Search Results for

April 12, 2022

Want To Show That Dems Have Learned Nothing Since 2008? Give Michael Barr A Fed Seat

“Michael Barr was too close to fintech and cryptocurrency schemers to be the Comptroller of the Currency, and he is still too close to them to be Vice Chair for Supervision.”

April 12, 2022

Corporate Crackdown Updates: 4/11/22

Rohit Chopra’s CFPB walked the walk after his incredible speech at the University of Pennsylvania last month.

April 04, 2022 | The American Prospect

The Corporate Past Of Jeffrey Zients

Over the span of two decades, the health care companies that Zients controlled, invested in, and helped oversee were forced to pay tens of millions of dollars to settle allegations of Medicare and Medicaid fraud. They have also been accused of surprise-billing practices and even medical malpractice.

March 29, 2022

Press Release Congressional OversightCorporate CrackdownDepartment of JusticeExecutive BranchIndependent Agencies

Biden Gave Most Corporate Crimes A Pass This Winter, New Analysis Shows

The Biden administration pursued at least 24 prosecutions and rulemakings to crack down on white-collar crime this winter, but took no action against at least 48 crimes or abuses, a new data set from the Revolving Door Project shows

March 28, 2022

Biden’s Weak Record On White-Collar Crime Is (Partly) Thanks To Congress

When Republicans blockade confirmation hearings, they handcuff the government’s ability to handcuff lawbreaking executives.

March 02, 2022

Dylan Gyauch-Lewis Max Moran Toni Aguilar Rosenthal

Blog Post Corporate CrackdownEthics in GovernmentExecutive BranchFederal ReserveFinancial RegulationIntellectual PropertyRevolving DoorTech

What Can Biden Actually DO From His State Of The Union?

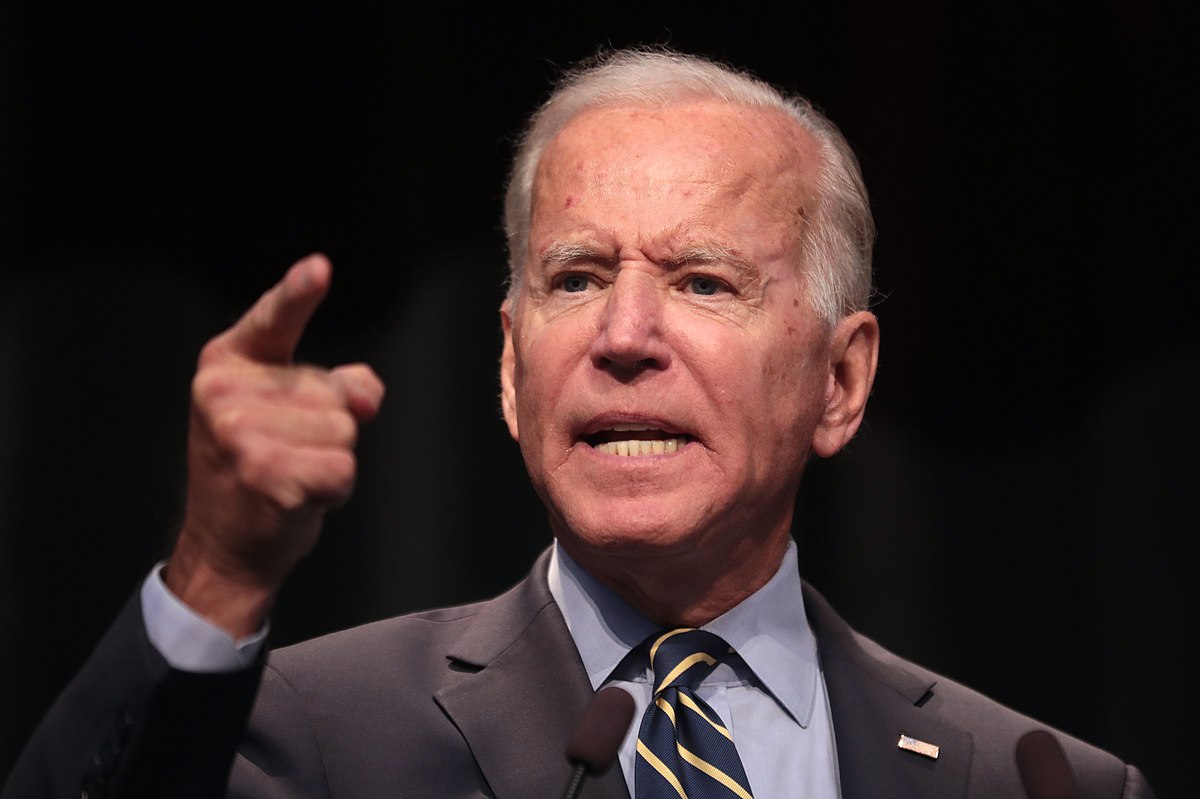

Biden is still married to reviving a long-lost vision of bipartisanship. Never mind that the same Republicans he’s desperate to welcome into the fold literally did not applaud the ideal of bipartisanship he is pushing.

March 02, 2022 | Revolving Door Project Newsletter

Dylan Gyauch-Lewis Max Moran Toni Aguilar Rosenthal

Newsletter Corporate CrackdownDepartment of JusticeEconomic PolicyFinancial Regulation

What Can Biden Actually DO From His State Of The Union?

If there’s one thing the readers of this newsletter definitely haven’t read yet today, it’s a reaction to last night’s State of the Union address.

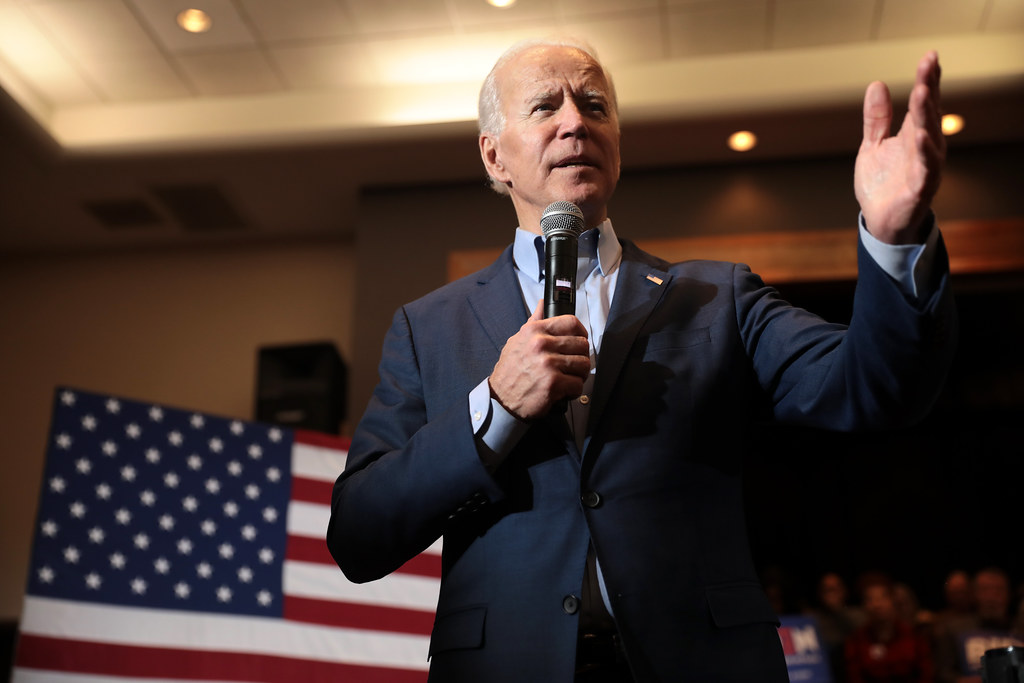

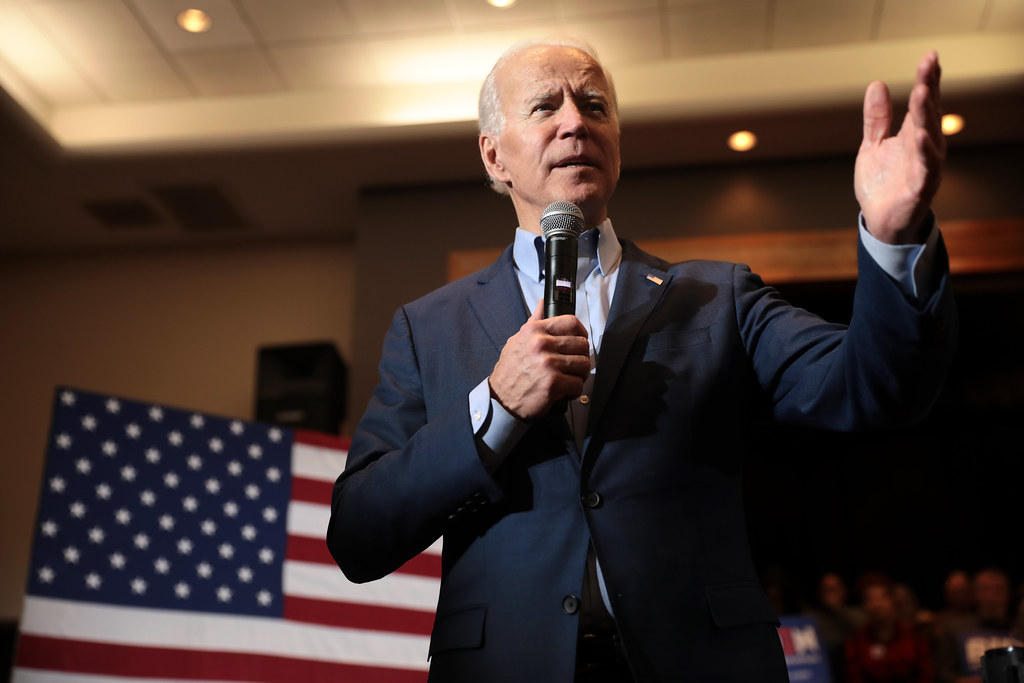

Like many, we were hoping to see President Joe Biden adopt a new overall message to the American people as his poll numbers have sagged and Democrats brace for a rough midterm election in just eight short months. We’ve been making our pitch for the last few months about what that message should be: Biden ought to use his powers to crack down on corporate villains, and heavily publicize doing so. The ubiquity of already unpopular enemies and latent presidential powers gives Biden the chance to clarify to the public what exactly he stands for. Our Jeff Hauser and Max Moran laid out the case for this “Corporate Crackdown” message in Democracy Journal in January.

February 16, 2022 | The American Prospect

Bloomberg’s Military Investments Unknown as He Heads to Pentagon Position

I was curious if Bloomberg’s billions of dollars in investments might shed any light on his sudden interest in the Pentagon, so I looked up his financial disclosures from the 2020 Democratic primary. It turns out, they don’t exist.

February 01, 2022

The Chamber Of Commerce Gives Cover To Scared Wall Streeters

Quaadman’s letter is full of technical language and oozes elite respectability, but underneath all of the jargon, it’s just a bunch of Wall Street banks scared that someone might hold them to account.

January 20, 2022 | The New Republic

The People Dream Of A President Who Will Take On Corporations

We must recognize the common root cause of many of the problems we are currently enduring: corporate greed.

January 13, 2022 | Democracy Journal

What Biden’s Message Should Be

Americans were more divided than ever in 2021, but everyone in the country still agreed on one thing: The Democratic Party has a messaging problem.

“We’ve got a national branding problem that is probably deeper than a lot of people suspect,” Democratic pollster Brian Stryker, who is currently working with the centrist think tank Third Way to understand why Democrats lost the recent governors’ race in Virginia told The New York Times. “I’m not going to argue it’s working right now, but I need it to work when it matters,” Rep. Sean Patrick Maloney (D-NY), chair of the Democratic Congressional Campaign Committee told The Washington Post in November of the Democrats’ efforts to sell their legislative victories. Senator Kirsten Gillibrand (D-NY) seemingly agrees, telling attendees at a recent fundraising dinner that “Democrats are terrible at messaging. It’s just a fact.”

January 10, 2022

Questions And Answers About The FDIC

McWilliams resigned after spending December publicly insisting that Chopra, Gruenberg, and Hsu were undermining her authority by conducting a legal, notational vote-by-mail on a proposed Request For Information (RFI) about possible updates to bank merger review rules.

January 06, 2022 | The American Prospect

Merrick Garland Is Undermining The Biden Antitrust Strategy

In theory, nothing prevents Biden from hiring whomever Kanter personally trusts to help execute their shared agenda. So what’s causing the chaos?

December 21, 2021 | The Hill

Is The Media Laundering Open Lawlessness At The FDIC?

McWilliams and Chopra both make compelling characters, but only one is quite clearly violating the law, and attempting to seize absolute power over a crucial agency with no repercussions.

December 14, 2021

FDIC Chair Uses Circular Logic And Revolving Doors To Retain Unlawful Power

If the FDIC general counsel is loyal primarily to McWilliams, then his opinion can’t be taken as independent in this matter.