Our Blog

January 24, 2022

Corporate Capture’s Circle of Life: The Copyright Office’s New Disney Lawyer

Since the Copyright Office provides expert recommendations and advice to Congress, the executive branch, and the courts, Disney’s recent employees may soon be advising government officials about copyright policy.

January 24, 2022

Revolver Spotlight: Tommy Beaudreau Is Big Oil’s Back Door to Biden’s Interior

President Biden nominated Tommy Beaudreau to be his Deputy Secretary of the Department of the Interior last April, and he was confirmed to the position by June. Unfortunately, though Biden seeks to be seen as a climate champion, Beaudreau was, and is, a uniquely terrible choice to help helm a climate-focused administration. His revolving door record is extensive, his conflicts of interest are nearly unprecedented, and his (re)installment at the highest circles of the Department of the Interior was ultimately a win for oil and gas conglomerates.

January 21, 2022 | The American Prospect

The Government Is Still Operating Under Trump’s Budget

A lot has changed in the year since President Biden took office. Across the executive branch, leaders who believe in the power of government to advance the public interest have replaced predecessors who were intent on dismantling the institutions they led. Unsurprisingly, policy priorities have shifted as well, with regulators embarking on ambitious new rulemakings and ramping up enforcement.

But there is one troubling constant looming above all of these changes: President Trump’s holdover budget is (basically) still in place, leaving the Biden administration to implement a bold new agenda with funding levels negotiated and approved by an administration that was determined to make that impossible.

January 20, 2022 | The New Republic

The People Dream Of A President Who Will Take On Corporations

We must recognize the common root cause of many of the problems we are currently enduring: corporate greed.

January 20, 2022

Revolving Door Project Examines Agency Capacity

The Revolving Door Project is fighting for an executive branch whose every corner is working tirelessly to advance the broad public interest and not to further entrench corporate power. That means scrutinizing the federal government’s highest ranks and applying pressure to keep them free of undue corporate influence. It also means interrogating whether the institutions those political leaders steer have the provisions they need to fulfill their missions.

January 20, 2022 | Revolving Door Project Newsletter

Eleanor Eagan Toni Aguilar Rosenthal

2020 Election/TransitionDe-TrumpificationExecutive BranchRevolving Door

One Year On

It has now literally been a year since President Biden officially took office, yet Donald Trump’s legacy lives on across the federal landscape. Trump’s threat to governmental stability and Democratic policy priorities particularly endure in the bad-actor figures his administration installed in termed positions and within the federal bureaucracy.

January 19, 2022

Climate Finance Capacity: Office of the Comptroller of the Currency

supervising all national banks, federal savings associations, and agencies of foreign banks. It primarily regulates the risk that banks can take on, delineates what is considered “banking,” and investigates banks’ balance sheets.

January 19, 2022

New Report Warns Agency Capture Threatens OCC Climate Response

Today the Revolving Door Project released a report on the Office of the Comptroller of the Currency’s OCC) capacity to implement and enforce climate regulation. This is the third installment of the project’s ongoing Climate Finance Capacity project \identifying the tools each component of the Financial Stability Oversight Council (FSOC) has to address the climate crisis through regulatory reform and the capacity-related obstacles that could stand in the way. Prior installments have looked at the Commodities Future Trading Commission (CFTC) and the Securities and Exchange Commission (SEC).Through this project, we aim to highlight the responsibility each of these agencies have in regulating our financial system towards a more sustainable future, and the reforms necessary to achieve this vision as examined through the lens of each agency’s unique resourcing.

January 19, 2022

The State of Independent Agency Nominations - Update for Fall 2021

Since the start of the year, we have warned that failure to promptly fill vacant and expired seats on independent agency boards would undermine the Biden administration’s agenda across many issue areas. Now, as executive branch policymaking kicks into high gear across this administration, we are seeing examples of this warning becoming a reality.

January 14, 2022

Personnel Is Policy For Communities On The Wrong Side Of The Digital Divide

Many of Biden’s broadband equity initiatives are being overseen by a former telecom lobbyist with little expertise in digital equity.

January 13, 2022 | Democracy Journal

What Biden’s Message Should Be

Americans were more divided than ever in 2021, but everyone in the country still agreed on one thing: The Democratic Party has a messaging problem.

“We’ve got a national branding problem that is probably deeper than a lot of people suspect,” Democratic pollster Brian Stryker, who is currently working with the centrist think tank Third Way to understand why Democrats lost the recent governors’ race in Virginia told The New York Times. “I’m not going to argue it’s working right now, but I need it to work when it matters,” Rep. Sean Patrick Maloney (D-NY), chair of the Democratic Congressional Campaign Committee told The Washington Post in November of the Democrats’ efforts to sell their legislative victories. Senator Kirsten Gillibrand (D-NY) seemingly agrees, telling attendees at a recent fundraising dinner that “Democrats are terrible at messaging. It’s just a fact.”

January 13, 2022 | The American Prospect

Fire Jeff Zients

Biden’s COVID czar has gone from ‘Mr. Fix-It’ to grim reaper, steering the administration’s pandemic response to catastrophic lows.

January 12, 2022 | Revolving Door Project Newsletter

Pelosi Turns a Political Slam Dunk to a Troubling Liability

With Omicron surging, Build Back Better sputtering, and the latest voting rights push facing long odds, it’s no secret that Democrats are in desperate need of a win to prove their worth. So what did Democratic leadership do when one such opportunity – enthusiastically championing a move to ban members of Congress from trading stocks – fortuitously fell into its lap? You guessed it…Speaker Nancy Pelosi mocked and immediately rejected it.

January 11, 2022

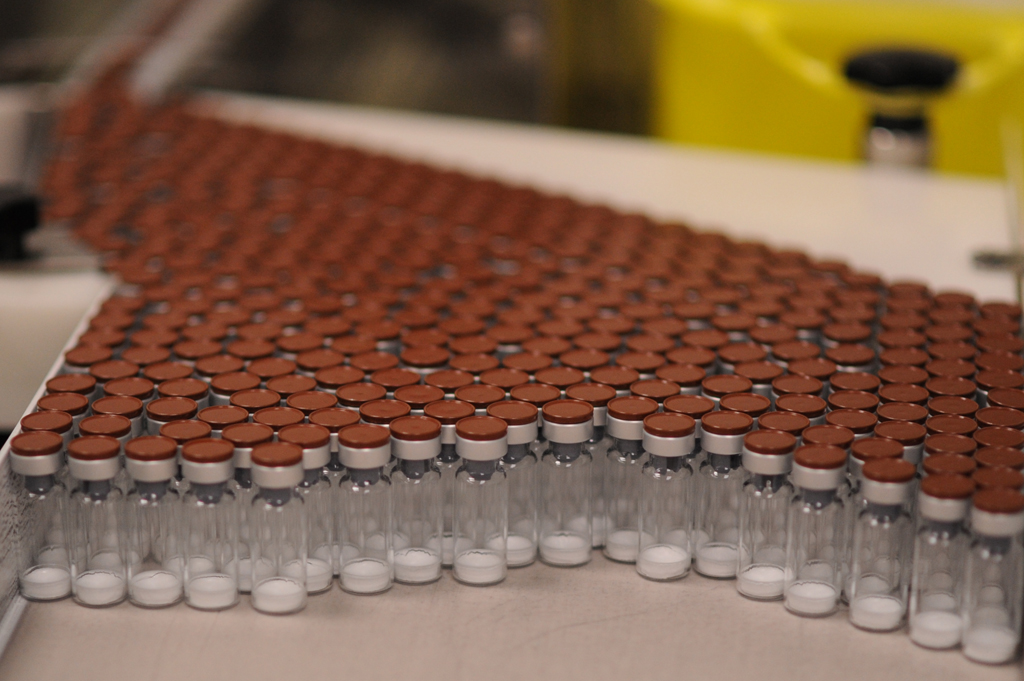

The Case For Vaccine Equity

To truly bring an end to the Covid-19 pandemic which has ravaged the globe, the Biden administration must embrace a strategy of vaccine equity.

January 11, 2022

Climate Finance Capacity Project: Securities and Exchange Commission

Climate change poses a serious threat to everything the Securities and Exchange Commission (SEC) is meant to protect and oversee. The Commodity Futures Trading Commission (CTFC)’s “Managing Climate Risk in the U.S. The Financial System ”report makes this abundantly clear. The report concludes that climate change may “exacerbate existing, non-climate related vulnerabilities in the financial system, with potentially serious consequences for market stability”. Furthermore, the physical and transitional risks of climate change will likely lead to systemic and sub-systemic financial shocks. These shocks would cause “unprecedented disruption in the proper functioning of financial markets and institutions” and further marginalize communities underserved by the financial system. To fulfill its mandate, of maintaining fair, orderly, and efficient markets, protecting investors, and facilitating capital formation, the SEC must proactively ensure there is enough personnel to monitor and enforce regulations that will keep markets stable and adaptable.