Our Blog

July 13, 2023

RELEASE: Via Baseless Attacks On Khan, House Republicans Continue to Serve their Monopolist Funders

“Today’s hearing further proved that Republican’s attacks on Lina Khan and her leadership are blatant attempts to weaken antitrust enforcement to the benefit of the corporations that fund the Republican Party. Members, including Jim Jordan, focused on baseless allegations in an attempt to delegitimize the work the FTC is doing to crack down on anti-competitive and harmful practices that monopolistic companies use to amass economic power and squeeze profits out of consumers and workers.”

July 12, 2023 | Revolving Door Project Newsletter

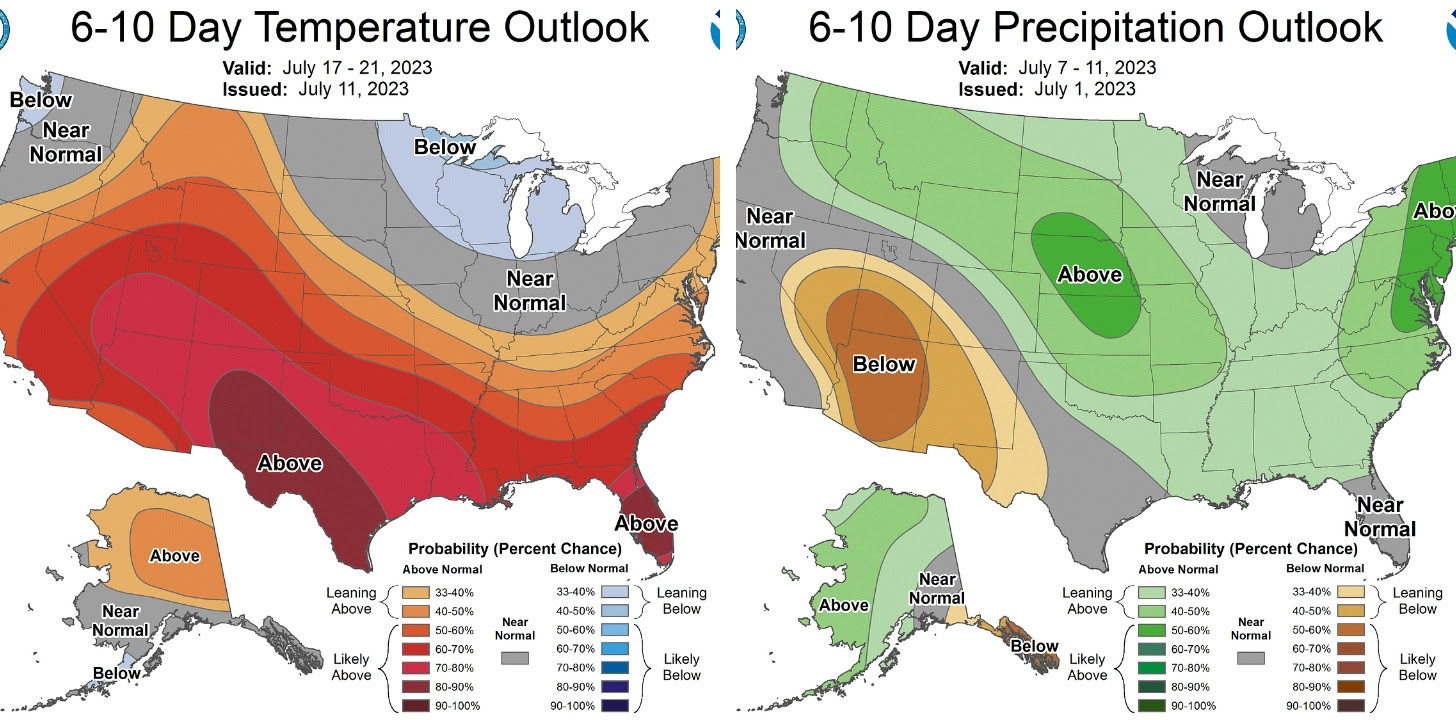

Why Is The Administration Ignoring The Extreme Weather?

Extreme weather is the story of this summer so far, the hottest in 120,000 years. But you wouldn’t know it from following Beltway politics.

July 11, 2023

Revolving Door Project Sends Chair Khan Letter on FTC Ethics

In advance of the House Judiciary Committee holding a hearing on Thursday, July 13, 2023, at 10:00 a.m. ET on “Oversight of the Federal Trade Commission,” Revolving Door Project has sent a letter to FTC Chair Lina Khan calling on her to take on the FTC’s considerable internal revolving door challenges.

July 11, 2023

Blog Post Consumer ProtectionFinancial RegulationIndependent AgenciesJudiciaryRevolving DoorSupreme Court

Trump’s CFPB Saboteurs Tell The Supreme Court To Finish The Job

Mick Mulvaney and Eric Blankenstein want to permanently cripple their former agency.

July 11, 2023

A Corporate-Led Trade Agenda Is the Wrong Path Forward

Yet despite these promises, email correspondence obtained through FOIA requests by Demand Progress show that senior officials across USTR, including Deputy U.S. Trade Representative Sarah Bianchi, actively seek input from executives at Big Tech firms such as Amazon and Google. Giving Big Tech a privileged ability to mold American trade policy undermines Biden’s commitment to a new era of trade deals.

July 07, 2023

Blog Post 2020 Election/TransitionConsumer ProtectionFinancial RegulationIndependent AgenciesJudiciarySupreme Court

Coup Memo Author John Eastman Tells SCOTUS To Gut The CFPB

The crackpot former Trump lawyer, who is facing disbarment for trying to overturn the 2020 election, wants to help Big Business rip you off.

July 07, 2023 | Democracy Journal

RELEASE: Understanding How Budget Reforms Were Exploited To Drain Federal Agencies Can Help Americans Develop a Strategy to Fight Back.

Revolving Door Project’s Fatou Ndiaye published a piece in Democracy Journal outlining the staggering gap between how the appropriations process for federal agencies is supposed to work versus how it currently works. Understanding the difference can help Americans refine strategies to get our voices heard in Congress and shine light on overlooked contributors to chronic underfunding across the federal government. Such an examination is especially relevant as Congress appears poised for a series of fiscal nightmares this fall.

July 07, 2023 | Revolving Door Project Newsletter

The Supreme Legislature…Err…Court: It’s Getting Harder to Tell the Difference

July 07, 2023 | The American Prospect

Secretary Yellen, Where Are the Crypto Tax Regulations?

Despite this, Janet Yellen’s Treasury Department has yet to formalize the regulations that would usher in this new reporting regime. The initial expectation was to have Treasury provide the new guidance by the end of 2022, allowing reporting changes to begin with transactions completed in 2023. However, despite approval of the proposed regulations by the Office of Information and Regulatory Affairs in February (the usual stumbling block in this sort of proceeding), the department has yet to publish the regulations.

July 05, 2023

Calling for a Corporate Crackdown, Not Lukewarm Apologism

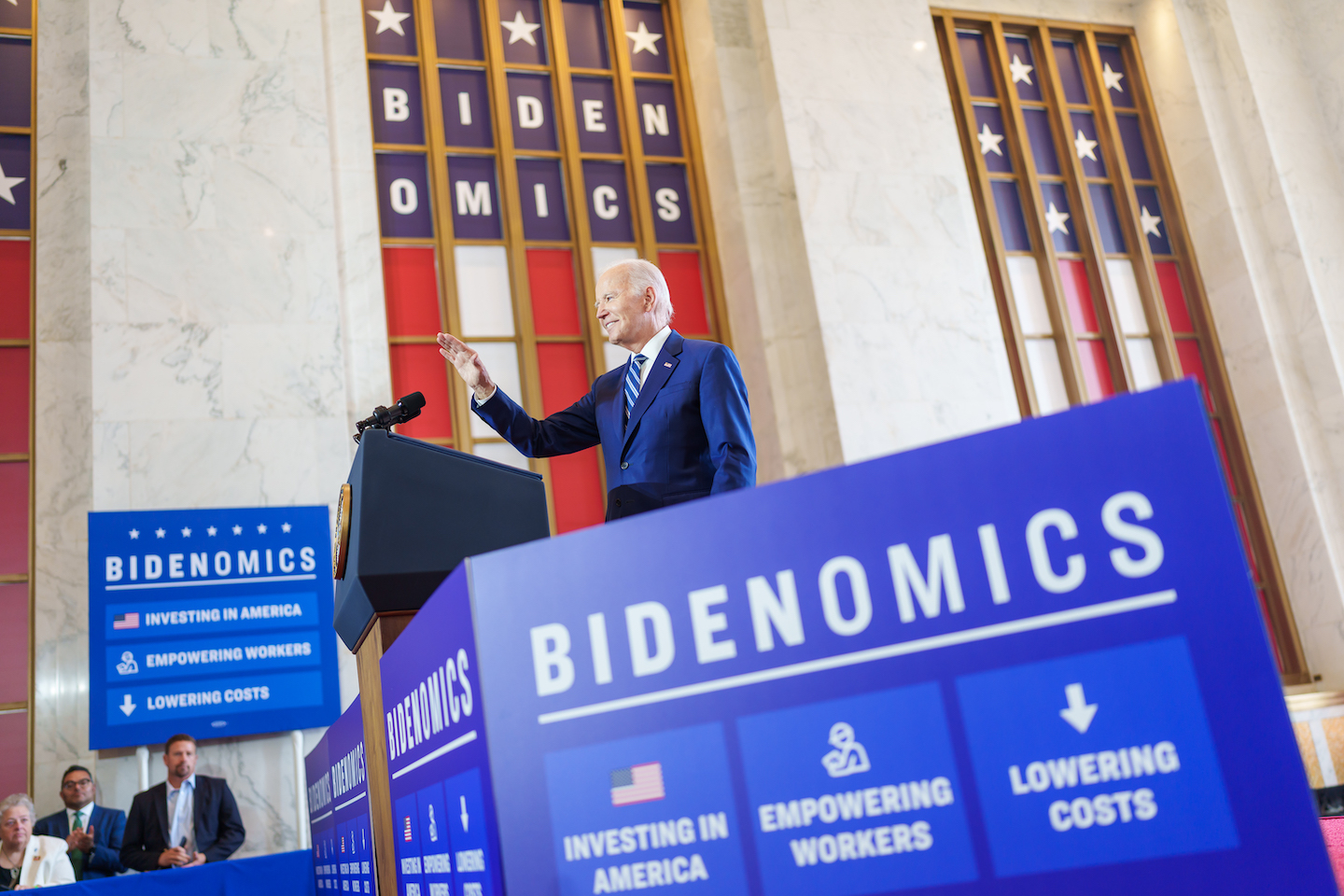

With smog from fossil-fueled wildfires hanging in the Chicago air, Biden shared an underwhelming vision of corporate accountability as part of his “Bidenomics” platform.

July 05, 2023 | The American Prospect

Lina Khan Haters Took A Premature Victory Lap

It turns out that the ethics official who recommended that Khan recuse herself from a case involving Meta is an owner of Meta stock. This ethics judgment was music to the ears of the media organizations, Republicans, and antitrust hacks who have been attacking Lina Khan throughout her leadership. Beyond being wrong and selective in singling out FTC officials for ethics concerns, the problem with Pankey’s opinion is deeply ironic. Pankey herself has a legitimate conflict of interest in relation to Meta.

June 30, 2023

RDP Asks FTC IG To Investigate Ethics Officer Who Pushed Khan To Recuse While Owning Meta Stock

The ethics officer who recommended Lina Khan recuse herself from the Meta/Within case owns between $15k and $50k in Meta stock.

June 30, 2023

Hack Watch: The Dangerous Cult Of The Entrepreneurial “Innovator”

It shouldn’t take a catastrophe for reporters to critically engage with entrepreneurial notions of so-called innovation.

June 30, 2023 | Common Dreams

Right-Wing Activists, Not Asian Americans, Killed Affirmative Action

Conservative legal strategists leveraged the Asian American community into their fight against affirmative action. The media continues to let them hide and evade blame.

June 29, 2023

RDP Calls On Microsoft/Activision Judge Who Disclosed Son's Employment At Microsoft To Recuse

The Revolving Door Project sent a letter to Judge Jacqueline Scott Corley, who is presiding over the FTC’s challenge of the Microsoft/Activision merger, after Judge Corley disclosed that her son is an employee of Microsoft but did not recuse. This relationship may violate the Code of Conduct for US Judges.