This article first appeared in Hack Watch, our weekly newsletter on media accountability. Subscribe here to get them delivered straight to your inbox every week, and check out our Hack Watch website.

It’s been a busy week in Washington, from the death of Henry Kissinger, to the expulsion of George Santos from the House of Representatives, to the Senate Judiciary Committee’s long-awaited subpoenas of Harlan Crow and Leonard Leo. You’d be forgiven if you missed another major event on the Hill this week: Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra’s semi-annual report to Congress.

Readers of this blog will recall that Chopra — a stalwart champion for everyday Americans — was last in the Congressional hot seat this June, when Wall Street-funded Republicans lobbed ludicrous smears ghostwritten by their corporate donors against Chopra’s pro-consumer record.

This week’s hearings were more of the same, with Chopra parrying loaded and disingenuous questions from GOP corporate shills about the CFPB’s crackdown on predatory banking junk fees, anti-discrimination efforts in small business lending (the “1071” rule), and scrutiny of mobile payment apps. Major Wall Street banks and lobbying groups – including the U.S. Chamber of Commerce, American Bankers Association (ABA), and Consumer Bankers of America (CBA) – have declared war on Chopra for trying to curb the industry’s scummiest practices and return money to the pockets of ripped-off consumers.

The hearing was also Chopra’s first time appearing before Congress since the Supreme Court heard oral arguments in CFSA v. CFPB, a lawsuit filed by predatory payday lenders that seeks to overturn the Bureau’s funding structure. A payday lender victory in this case (which would greatly benefit Clarence Thomas’ and Samuel Alito’s rich friends) would effectively kill the CFPB. (For a comprehensive rundown of the case and the special interests backing it, check out our explainer article).

As we did back in June, let’s follow the money to see where anti-CFPB Republicans are getting their talking points:

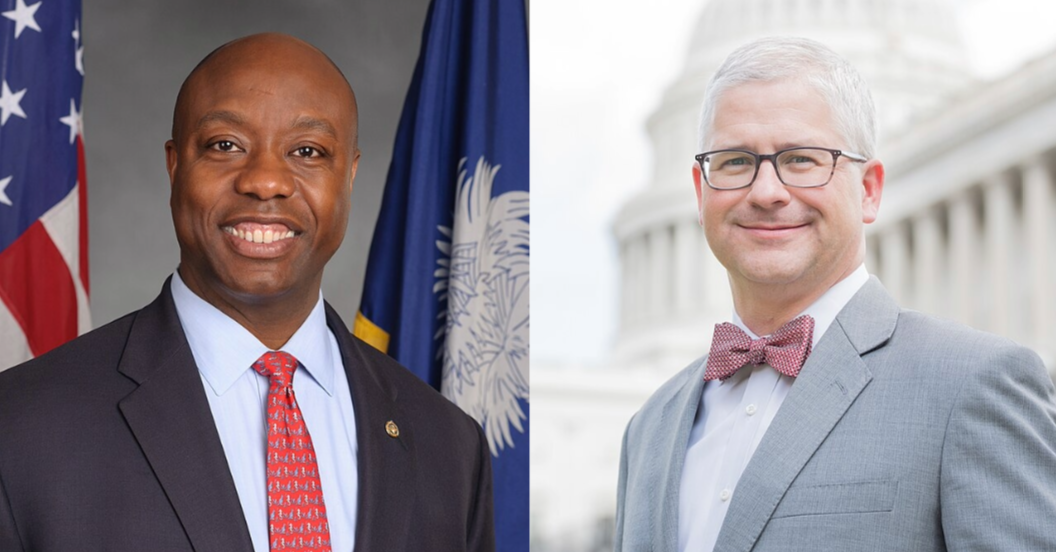

- Sen. Tim Scott (SC): Fresh off ending an embarrassing presidential run (do political donors need their own form of consumer protection bureau?), Scott alleged on Thursday that the Chopra-led CFPB was “straying further from its mandated mission” by embracing “misguided and partisan regulatory proposals.” He also proudly highlighted his own leadership of a Congressional Republican amicus brief calling on SCOTUS to gut the CFPB.

- Scott’s top career contributors have much to gain from a crippled CFPB unable to fulfill its mandate of rooting out unfair, deceptive, or abusive financial acts and practices: he’s raked in hundreds of thousands from the junk fee-loving financiers at Visa, Capital One, JPMorgan Chase, PNC Bank, American Express, Wells Fargo, and the ABA.

- Sen. Steve Daines (MT): Daines accused Chopra of operating as a “political arm of the Biden administration,” arguing that the Bureau’s credit card late fee rulemaking would hurt consumers and incentivize late payments. Chopra rebutted his lies with surgical precision, noting the Bureau’s rulemaking merely enforces a 2009 law prohibiting companies from charging unreasonable fees to pad their profits (CFPB’s rule caps fees at $8 and requires companies to show their math to justify higher charges), while still allowing issuers to deter repeated late payments through other means (such as credit limits, interest rates, and legal action).

- Daines’ top career contributors include repeat offenders Bank of America and Wells Fargo, both of whom were recently hit with massive CFPB fines for illegally charging junk fees.

- Rep. Patrick McHenry (NC-10): One of Wall Street’s most loyal foot soldiers in Congress, the bow tie-clad ex-acting Speaker charged Chopra’s CFPB with behaving as a “hyperpartisan agency doing the bidding of the White House rather than protecting consumers” and of “vilifying entire sectors of the financial services industry, rather than targeting independent bad actors.”

- McHenry’s top career contributors are a most-wanted list of anti-consumer repeat offenders, including Truist Bank, Wells Fargo, Bank of America, and JPMorgan Chase. A recent investigation by The Lever found that McHenry receives a jaw-dropping 90% of his campaign cash from lobbyists and industries he regulates – and only 0.06% from small donors.

- Rep. Andy Barr (KY-06): Barr, who has authored a bill that would allow the Republican Congress to financially starve the CFPB, called the Bureau the “most unaccountable agency in the entire federal bureaucracy” and ranted about Congress having “no visibility” over the agency (this is blatantly false, which Barr himself has accidentally admitted).

- Barr’s repeated efforts to subject the CFPB to Congressional Appropriations (where he can directly gut its funding) are shared priorities of his top career contributors: Wells Fargo, Truist Bank, U.S. Bank, Bank of America, JPMorgan Chase, and the ABA.

- Rep. Bill Posey (FL-08): Posey, who has endorsed the payday lender attack against the CFPB’s funding structure and called the Bureau “arrogant” and “petulant,” unsuccessfully tried to stump Chopra by asking him to define the term “junk fee.” Chopra explained that the term applies to fees “not subject to the competitive process, for services that don’t exist or are completely hidden or random,” giving an example of one company that charged a recurring “paper statement fee” despite all of its billing statements being paperless. The 75-year-old Posey accidentally admitted the truth in response, saying: “that just sounds like a fraud!”

- Posey’s top career campaign contributors include the anti-CFPB Credit Union National Association, the ABA, and UBS Bank. Just two weeks after signing onto Tim Scott’s anti-CFPB amicus brief, Posey received $7500 from predatory payday lender Ian MacKechnie (who pleaded guilty to racketeering in 1998 and is banned from selling insurance in the state of Florida) and his family.

- Rep. Blaine Leutkemeyer (MO-03): Leutkemeyer, a former banker who has argued that junk fees don’t exist, stooped to new lows on Wednesday when he asked Chopra to say “whether you’re a capitalist or a socialist.” Leutkemeyer even accused Chopra of believing financial services should be a “government-provided utility” (don’t threaten us with a good time, Blaine!).

- Besides being an ex-banker (hoping to revolve into a lucrative lobbying gig later?), Leutkemeyer has another self-serving reason to feign ignorance about junk fees: according to watchdog Accountable.US, he’s received over $556,000 from the three largest banks (Wells Fargo, JPMorgan Chase, and Bank of America) that raked in over $6.8 billion in overdraft fees in 2019 and industry groups that have opposed Chopra’s CFPB.

- Rep. Ralph Norman (SC-05): Norman, a real estate developer who has called the CFPB a “rogue agency” full of “woke bureaucrats”, proudly declared during Wednesday’s hearing that he had repeatedly voted to eliminate the CFPB.

- Norman, who succeeded his “good friend” (and payday lending darling) Mick Mulvaney in Congress, has raked in tens of thousands from anti-CFPB lobbying groups and special interests, including the National Auto Dealers Association, Koch Industries, and the ABA.

- Rep. Dan Meuser (PA-09): After Chopra noted that 1071 rules are needed to curb discriminatory small business lending by banks (secret-shopper tests by consumer groups have found strong evidence of unequal treatment of minority loan applicants), Meuser offered an laughable defense of the industry, saying: “It’s a competitive marketplace […] they’re not trying to abuse their customers. That would be ridiculous, they would go out of business, that’s how it works.” Defending the honor of Big Banks is nothing new for Meuser, who was widely ridiculed in June for asking Chopra why he “wasn’t doing a better job of “serving banks […] the clientele you’re supposed to be helping.”

- In the 2022 cycle, Meuser received tens of thousands in campaign contributions from Goldman Sachs, Wells Fargo, UBS, and the ABA. Banks may not be Chopra’s clientele, but they are Meuser’s!

It’s worth noting that these Wall Street-bankrolled Republican attacks on the CFPB aren’t just profiles in corruption; polls show that these industry shills are also wildly out of step with the American people. As I detailed previously, polling from Lake Research Partners and Chesapeake Beach Consulting has found that an overwhelming 82% of voters – including 77% of Republican voters! – support the CFPB’s mission and continued existence. Strong majorities of Republican voters likewise back the CFPB policies that Congressional Republicans keep trashing, including limits on credit card late fees (83%), protections against discriminatory lending (80%), and fair lending for women- and minority-owned small businesses (63%).

Unfortunately, the mainstream media has yet to get the memo. Coverage of Tim Scott during his doomed presidential campaign either fawned over him as a “likable” and “positive” Trump alternative or hyper-fixated on the soft-launch of his girlfriend, with little reporting on Scott’s transactional voting record for his Big Bank donors. Likewise, Wall Street lapdog Patrick McHenry was treated with kid gloves by the mainstream press during his pro tem Speakership: CNN and Axios described his Financial Services Committee chairmanship in the vaguest possible terms; the New York Times said he had a reputation for “brainy wonkishness”’; Politico feted him as a “pragmatist” and an “adult in the room.” Do these extreme anti-consumer and pro-fraud positions – bought and paid for by big money donors and opposed by a resounding majority of voters – sound like “positive” or “pragmatic” politics to you?

I reiterate what I said in June: the press must start following the money and connecting the dots between anti-CFPB Republicans’ aggressively anti-consumer positions and their Wall Street campaign donations. Independent media outlets, like The Lever and Sludge, are putting the mainstream press to shame with their diligent investigative journalism – giving the public crucial context for why Republican lawmakers keep attacking the popular CFPB.

In the meantime, Rohit Chopra is continuing to prove why he’s a model public servant, taking action against corporate titans like Citibank for racial discrimination, Bank of America for falsifying mortgage data, and TransUnion for illegal rental background check practices. His message to these repeat offenders is unwavering, even in the face of relentless GOP attacks and well-funded legal assaults. It doesn’t matter how wealthy and well-connected you are or how many lawmakers and judges you’ve bought off – if you rip off the American people, you will be brought to justice.

READ MORE: Revolving Door Project on the CFPB

- Everything You Should Know About The CFPB SCOTUS Case

- Clarence Thomas Has Yet Another Huge Conflict of Interest

- Payday Lenders Repped In CFPB Case By Firm That Picked Trump’s SCOTUS Nominees

- Disgraced Revolving Door Republicans Back Payday Lender Attack On CFPB

- Trump’s CFPB Saboteurs Tell The Supreme Court To Finish The Job

- Coup Memo Author John Eastman Tells SCOTUS To Gut The CFPB

- Republican CFPB Opponents Are Crooked Corporate Shills

- Why Does Thom Tillis Love Junk Fees?

- CFPB To Tenants: We’ve Got Your Back

- Bankers’ Complaints About Junk Fee Crackdown Offer Biden an Opening

- The Unlikely Origins of the Chamber-Chopra War

- New RDP White Paper: Who’s Afraid of Rohit Chopra?