Our Blog

May 31, 2023 | Revolving Door Project Newsletter

Tracing the Impact of Sackett v. EPA On Beloved Waters

There is a ripe poetic injustice to the fact that this long Memorial Day weekend in late May—a lush time of year when the generosity of this planet is so apparent—was book-ended by attacks on two of this country’s most important environmental laws.

May 30, 2023

Being A Board Member Is Hard, Just Ask Larry Summers

Former Secretary of the Treasury Larry Summers recently learned that making business decisions can be hard even if you’re an economist. Or, alternatively, Summers has again proven to be a real-life embodiment of an economic “rational individual;” willing to do whatever maximizes his personal interests, regardless of broader consequences. If true, this further demonstrates why the press needs to end their reliance on Summers for economic speculation – because his judgment is for sale.

May 27, 2023 | Common Dreams

Three Things the Media Misses When Discussing the Debt Ceiling

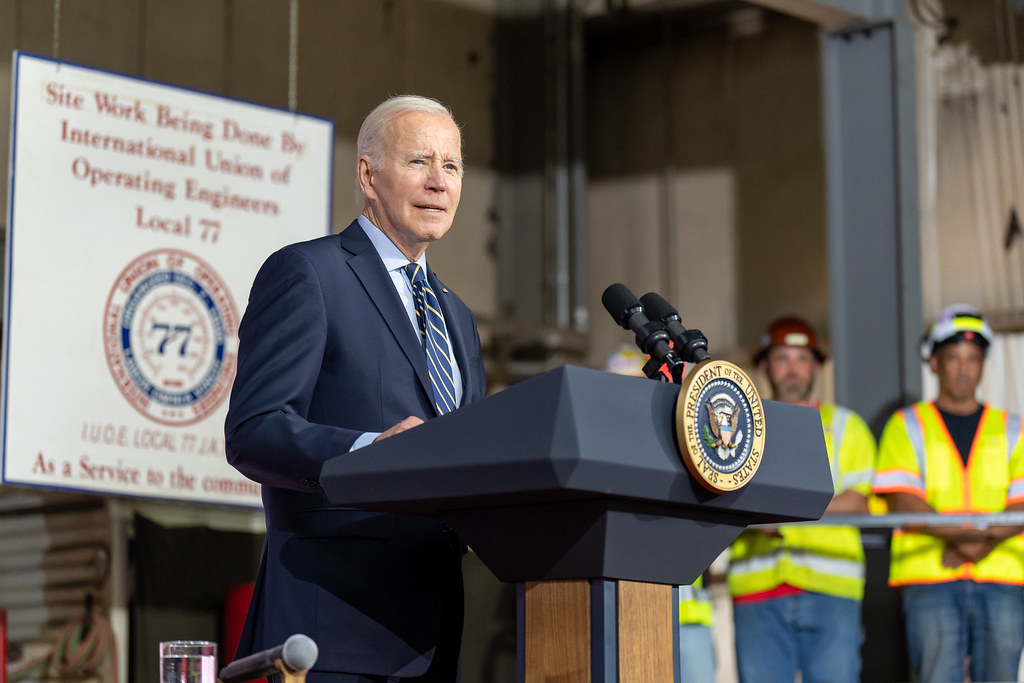

Spending cuts aren’t minor, caps ignore inflation, and President Biden isn’t helpless.

May 26, 2023

RELEASE: Revolving Door Project Reacts to Biden’s Debt Ceiling Cave & the Media’s Incompetent Coverage

In response to the emergence of the structure of a potential deal between President Biden and Speaker McCarthy, Revolving Door Project Executive Director Jeff Hauser issued the following statement:

“There are three aspects to the substance and coverage of this debate that have been infuriating.”

May 26, 2023 | Revolving Door Project Newsletter

Hack Watch: Everyone’s So Worried About The President Getting Sued About the Debt Ceiling, No One Seems to Have Noticed He Already Was

May 24, 2023 | Revolving Door Project Newsletter

Who’s Going To Keep Corporations Honest?

The Washington Post last week ran a delightful little synopsis of Senator Bernie Sanders’ (I-VT) true passion: congressional oversight. Bernie is revered for his willingness to hold corporations and their CEOs accountable for their villainy, and how he does so with extraordinary dexterity. Be it by ruthlessly interrogating Big Pharma executives for their murderous price gouging of lifesaving treatments or humiliating Howard Schultz for being a whiny billionaire union-buster, Bernie Sanders makes congressional oversight hearings fun. The fun he makes for himself and for the public he strives to give real voice to through speaking truth to power is not just gratifying; it also helps sharpen congressional oversight into a tool to actually achieve something.

May 22, 2023

RELEASE: The Justice Department Should Not Defend The Legal Incoherence That Is The Debt Ceiling

On Friday, May 19, the National Association of Government Employees filed an emergency motion in their lawsuit against President Joe Biden and Treasury Secretary Janet Yellen. NAGE urged the Massachusetts District Court to issue a preliminary injunction holding that the debt ceiling violates the separation of powers and Presentment Clause set forth in Articles I and II of the U.S. Constitution.

May 19, 2023

98 Organizations and Individuals Call on the IPCC to Uplift Settled Science and to Reject the Influence of the Global Meat Industry

This morning, 98 organizations and individuals sent a letter to calling on the Intergovernmental Panel on Climate Change (IPCC) to affirm its independence from private and corporate interests, to maintain a strict ethics regime that avoids even the appearance of interference or impropriety, and to boldly uplift the huge body of existing climate science that affirms the devastating climate consequences of animal agriculture and the global meat industry. Read their letter to Dr. Hoesung Lee, Chairman of the IPCC here.

May 19, 2023

It’s Time To Discuss The Real Stakes Of Negotiating The Debt Ceiling

May 17, 2023

Release: New Letter Urges President to Make Leadership Change at Surface Transportation Board

A whole-of-government economic agenda requires leadership devoted to rebuilding an economy that works in the public interest. As we explain in the letter, we believe Chairman Oberman has eschewed this responsibility and should no longer be trusted to lead vital oversight of the American rail industry.

May 17, 2023 | Revolving Door Project Newsletter

Progressive Counteroffers to Manchin’s Dirty Deal, Debt Ceiling Edition

Manchin’s dirty deal is back on the table, again, according to coverage of the play-by-play of Biden and congressional leaders’ not-not-negotiations over raising the debt ceiling. Whether or not Manchin’s proposal gets packaged with a debt ceiling deal, it seems the question is when, not if, it gets taken up. That’s due in large part to Biden and Schumer’s unjustifiable fealty to Manchin, the administration’s chief saboteur, whose latest pledge is to block all of Biden’s EPA nominees.

May 17, 2023

Executive Branch Agencies That Protect Americans From Corporate Abuses Need Robust Funding, Not Cuts

With executive branch agencies under renewed attack as President Biden negotiates with the GOP, we revisit our research on government capacity.

May 17, 2023

Coinbase Spins The Crypto Revolving Door

Coinbase’s establishment of a new advisory council comprising former members of Congress is the latest example of the crypto industry’s embrace of Washington’s revolving door.

May 17, 2023 | The Sling

Biden Should Relieve Martin Oberman from His Chairmanship at the Surface Transportation Board

Just weeks after a series of high profile train derailments headlined by the disaster in East Palestine, Ohio, the Surface Transportation Board (STB) decided to double down on the current railroad oligopoly. The STB approved a merger between Canadian Pacific Railway and Kansas City Southern Railway Company, cutting the number of major “Class I” rail companies in the United States from seven down to six. This decision is diametrically opposed to the public interest and seriously undermines trust in rail regulators.

May 15, 2023

Biden Will Show He Can Be Bullied If He Caves To Republican Debt Demands

“GOP leaders have sent a wildly exploitative ransom note to the public. The administration should not accept its terms.”