Search Results for

July 26, 2024

Texas Judge Hands Elon Musk A Big Win, Workers A Big Loss

On Tuesday, Judge Alan D. Albright of the Western District of Texas sided with Elon Musk’s SpaceX and ruled that the structure of the National Labor Relations Board (NLRB) is unconstitutional. Specifically, the Judge ruled against the removal protections enjoyed by administrative law judges and the board’s members. The preliminary injunction will prevent the NLRB from pursuing an unfair labor practice charge against SpaceX, but as Matt Bruenig explains, “The real question is going to be what the Supreme Court does once this case makes it to their docket.”

July 26, 2024

RELEASE: Elon Musk’s War On Workers Is Being Aided By The Courts

Billionaires and right-wing judges are attacking the NLRB because it protects workers.

July 25, 2024

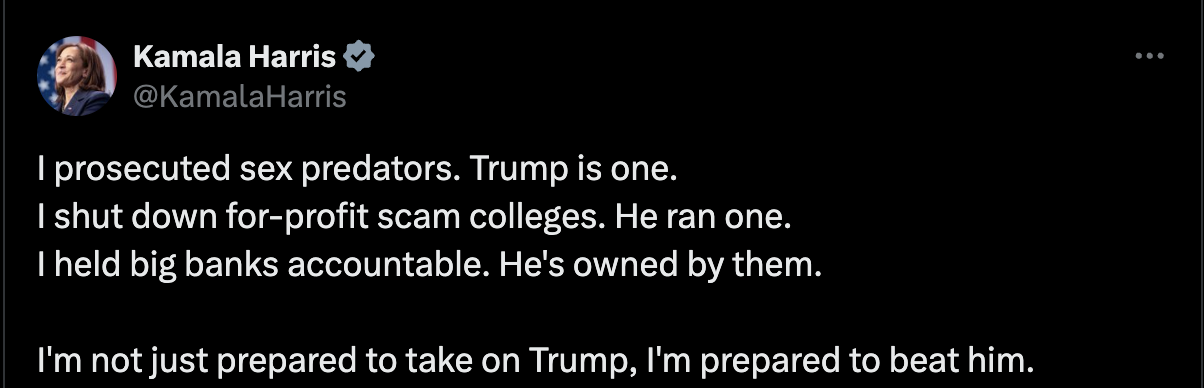

HackwatchNewsletter 2024 ElectionAnti-MonopolyCorporate CrackdownHousingKamala HarrisMedia Accountability

Kamala Harris Must Ignore Corporate Landlord Apologists and Double Down On Protecting Tenants

President Biden’s proposal to cap rents brought the neoliberal hacks and Big Real Estate propagandists out of the woodwork, but that shouldn’t stop Harris from adopting—and expanding—upon what tenants desperately need.

July 23, 2024

A Window Opens

The past 48 hours have ushered in a historic shift in a presidential race with undeniable consequence for the world. The Democrats suddenly appear as if they will have a nominee capable of waging a vigorous campaign.

July 23, 2024

Mark Kelly’s Less Than Stellar Record On Labor

There’s Little Difference Between The Potential VP Pick And His Fellow Arizona Senator, Kyrsten Sinema When It Comes To Labor.

July 18, 2024

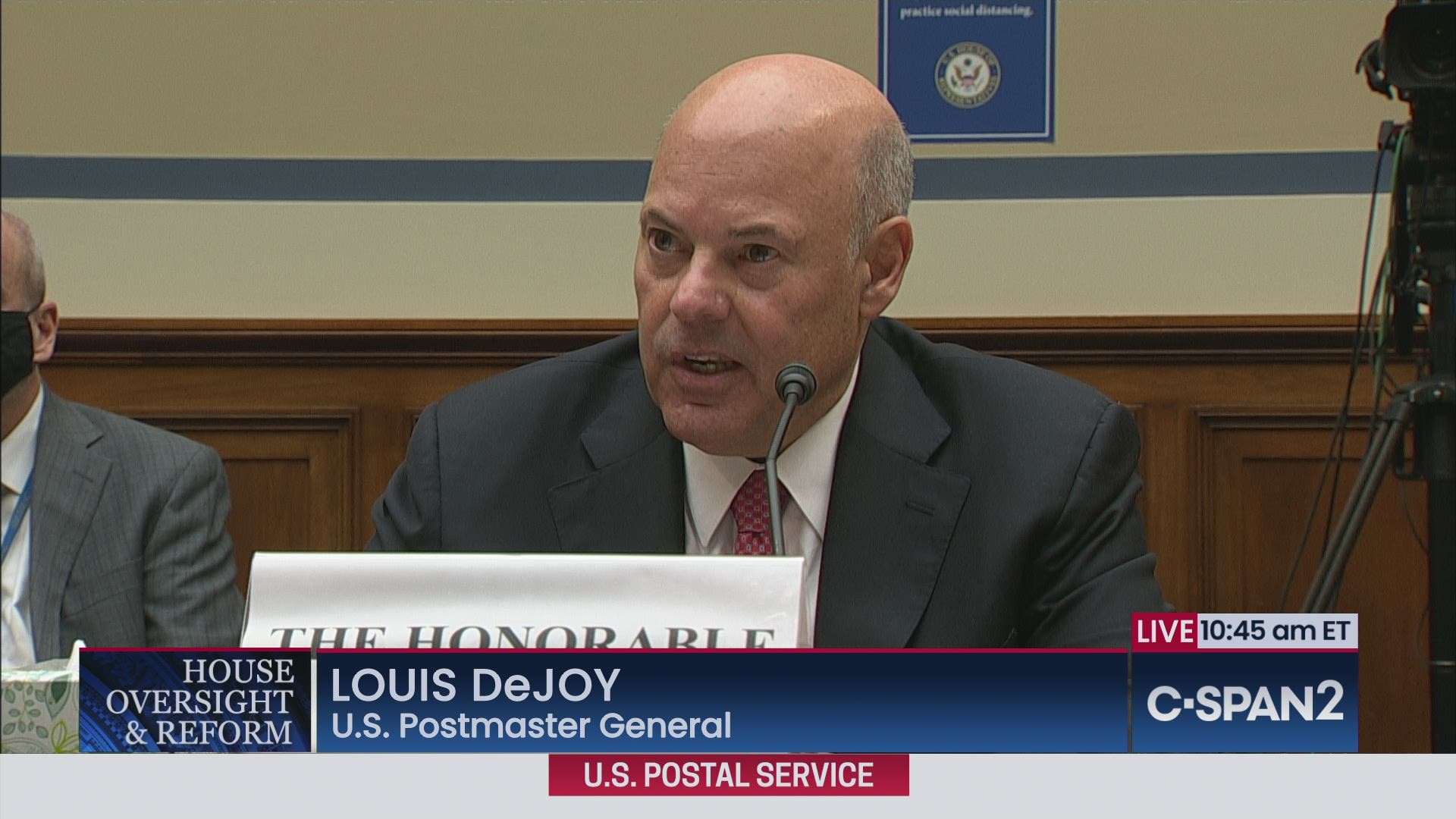

Don’t Buy Louis DeJoy’s “Second-Act” Spin

The Postmaster General is still wrecking the Post Office.

July 16, 2024

Graft And Scams Rule The Republican Party. Let Them Have It.

Biden’s Futile Attempts To Win Back The Hearts Of Long-Gone Crypto Scammers Won’t Work. They Will, However, Allow The Democratic Party And Its Base To Get Fleeced.

July 16, 2024

Former Trump Officials Wrote 25 of the 30 Chapters in the Project 2025 Playbook

Former President Trump has recently sought to distance himself from Project 2025 and its radical proposals, claiming that he knows “nothing about” it, has “no idea who is behind it,” and has “nothing to do with them.” Project 2025 has tried to create some distance as well, maintaining in a recent tweet that it is “not affiliated with former President Trump.” It’s a classic example of drawing a distinction without a difference.

July 13, 2024

The Supreme Court’s Billionaire Buddies Just Made Your Life Worse

SCOTUS’ assault on Chevron doctrine is an assault on everyday people, carried out on behalf of corporations and the Court’s wealthy benefactors.

July 12, 2024

Economic Policy And SCOTUS

The media needs to start getting wise to the court’s role in shaping the economy.

July 10, 2024 | Revolving Door Project Newsletter

RDP Work Roundup: 4th of July Edition

After a long 4th of July weekend, we figure this a good time to take a look back at the important work we’ve fired off over the last month or so. From analyses of Trump’s executive tenure to a take-down of a Big Oil myth pushed by compromised Democrats, here’s another edition of an RDP Work Roundup for you to digest along with your leftovers from holiday barbecues.

July 09, 2024

Interview Climate and EnvironmentEthics in GovernmentExecutive BranchFinancial RegulationIndependent AgenciesJudiciarySupreme Court

PODCAST: RDP's Vishal Shankar Talks SCOTUS Chevron Ruling On KALW's Your Call

RDP’s Vishal Shankar joined KALW’s Your Call to discuss the Supreme Court’s overturning of Chevron deference and the right-wing Big Money interests that lobbied for the ruling.

July 03, 2024 | The American Prospect

The Justice Department’s Next Climate Test

President Biden’s Justice Department has been offered two opportunities to act on holding oil and gas companies responsible for their deceit. It can protect state efforts to pursue accountability, and it can join them.