March 02, 2023

Workers Beware: Biden’s Potential Fed Pick Prescribes Unemployment & Reduced Social Security Benefits

Karen Dynan has been reported as one of a few economists on Biden’s shortlist to replace Lael Brainard on the Federal Reserve Board of Governors. While her proponents have highlighted the Harvard-trained economist’s perfect centrist resume, her recent statements on how best to tackle inflation should concern workers and their allies. And this blithe analysis concerning unemployment should come as no surprise – Dynan, like Biden’s foils in the GOP, believes cuts to Social Security benefits are likely.

March 01, 2023

We Don't Need A Morgan Stanley Economist On The Fed

The conflict of interest here would be self-evident.

February 27, 2023

Vishal Shankar Max Moran Jeff Hauser

Press Release Consumer ProtectionFinancial RegulationIndependent AgenciesJudiciarySupreme Court

Supreme Court Must Overturn Fifth Circuit's Radically Pro-Corporate Attack On The CFPB

The Fifth Circuit is trying to destroy the only cop on the beat protecting consumers. SCOTUS must overturn their radical assault on the CFPB.

February 24, 2023 | Revolving Door Project newsletter

"Economic Science" Is Whatever Larry Summers Wants It To Be

In many cases, Summers refuses to distinguish between his personal ideology about economics and what he thinks are scientific laws of nature.

January 19, 2023

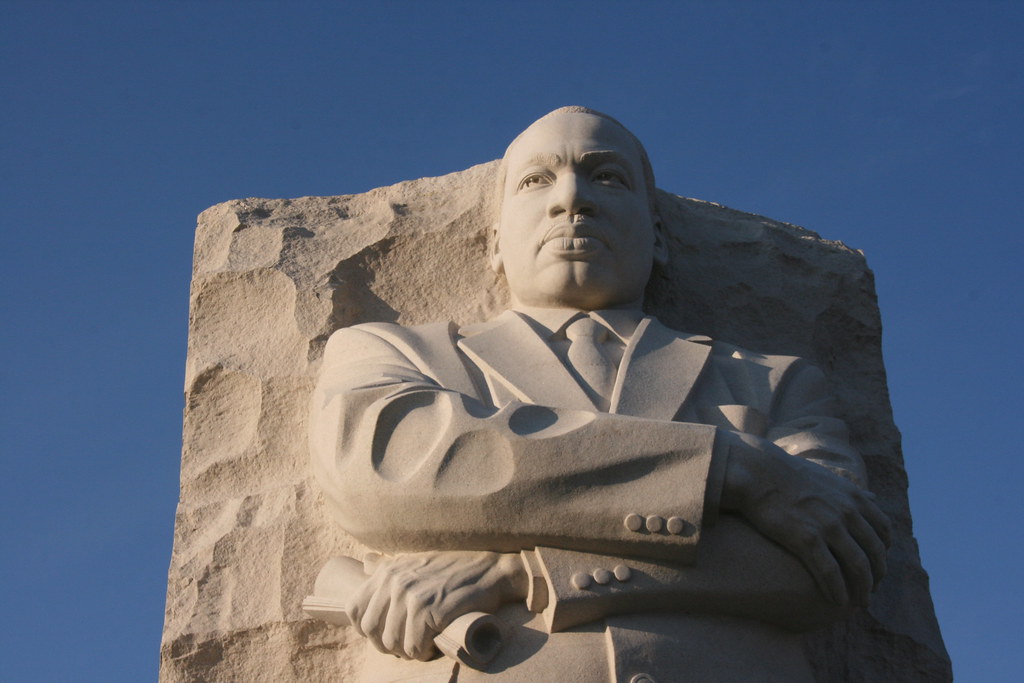

Corporate Hypocrites Celebrate MLK Day While Suing To Protect Discrimination

Big banks publicly tout a “great leader’s legacy” while quietly fighting against what he stood for.

January 18, 2023

Treasury's Ineffectual Climate Advisor Revolves Out

Morton’s tenure brought no visible advancement in the fight against climate change.

January 18, 2023

Larry Summers Must Answer for Years of Revolving Door Service to Collapsing Crypto Company

The media must stop treating Summers as an impartial expert and recognize how he uses his status in the economic media to provide credibility to corporations.

January 11, 2023

Larry Summers Advised A Possible Crypto Fraudster. Is Anyone Going To Ask Him About It?

Considering how much of the financial press eagerly solicits Summers’ take on every imaginable economics topic, it’s bizarre that no reporters have gotten his thoughts about his involvement in this crumbling company, and the asset class it promotes.

December 20, 2022

CFPB Alone Cannot Cure Wells Fargo's Disease

Fed and OCC Must Step Up With Their Own Preventative Tools

December 14, 2022 | Revolving Door Project Newsletter

Real Politicians Stay Bought by Fake Money Tycoons

Sam Bankman-Fried may have been arrested, but his influence campaign in DC is continuing unabated, with Members of the House and Senate looking to use FTX’s collapse to push for SBF’s hand-picked regulatory framework and undermine the work of SEC Chair Gary Gensler.

November 30, 2022 | Revolving Door Project Newsletter

Union Joe’s Disgrace

If rail workers are so important to our economy that a single week of striking could cost the economy $1 billion, and if their demands are so modest that any decent employer would easily exceed them, then meeting their demands seems like the obvious solution. But the American balance of power is such that railroad bosses have the allegedly most pro-labor president in history doing their dirty work for them.

November 24, 2022 | The American Prospect

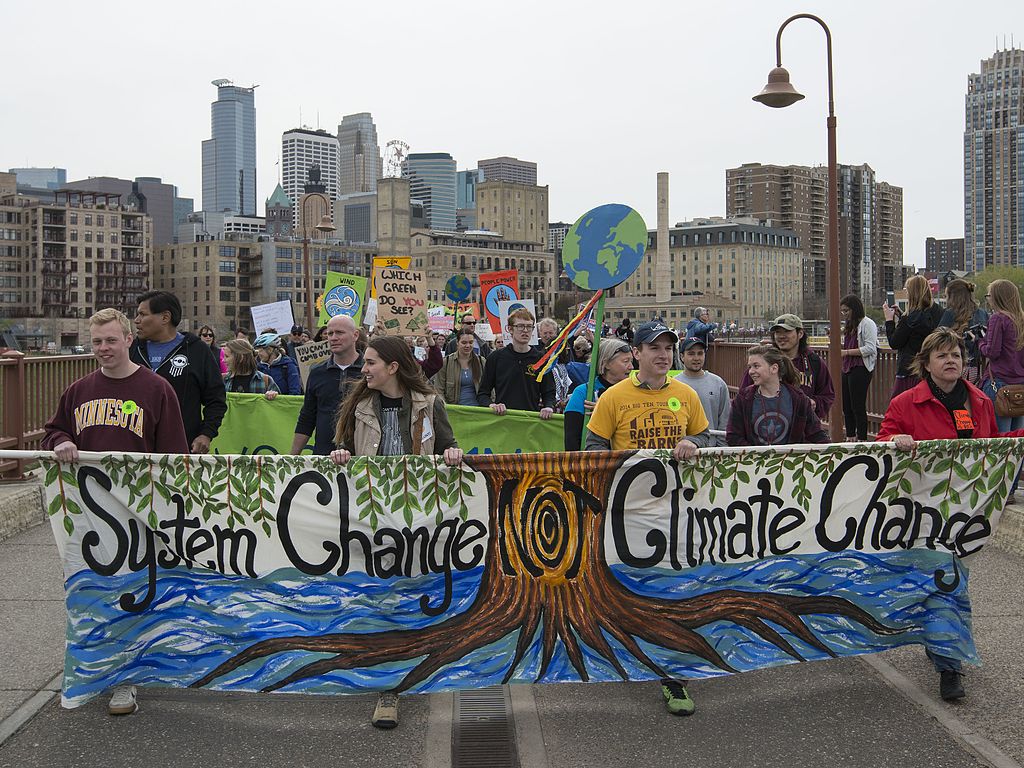

Quants, Carbon, and Climate Change

It’s been a bad few weeks for the sort of opinionated center-left pundit who prides themselves on data-driven, hyper-quantitative approaches to solving society’s intractable problems.

November 24, 2022 | The American Prospect

Quants, Carbon, And Climate Change

Both EA and popularism appeal to a desire for mathematical rigor and objective calculation, whether it’s calculating lives-saved-per-dollar or playing probabilities in politics.Both EA and popularism appeal to a desire for mathematical rigor and objective calculation, whether it’s calculating lives-saved-per-dollar or playing probabilities in politics.

November 23, 2022 | The New Republic

Timi Iwayemi Dylan Gyauch-Lewis

Op-Ed Congressional OversightCryptocurrencyFinancial RegulationIndependent Agencies

Don’t Fall for FTX’s Final Con

The FTX disaster should be all the impetus needed to kill off any new crypto industry–approved legislation. Instead, we need Congress to provide material support for financial regulators in the form of increased appropriations to guard against the next collapse. Much of the crypto industry is already subject to laws—the very ones that the SEC seeks to enforce and that the crypto industry broadly (not just Sam Bankman-Fried) seeks to evade by reducing the SEC’s jurisdiction ex post facto. Both the CFTC and SEC urgently need funds to fulfill their mandates. Crypto stretches these needs even further, but the need has existed for years. For decades, financial crimes have too often gone unpunished. This wasn’t for a lack of rules, but a lack of will, funds, and people willing to enforce them. Crypto doesn’t need special treatment, it needs to face the music.