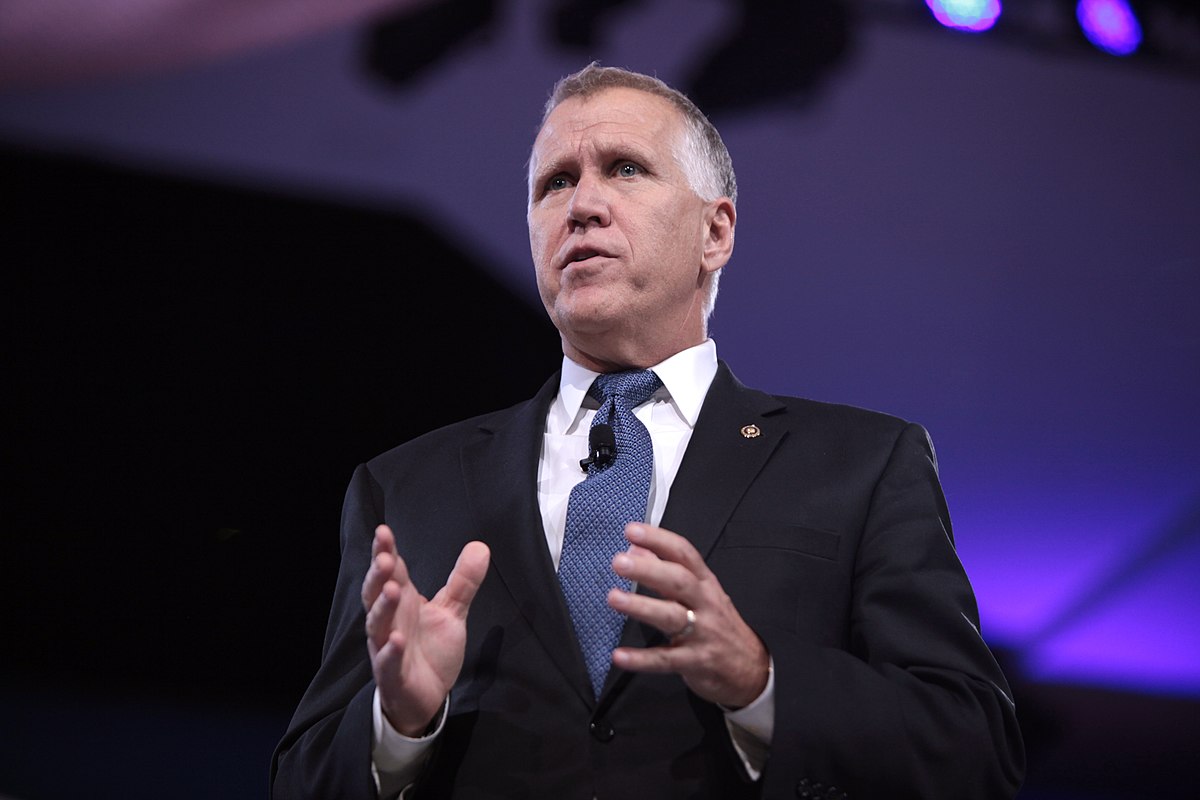

Last Wednesday, the Senate Banking Committee held a hearing on excessive surprise fees that big corporations are increasingly charging consumers, known as “junk fees”. Attendance was sparse, but that didn’t stop North Carolina Senator Thom Tillis – the sole Republican in attendance – from sparring with the committee’s Democratic majority.

In each opportunity he was given to speak, Tillis attacked the Biden administration for launching what he described as “an exceedingly wide and vaguely defined” crackdown on junk fees:

- In his opening statement, Tillis claimed that the public would “be hard-pressed to find a formal definition of the term ‘junk fees’, quite simply because it doesn’t exist.”

- Tillis opined that both the term “junk fee” and the Biden administration’s crackdown on them were “political in origin”, alleging that Biden’s initiative was simply an attempt to distract the public from rising inflation purportedly caused by Biden’s legislative accomplishments.

- Tillis argued that the Consumer Financial Protection Bureau (CFPB) had a “well-established reputation for pushing beyond its regulatory and jurisdictional boundaries” and claimed the Bureau was engaging in “name-and-shame, coercion-style tactics” against banks for their use of overdraft fees.

- At several points during the hearing Tillis teed up softball questions for Brian Johnson, a financial industry consultant (read: unregistered lobbyist) and former deputy to corrupt ex-CFPB director Mick Mulvaney, who defended junk fees as “lawful and fully disclosed”.

- During the hearing, Tillis submitted a letter defending junk fees from the Consumer Bankers Association – a lobbying group that represents the biggest (and most discriminatory) banks in America – into the Congressional record.

As I’ve written on this blog before, these pathetic defenses of junk fees and attacks on the regulators cracking down on them are complete nonsense.

- Junk fees absolutely do exist, and have been growing in prominence since the late 1990s – when late fee revenue for card card companies surged by over $6 billion in just 5 years (today, they cost consumers a jaw-dropping $12 billion annually).

- Junk fees are rarely fully disclosed to consumers, with many banks even manipulating customers’ sequence of transactions to charge more fees.

- Contrary to Tillis’ insinuation, the CFPB’s enforcement work against junk fee-abusing corporations like Wells Fargo and Bank of America has a strong basis in existing federal consumer protection laws within the Bureau’s jurisdiction, including the Consumer Financial Protection Act, Fair Credit Reporting Act, and Truth in Lending Act. This enforcement work has already restored millions of dollars to consumers’ pockets (money that people like Tillis would like to see the banks keep instead).

- Tillis’ harsh stance on the CFPB is resoundingly unpopular, putting him at odds with the 79% of Americans (including 86% of Democrats, 75% of Republicans, and 64% of independents) who support the Bureau’s work.

What can explain Tillis’ protectiveness of junk fees and the corporations who charge them? According to FEC data compiled by OpenSecrets, Tillis has raked in huge campaign contributions from junk fee-loving corporations and the lobbying groups who represent them:

- Truist Financial: Tillis has received at least $25,000 in PAC and $79,000 in individual contributions from this North Carolina-based banking company, making it Tillis’ fourth-largest campaign contributor overall. According to watchdog Accountable.US, Truist raked in over $1 billion in junk fee revenue in 2022 alone.

- Wells Fargo: Tills has received over $15,000 in PAC and $71,000 in individual contributions from Wells Fargo since 2013, making it Tillis’ sixth-largest campaign contributor overall. According to Accountable, Wells Fargo collected over $4.7 billion in junk fee revenue in 2022.

- Last December, the CFPB fined Wells Fargo $3.7 billion for illegally charging its customers surprise overdraft fees.

- Bank of America: Tillis has received over $15,000 in PAC and $59,000 in individual contributions from Bank of America since 2013, making it Tillis’ eighth-largest campaign contributor overall. According to Accountable, Bank of America collected over $4.2 billion in junk fee revenue in 2022.

- Last month, the CFPB fined Bank of America over $250 million for illegally double-dipping on overdraft junk fees.

- Regions Financial: Regions gave Tillis and his leadership PAC over $35,000 in PAC and $6,000 in individual contributions from 2017 to 2022. According to Accountable, Regions made 26% of its net income in 2021 from junk fees and disproportionately targeted lower-income consumers through its branch locations.

- Last September, the CFPB fined Regions (a repeat offender) $191 million for illegally charging its customers surprise overdraft fees on ATM withdrawals and debit card purchases

- PNC Financial: PNC gave Tillis and his leadership PAC over $54,000 in PAC and $3,000 in individual contributions from 2017 to 2022. According to Accountable, PNC raked in over $1.4 billion in junk fee revenue in 2022

- JP Morgan: JP Morgan gave Tillis and his leadership PAC over $26,000 in PAC and $18,000 in individual contributions from 2017 to 2022. According to Accountable, JP Morgan raked in over $5.2 billion in junk fee revenue in 2022.

- National Multifamily Housing Council (NMHC): The NMHC, a massive lobbying group that represents leading private equity landlords and tenant screening companies, has given Tillis and his leadership PAC over $40,000 in PAC contributions since 2017. According to a new Revolving Door Project report, NMHC has close ties to Clarence Thomas benefactor Harlan Crow and represents several companies cited by the CFPB for charging rental and tenant screening junk fees.

- American Hotel And Lodging Association: The AHLA, a lobbying group that represents over 32,000 hotel and lodging property companies, has given Tillis and his leadership PAC $35,000 in PAC contributions since 2017. The hotel industry has been criticized by the Biden administration and independent junk fee experts for increasingly tacking on exorbitant “resort” and “service” junk fees to guests’ bills (fees that AHLA has publicly defended and spent hundreds of thousands lobbying to protect).

Like his GOP colleagues in the House, Tillis is nothing more than a puppet of corporate criminals and con artists. The next time you hear him spout this kind of anti-consumer nonsense, just remember: follow the money.