April 18, 2024

Advocacy Groups Comment On Biden Administration Rule To Combat Money Laundering In The Real Estate Sector

The Revolving Door Project joined Transparency International and other advocacy groups to provide comments on the Financial Crimes Enforcement Network’s (“FinCEN”) Notice of Proposed Rulemaking (“NPRM”) to combat and deter money laundering in the U.S. residential real estate sector by increasing transparency.

March 15, 2024 | Common Dreams

Trump Lackeys Run to Rescue Ailing Bank in Predictable—And Telling—Move

Political reporters must explain the consequences likely to ensue if Steven Mnuchin, Joseph Otting, or their pro-Wall Street doppelgangers return for a second Trump administration.

March 07, 2024

RELEASE: Top Trump Officials’ Latest Move a Reminder of Trump’s Prioritization of Wall Street

Campaign coverage should feature more questions about who would again feature in a second Trump Administration.

February 29, 2024

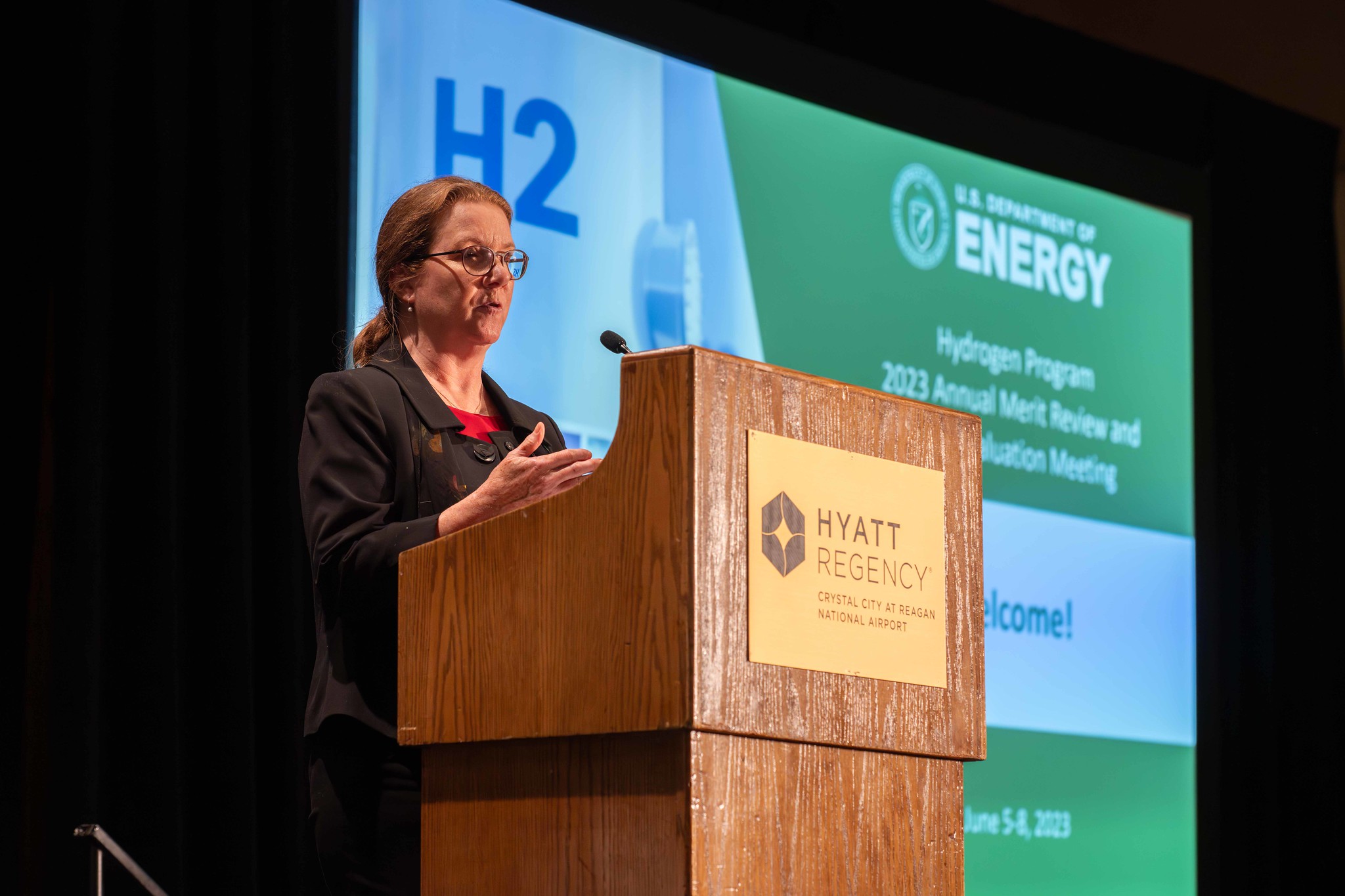

RELEASE: Treasury Must Continue To Stand Firm Against Industry Fearmongering and Regulatory Capture in Finalizing Clean Hydrogen Guidance

In response to Thursday’s reporting from E&E News on the Energy Department pushing the Treasury Department to align its clean hydrogen tax credit guidance with industrial polluters’ wishlist, the Revolving Door Project released the following statement:

September 06, 2023

Hannah Story Brown Emma Marsano

Press Release Climate and EnvironmentCorporate CrackdownExecutive BranchTreasury Department

RELEASE: As the Hydrogen Industry Vies for Tens of Billions of Federal Dollars, Lax Oversight and Entrenched Fossil Fuel Ties Raise Red Flags

The Revolving Door Project released a new Industry Agenda report today examining the executive branch influence agenda of the rapidly growing “clean” hydrogen industry, which is poised to receive tens of billions of dollars under the Infrastructure Investment and Jobs Act of 2021 and the Inflation Reduction Act of 2022.

July 07, 2023 | The American Prospect

Secretary Yellen, Where Are the Crypto Tax Regulations?

Despite this, Janet Yellen’s Treasury Department has yet to formalize the regulations that would usher in this new reporting regime. The initial expectation was to have Treasury provide the new guidance by the end of 2022, allowing reporting changes to begin with transactions completed in 2023. However, despite approval of the proposed regulations by the Office of Information and Regulatory Affairs in February (the usual stumbling block in this sort of proceeding), the department has yet to publish the regulations.

June 28, 2023 | Revolving Door Project Newsletter

Eighteen Months To Avoid Another X-Date

Earlier this month, Politico reported that after Biden secured his debt ceiling deal—a deal whose poison pills we’ll still be unpacking for some time to come—he went quiet on exploring options to permanently get rid of the debt ceiling.

This goes against what the president promised agitated members of his own party who urged him to take any manner of executive branch routes to resolve the crisis without capitulating to Republican demands: that it was his “hope and intention” to “find a rationale to take it to the courts to see whether or not the 14th Amendment is, in fact, something that would be able to stop it.” And it sets us up for another protracted, exhausting, damaging tête-à-tête at the edge of a fiscal cliff in just eighteen months.

January 18, 2023 | Revolving Door Project Newsletter

Climate and EnvironmentDepartment of TransportationEthics in GovernmentRevolving DoorTreasury Department

FDA Tobacco Scientist Joins Cigarette Company. Nothing To See Here!

We’ve barely begun wading into the troubled waters of the 118th Congress, and House Republicans are already out for the blood of their longtime nemesis: federal workers.

December 19, 2022

Vishal Shankar Andrea Beaty Kalimah Muhammad

Blog Post Consumer ProtectionDepartment of JusticeExecutive BranchFTCHousingTreasury Department

Biden Can Protect Millions Of Vulnerable Tenants With The Stroke Of A Pen

Housing experts have drafted an executive order to protect tenants and stop rent-gouging. All Biden has to do is sign it.

March 07, 2022

Obscure Agency Must Deny Russian Oligarchs Possible Crypto Sanction Evasion Tool

While it is unlikely that an economy as large as Russia’s can be rerouted through present crypto infrastructure, there remains opportunity for targeted individuals and entities to leverage the industry’s weak compliance mechanisms to move some of their assets. The Treasury Department’s Office of Foreign Asset Control (OFAC) and Financial Crimes Enforcement Network (FINCEN), in conjunction with the White House’s National Security Council, need to ensure this does not happen.

November 17, 2021

Newsletter Climate and EnvironmentDepartment of JusticeExecutive BranchFederal ReserveIndependent AgenciesTreasury Department

After Infrastructure Week

Congressional selfies and self-congratulations inaugurated the week, but a lot of hard work remains to translate the Infrastructure Investment and Jobs Act’s (IIJA) policies into real-life results. Given that those policies are (generously) middling and that the most promising ones are underfunded, turning these into winning programs will demand energy, creativity, competence, and a strong commitment to the public interest.

October 26, 2021

Blog Post Climate and EnvironmentExecutive BranchFederal ReserveFinancial RegulationTreasury Department

Yellen Is Empowering Powell and Selling Out the Climate

It is very possible that President Biden will show up empty-handed to COP26 in Glasgow next week. And that isn’t just because of the apocalyptic vanity of two Senators from Arizona and West Virginia. Many executive-led policies that are just a matter of political will have not been done, and some of those which have are pure paper tigers. Biden’s administration failed last week to take advantage of a lesser known, but extremely meaningful climate action opportunity. The Financial Stability Oversight Council (FSOC) released its long-awaited report on climate-related financial risk, which the President personally ordered months ago. And it was a complete flop.

July 08, 2021

Biden Must Withdraw ExxonMobil- And Wall Street-Linked Nominee, 23 Groups Say

“As a private corporate attorney, MacBride defended fossil fuel companies, Wall Street giants, Big Tech monopolies, and a myriad of other corporate industries,” the groups wrote. “His past work fighting vigorously and successfully on behalf of corporations against the public interest disqualifies him from a role in the administration.”

June 30, 2021

Blog Post Climate and EnvironmentEthics in GovernmentExecutive BranchRevolving DoorTreasury Department

Amid Climate Crisis, Biden Stacks Administration With Fossil Fuel Industry Allies

President Biden has hired several Big Oil consultants and insiders to staff the executive branch amid growing calls for federal climate action.