April 09, 2021

New BigLaw Revolving Door Report Series Will Examine Corporate Law Firm Influence In Executive Branch And Regulatory Law

Today the Revolving Door Project and People’s Parity Project launched the BigLaw Revolving Door report series to investigate the outsized influence of corporate law firms and their clients on the executive branch and regulatory law spaces. As activists and legal experts continue to urge the Biden Administration to lock BigLaw attorneys, particularly those with large corporate clients, out of the leadership of his Department of Justice, RDP and PPP recognize the importance of exposing the horrific track record of these firms. Through this series, RDP and PPP plan to examine these corporate law firms and their clients more closely and educate the public about this often overlooked system of influence peddling.

April 08, 2021

Blog Post CabinetDepartment of JusticeEthics in GovernmentExecutive BranchRevolving DoorRight-Wing MediaTreasury Department

Biden Cabinet Confirmations Show Continued Political Potency Of Revolving Door Critiques

The prolonged confirmation fights for top Biden nominees proved one thing: Republicans will gleefully and cynically exploit anti-corruption critiques of Biden’s Cabinet for their own political purposes. The President must deny them this potent political weapon by closing corporate America’s revolving door for good.

March 29, 2021 | The American Prospect

Toward a Conflict-of-Interest-Free West Wing

The latest batch of White House financial disclosures revealed close ties between top Biden Administration officials and corporate titans in Big Tech, Big Oil, and Big Pharma. Eleanor Eagan and Elias Alsbergas explain why these disclosures reveal the need for the Biden White House to adopt stronger ethics disclosures and mandate total divestment from potential conflicts of interest.

March 23, 2021

Revolver Spotlight: Jonathan Su

His work for Latham & Watkins included representing a high-profile convicted sex offender, a Republican Senator who profitted off the COVID-19 pandemic while deceiving the public, and a pharmaceutical company that created an artificial shortage of life-saving medicine.

March 23, 2021

Revolver Spotlight: Elizabeth Rosenberg

Elizabeth Rosenberg, a lesser-known Obama-era official, is being considered to lead the Treasury Department’s Terrorism and Financial Intelligence unit. Her record designing painful economic sanctions, supporting fossil fuel industry-friendly policies, and helping powerful corporations gain close access to the highest levels of government is cause for alarm, writes Vishal Shankar.

March 22, 2021

Jake Sullivan Advised Microsoft On Policy, And Now Coordinates With Microsoft On Policy. What Could Go Wrong?

ullivan, like Secretary of State Blinken and others in the Biden national security apparatus, spent the Trump years as a “consultant,” better termed as a shadow lobbyist, for Big Tech and other industries.

March 17, 2021

Elias Alsbergas Vishal Shankar

Report 2020 Election/TransitionDefenseExecutive BranchForeign PolicyRevolving Door

The Industry Agenda: Military-Industrial Complex

A powerful collection of weapons manufacturers and defense contractors are shaping American foreign policy by lobbying policymakers and funding hawkish think tanks to keep U.S. defense spending the highest in the world. Their influence-peddling efforts prioritize the defense industry’s profits over countless lives and pressing domestic priorities like universal healthcare. Our Elias Alsbergas and Vishal Shankar explain how the military-industrial complex seeks to influence the executive branch and which defense industry allies are seeking jobs in the Biden Administration.

March 16, 2021

Revolver Spotlight: Manny Alvarez

Alvarez only re-entered the regulatory world after six years at Affirm, a fintech e-lender that offers loans up to 30 percent APR under sometimes confusing terms at the point of sale, so consumers rarely have the opportunity to shop around or read the fine print for an informed decision.

March 16, 2021

Revolver Spotlight: Sonal Shah

What is the spirit of a revolver? Perhaps it’s best described as someone who advances “the increasingly influential private-sector approach to world-changing.” That, after all, is how Anand Giridharadas, in his essential book Winners Take All: The Elite Charade of Changing The World, once described Sonal Shah’s current work.

March 15, 2021 | Independent Media Institute

When Public Officials Get Rented Out By Corporate Power, The People Lose

From Vivek Murthy’s lucrative consulting work with Netflix and Carnival Cruise Lines to Brian Deese’s “greenwashing” of fossil fuel investments at BlackRock, the revolving door between corporate industry and government continues to undermine public trust in the Biden Administration, writes our Elias Alsbergas.

March 11, 2021

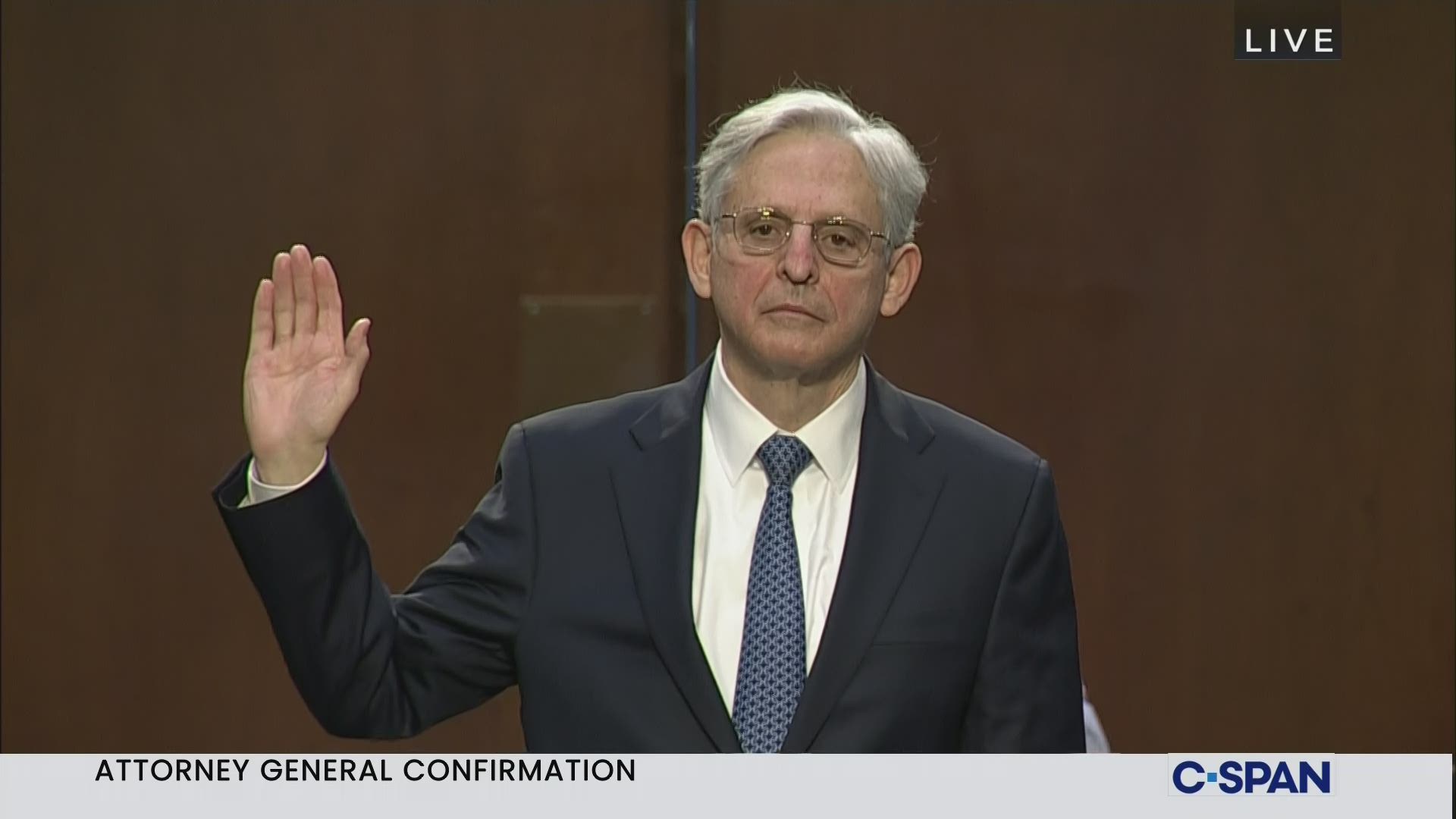

Letter Calls On Garland To Commit To Greater Transparency At DOJ

Long before Trump and his cronies took a sledgehammer to the Justice Department, blatant conflicts of interest and endless trips through the revolving door were already eroding its foundation and threatening its structural integrity. Yet, despite an appeal from 37 progressive and good government groups, including ours, Garland has signaled that he will not target that longer-running source of distrust at the root by shutting out BigLaw attorneys from the Justice Department.

February 23, 2021 | Jacobin

INTERVIEW: Who Is Merrick Garland's Friend Jamie Gorelick?

Jamie Gorelick, a high-powered lawyer who defended the city of Chicago after the police murder of Laquan McDonald and sits on the board of Amazon, is a case study of the influence big corporate law firms wield behind the scenes in Washington — and she has friends like Merrick Garland in high places in the Biden administration. The Revolving Door Project’s Elias Alsbergas and Max Moran spoke with Jacobin’s Alex N. Press about what Gorelick’s ties to Garland could mean for the Biden Administration’s Justice Department.

February 22, 2021 | Responsible Statecraft

American Primacy On The Menu For Big Industry Donors At CNAS

The Center for a New American Security (CNAS), a foreign policy think tank with at least 16 alumni in the Biden administration, has repeatedly published reports that directly promote the interests of its donors — including defense contractors, fossil fuel companies, and foreign governments — without disclosing their support. These conflicts of interest raise larger questions about what CNAS’ core philosophy of “extending American power” truly means.

January 26, 2021

Vishal Shankar Zena Wolf Ella Fanger

Blog Post CabinetExecutive BranchRevolving DoorRight-Wing MediaTech

If Biden Doesn’t Close Big Tech’s Revolving Door, The Right-Wing Will Eat Him Alive

The right-wing’s revolving door attacks on President Biden are intensifying, with a particular focus on the new President’s ties to Big Tech. Biden must beware the potency of these attacks and address them head-on.

January 13, 2021 | The American Prospect

Biden Must Close the Revolving Door Between BigLaw and Government

Biden framed his campaign as “Scranton vs. Park Avenue,” promising an end to corporate government. But in order to do that, Biden must seal the revolving door between corporate law firms and the federal government. There is no shortage of brilliant attorneys who have dedicated their careers to serving the public interest and fighting for social justice who are ready to do that work within the new administration.