June 23, 2022 | The American Prospect

President Biden’s Best Agency Is Starved for Cash

Two months after Ithaca, New York, became the first city to unionize all of its Starbucks locations, Starbucks announced a dramatic alteration to its business plan for the city: It was closing a shop with one week’s notice. The coffee leviathan stated the store was closing due to “efficiency” concerns and would not guarantee new jobs for the location’s workers.

June 21, 2022

Coalition Urges the EPA to Rein in Rogue Federal Agencies via NEPA

We, the undersigned organizations, urge the Environmental Protection Agency (EPA) to revive the use of its authority to refer environmentally destructive federal projects to the White House Council on Environmental Quality (CEQ), and specifically call on the EPA to refer recent decisions made by the Tennessee Valley Authority and the United States Postal Service.

June 14, 2022

Gordon, Thompson Confirmations Spotlight Urgent Need To Fill HUD Vacancies

Two top Biden housing nominees have been confirmed after months of delays, but five more HUD vacancies still remain unfilled.

June 13, 2022

Toni Aguilar Rosenthal Mekedas Belayneh

Blog Post Food and Drug AdministrationGovernment CapacityIndependent Agencies

The Decades-Long Food Failure at the FDA

In 2008, a deadly salmonella outbreak from contaminated peanut products killed nine and sickened over 700 people. In the aftermath, the peanut executives who poisoned people with food they knew was contaminated received decades-long prison sentences, an all-too-rare case of a corporate criminal being held responsible for the harm they caused. Contemporary public outrage also helped to fuel a push for more structural reform to the food safety regulatory system as a whole. Shortly after the outbreak, the Obama administration began whipping bipartisan congressional support for the Food Safety Modernization Act (FSMA), which sought to prevent future food safety crises by expanding and strengthening the Food and Drug Administration’s (FDA) authority over food. FSMA ultimately passed both the Senate and the House by wide margins and enjoyed broad public support when finally enacted in 2011.

June 08, 2022

RELEASE: Lummis-Gillibrand Crypto Bill Is An Irresponsible Handout To The Crypto Industry

“The industry carve outs in this bill are a reminder of the danger of corporate influence in our political system. The crypto industry’s leading figures have spent enormous amounts to shield the industry from proper financial oversight. This money has been funneled towards revolving-door hiring of former CFTC officials, formation of super PACs, and congressional campaign donations. The industry has also bemoaned the SEC’s robust regulatory posture, decrying it with the self-defeating ostensible insult of ‘regulation by enforcement.’ That supposed criticism merely underlines the urgent need for the SEC to act. Existing law is clear, and it mandates that the SEC enforce existing statutory and regulatory limits that crypto bros have brazenly broken on the assumption that they will be able to buy clemency before they are sanctioned appropriately.”

June 08, 2022 | Revolving Door Project Newsletter

June Gloom for Student Debtors, Plus Biden’s Solar Breakthrough

The tortuous game of will-they-won’t-they cancel student debt continues. Biden’s decision this week to cancel $5.8 billion in debt held by 560,000 former students of the systematically fraudulent, now-defunct Corinthian Colleges seems to signal a willingness (finally!) to wield executive authority on higher ed issues. Meanwhile, a historic coalition of over 500 labor, civil rights and advocacy groups continues to press Biden for sweeping cancellation. The labor movement has been ramping up its calls for student debt cancellation, and more unions, including the Amazon and Starbucks unions and several traditionally blue-collar unions, are joining the fight. This show of force from a broad labor base could help Biden overcome his political reservations, with organized labor actively refuting the Republican talking point that student debt relief is a handout to elite university graduates.

June 01, 2022

With Jan. 6 Public Hearings on the Horizon, Garland Must Deliver Actual Accountability

“From Gerald Ford’s pardon of Richard Nixon, to George H.W. Bush’s pardons of the Iran-Contra scandal’s architects, to Eric Holder and Lanny Breuer’s acquiescence to the financial fraudsters who generated the Great Recession, America has seen a precipitous decline in equality under the law.”

June 01, 2022 | Revolving Door Project Newsletter

Biden's War Against Himself

If the unchecked blood letting, billowing inflation, foreign conflict, and typhoon of domestic Covid infection wasn’t enough to set Americans on edge the past week, a persistent high pitched whine–not unlike the kind projected outside 7/11s to deter listless teenage delinquents from Sacramento to Scranton–descended on the nation. It emanated not from a thoughtfully angled speaker system, but out of the oval office and into the pages of the Wall Street Journal and Fox News studios. Nonetheless, It has had a similar effect in driving young people away.

May 24, 2022

10 Things Biden Can Do About Inflation Without Congress

ome of the approaches can provide immediate relief, but many of them involve fixing broken incentive systems through increasing competition and corporate oversight. Inflation is not just a flash-in-the-pan issue, it is a consequence baked into our market structure and regulatory regime.

May 18, 2022

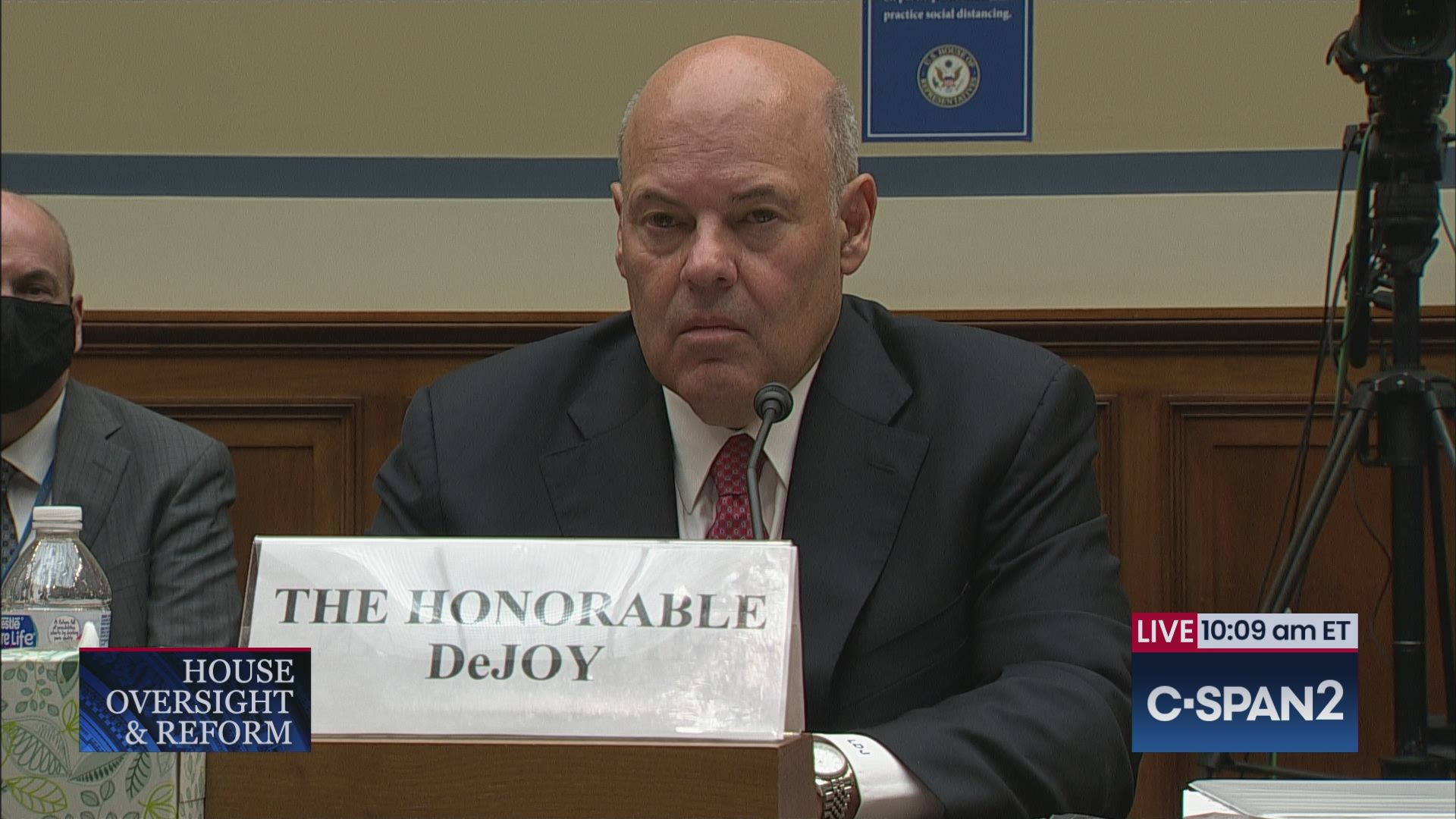

Will The New Postal Board Fire Louis DeJoy?

Probably not, thanks in part to some of Biden’s own board nominees.

May 18, 2022 | Revolving Door Project Newsletter

Biden Goes Beast Mode On Bezos, Corporate Crackdown Style

The 46th president going full Haymarket Hulk is not something anyone anticipated over a year ago, when Biden told America that if elected he’d be the “most pro-union president” ever. In the past, he’s gone off script during speeches to support the reawakened labor movement, only to have his words walked back by cautious press secretaries and the peanut gallery of advisors whispering “triangulation” in his ear. But in the past week Biden now seems to have decisively broke with the third way approach, hewing to the corporate crack down agenda–which RDP has long advocated–through a series of high profile union endorsements and their ensuing fallout.

May 17, 2022

Mekedas Belayneh Dorothy Slater

Blog Post Climate and EnvironmentExecutive BranchIndependent Agencies

One Weird Trick To Prevent the TVA From Building New Gas Plants

The Tennessee Valley Authority, an independent agency of the federal government which acts as a public utility for over 10 million residents in and around Tennessee, announced in March that it would replace two aging coal-fired power plants with gas-powered plants. As the nation’s largest public utility company, the move goes against Biden’s goal to achieve a clean energy grid by 2035. TVA could be leading the charge for renewables, but its fossil fuel CEO Jeff Lyash, who comes out of fossil fuels, is instead choosing to lock in polluting gas for decades. This does not have to be the case.

May 17, 2022

Coalition Tells DOJ: Don’t Bend to Google’s Bullying, Grant Kanter a Recusal Waiver Now

The Revolving Door Project and 27 groups sent a letter to Associate Attorney General Vanita Gupta Friday, urging her to promptly issue a recusal waiver for Assistant Attorney General Jonathan Kanter to work on the Department’s case against Google. The groups, including the American Economic Liberties Project, Demand Progress, the Institute for Local Self-Reliance, emphasized that ethics law does not require Jonathan Kanter to recuse and that Google’s attempts to insist otherwise is an effort to “bully regulators into submission.”

May 11, 2022 | Revolving Door Project Newsletter

Environmental Quality, Justice, Enforcement, Oh My!

Tuesday dawned with the unwelcome news that Antitrust Chief Jonathan Kanter has been indefinitely barred from working on the anti-monopoly case against Google while the Justice Department decides whether his past work representing Google’s critics should require his recusal. This, despite the fact that none of his past clients are parties in the Google case at issue.

May 10, 2022

The IRS Has Finally Been Given The Power to Rebuild. It’s Not Enough.

In March, six months after the start of Fiscal Year 2022, Congress finally passed an omnibus funding agreement that brought agencies out from under the shadow of Trump-era austerity (although still fell far short of enacting the funding levels that most agencies require to meet their responsibilities to the public). Critically, in the case of at least one agency, the omnibus did not just grant the money to hire new staff, but the means to do so much more quickly. At the Internal Revenue Service (IRS), Congress greenlit the use of direct hiring authorities to empower the agency to temporarily forgo some of the more onerous aspects of the federal hiring process as well as to facilitate a quick rebuilding of the IRS’ notoriously depleted ranks. With this designation, Congress acknowledged that staff shortages at the IRS had reached a state of emergency and thus acted accordingly.