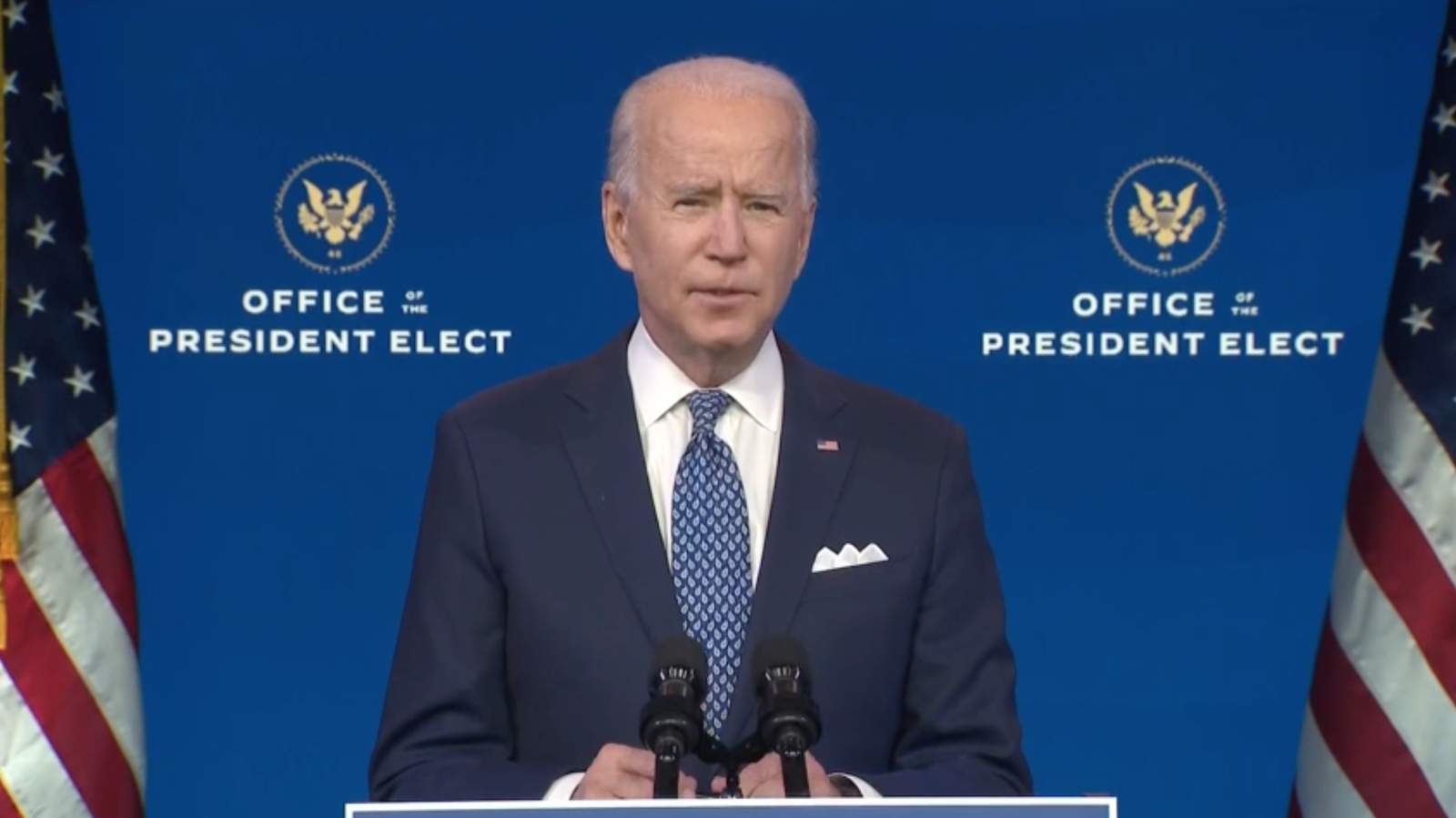

President Biden has promised to take a “whole-of-government” approach to tackling the climate crisis, and so far his appointees appear to be following suit. The National Climate Task Force met for the first time in a crowded zoom room last week, and Treasury Secretary Janet Yellen and International Climate Envoy John Kerry met earlier this month to discuss their “climate finance plan” to shift capital towards investments in line with a low-carbon economy.

February 04, 2021 | American Prospect

Dorothy Slater Max Moran Timi Iwayemi

Op-Ed 2020 Election/TransitionClimate and EnvironmentDepartment of JusticeFinancial RegulationFintech

Even After The Cabinet Selections, Personnel Is Policy

As grinding as the cabinet fights have been, they’re only the first wave of the Biden administration’s personnel. Now comes a new stage of the transition, in which the newly-named secretaries choose their own undersecretaries and senior advisers. Although occupants of these positions typically operate outside the national spotlight, they still wield enormous power.

February 02, 2021 | Talking Points Memo

New Dem-Majority Senate Must Assess Financial Reg Appointees Through Climate-Tinted Lens

It is no longer tolerable to confirm nominees who lack awareness of the scale of our climate emergency and the immense work needed to address it across all aspects of American life.

February 02, 2021

Yellen Should Move Quickly To Appoint A Climate Leader In Treasury

During Janet Yellen’s confirmation hearing to become Secretary of the Treasury, she promised to “look to appoint someone at a very senior level” to lead the Treasury’s efforts on climate action.

January 26, 2021

Why The Next CFTC Chairperson Must Prioritize Climate Action Over Market Fads

Initially created to regulate futures derivatives on crops that had yet to be harvested, the Commodity Futures Trading Commission (CFTC) holds newfound possibility in the coming decade. It is absolutely crucial that a modern-day CFTC taps into the power it already holds to lead on climate action. Naturally, this necessitates a leader with a proven record of taking on corporate power. Any appointee should be prepared to advocate for the public interest, acknowledge the current reality of climate decay we find ourselves in, and creatively apply tools of the government to take immediate action.

January 21, 2021

Why the Comptroller of the Currency Must Be a Climate Leader

The OCC could also update the Comptroller’s Handbook to guide bank examiners to measure climate risk in their assessments, which would force banks to measure climate risk in their own internal stress tests. This would also push banks to make environmentally sound decisions, because they would be recontextualized as financially savvy decisions.

January 14, 2021

Joe Biden's Newest Climate Appointees Provide Reason For Cautious Optimism

These personnel additions should leave climate activists cautiously optimistic, and many of these individuals are examples of people we would like to see staffed in every department and agency throughout the federal government.

January 12, 2021

Gary Gensler Would Lead An Un-Captured SEC To New Climate Regs

Gensler’s first order of business at the SEC will be to reverse Trump’s deregulatory agenda and rebuild the agency’s capacity to police American stock-trading. But this should only be a starting point: SEC activity was insufficient even under Obama, and issues linked to the financial system, from climate change to inequality, have worsened in the four intervening years.

December 23, 2020 | The American Prospect

The Most Important Biden Appointee No One Has Heard Of

One role that remains unfilled will be vital to enacting Biden’s policy agenda: the administrator of the Office of Information and Regulatory Affairs (OIRA). Although many Americans have never heard of OIRA, the office is well known among corporate lobbyists, who take full advantage of its ability to stop regulations in their tracks. Since the Reagan administration, OIRA has earned a reputation as “the death row of well-meaning legislation.”

December 16, 2020

An EPA Administrator Michael Regan Should Not Pacify Environmental Justice Community

After news broke that Michael Regan, who currently leads the North Carolina Department of Environmental Quality, was the new frontrunner to lead the EPA — and was also being considered to be director of the EPA’s Southeast Region Office — environmental justice leaders in North Carolina began pushing back immediately.

December 15, 2020

Exposing Big Oil's Payoffs To Corrupt World Leaders Falls To...The SEC?

Environmentalists and foreign policy activists shouldn’t overlook appointments to agencies outside of their usual portfolios.

December 11, 2020

Mary Nichols Is The Wrong EPA Administrator For 2021

Mary Nichols, the reported frontrunner to lead Biden’s Environmental Protection Agency, has been appointed four times to the California Air Resources Board (CARB) and is best known for spearheading California’s cap-and-trade program. Since the program began, California’s carbon emissions from its oil and gas industry rose 3.5%. For a state that would have the fifth-largest economy if it were a country, anything but a significant and ongoing decline in carbon emissions is disastrous.

November 24, 2020

Brian Deese's Policy Record Hurt The Most Vulnerable

From 2008 – 2016, Brian Deese rose from a law student to a Presidential advisor on fiscal policy, climate change, and trade. Deese’s personal geniality and intelligent demeanor drove this rise — but a review of his policy positions reveals a history of backing wildly incorrect conventional wisdom convivial to the powers that be.

November 23, 2020

What A Bold Treasury Secretary Could Do

President-Elect Joe Biden’s choice to name Janet Yellen as his Treasury Secretary represents a tremendous opportunity to take executive action on the issues most pressing to all Americans. Here are just some meaningful actions the next Treasury Secretary could take without having to go through Congress.