June 12, 2024

Amicus Spotlight: Moore v. United States

A dozen court whisperer-backed groups and MSNBC superstar Neal Katyal want SCOTUS to make wealth taxes illegal.

April 12, 2024

Let's Be Direct (File)

As the Taxman Cometh, The IRS’ Enemies Throw Everything And The Kitchen Sink

April 02, 2024

PODCAST: RDP's Kenny Stancil Talks IRS Whistleblower On Arnie Arnesen Attitude

RDP Senior Researcher Kenny Stancil joined Arnie Arnesen to discuss why Biden should pardon IRS whistleblower Charles Littlejohn.

March 25, 2024 | Slate

Why Biden Should Pardon the IRS Whistleblower Who Leaked Trump’s Taxes

Biden can make billionaire corruption a defining issue of the 2024 presidential race.

February 02, 2024 | The American Prospect

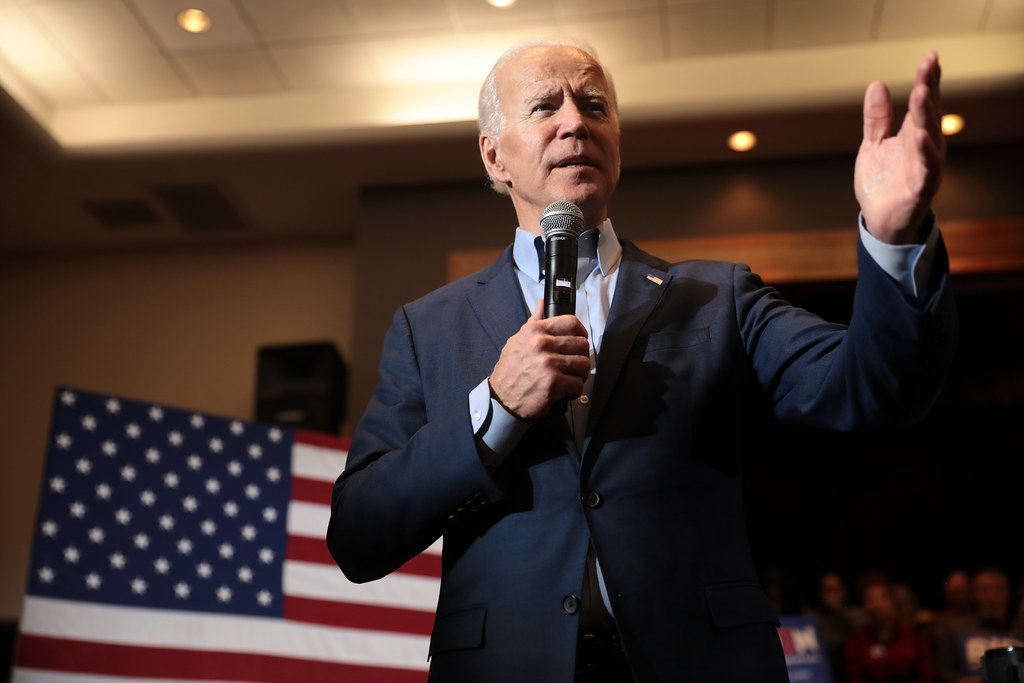

Biden Should Begin the Tax Wars Now

He needs to highlight his positions against the Republicans’. And not give away too much in interim deals.