Search Results for

June 24, 2024

Press Release Climate and EnvironmentDepartment of TransportationEducationEthics in GovernmentExecutive BranchFEMAFinancial RegulationHousingImmigrationLaborProject 2025Revolving Door

RELEASE: New Memos Detail The Trump Administration’s Troubling Stewardship of the Federal Executive Branch

The memos, which cover a broad range of themes, including disaster and emergency management, labor, housing, transportation, financial regulation and more, highlight the myriad ways the former president and his cast of conflicted appointees prioritized corporate interests while jeopardizing the health, safety and wellbeing of the American people.

April 18, 2024

Advocacy Groups Comment On Biden Administration Rule To Combat Money Laundering In The Real Estate Sector

The Revolving Door Project joined Transparency International and other advocacy groups to provide comments on the Financial Crimes Enforcement Network’s (“FinCEN”) Notice of Proposed Rulemaking (“NPRM”) to combat and deter money laundering in the U.S. residential real estate sector by increasing transparency.

April 05, 2024

Civil Society Comments on the Disclosure of Climate-Related Financial Risks

Disclosure of climate-related financial risks is critically important for investors, banks and other financial institutions, regulators, and the broader public.

April 05, 2024

Kenny Stancil Timi Iwayemi Jeff Hauser

Press Release Climate and EnvironmentFederal ReserveFinancial Regulation

RELEASE: When It Comes To Climate-Related Financial Risk, The Fed Needs To Get Its Head Out Of The Sand

Biden erred with his renomination of Powell, but if he gets another chance, he must choose a central bank leader dedicated to properly tackling the myriad challenges facing the Fed, which range from price stability and full employment to financial stability and climate-related financial risk.

March 29, 2024 | The American Prospect

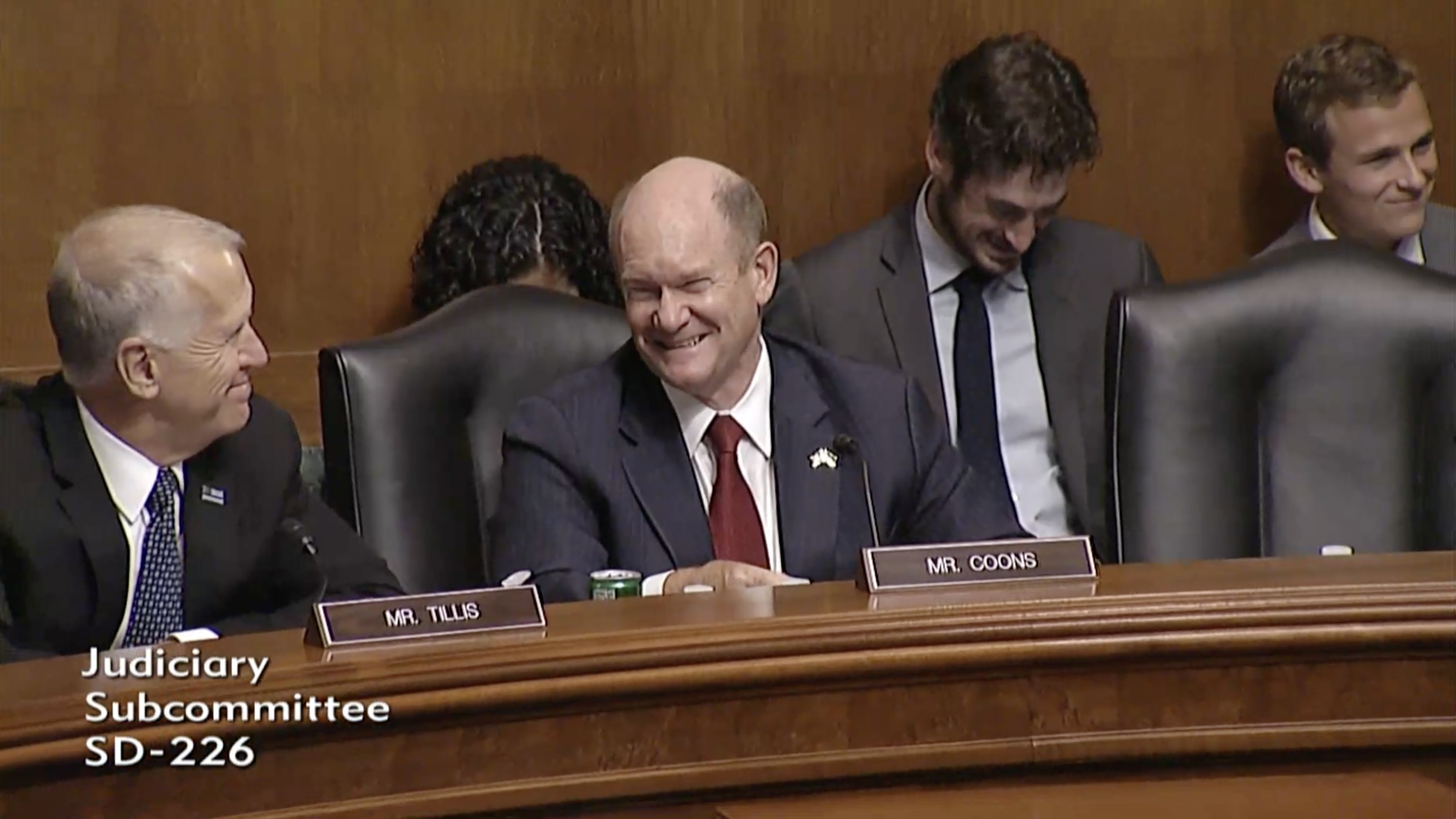

Senators’ Latest Attempt to Enrich Big Pharma Must Not Prevail

The patent system exists to promote scientific innovation to benefit the public, not to enrich private interests regardless of the merits of their scientific contributions. Yet that is precisely what PERA and PREVAIL would do by granting Big Pharma even more sweeping government monopolies and associated price-gouging power.

February 06, 2024

Civil Society Comment on the Draft Interagency Guidance Framework for Considering the Exercise of March-In Rights

Unfortunately, despite numerous petitions presented over the 40-plus year history of the Bayh-Dole Act, not once has a federal agency exercised its right to march-in and license competition to remedy price gouging (which constitutes a failure of the owner of a subject invention to make that invention available to the public on reasonable terms), or otherwise.

February 02, 2024

Advocates Thank President Biden and USTR Katherine Tai For Withdrawing Support For Extreme Digital Trade Proposals

RDP joined a coalition of labor unions, nonprofits and activist groups to thank President Biden and United States Trade Representative Katherine Tai for standing firm in support of a worker-centered trade agenda that preserves space for needed public interest policies.

January 26, 2024 | The American Prospect

Corporate Self-Oversight

Accounting’s technical jargon makes the industry obscure to most Americans. It’s likely your next-door neighbor has no idea of the PCAOB’s activities, its responsibility to protect investors, or its history of negligence. That’s expected, but chair Williams is now working to turn the ship around to fix the shortcomings of one of America’s most consequential oligopolies, and it will improve the economic lives of an unaware public.

November 02, 2023

Reporters Must Reject Republicans Unearned “Fiscal-Hawk” Self-Branding

The media should reject unearned ‘fiscal hawk’ self-branding and demand Johnson and other Republican leaders address how their attacks on the capacity of the executive branch are deleterious for all but the richest and most rapacious among us.

September 06, 2023 | The American Prospect

The Revolving Door Threatens the Integrity of the U.S. Patent and Trademark Office

More problematically, conflicts of interest have plagued the USPTO, including at the highest levels. Trump-era USPTO director Andrei Iancu was far too cozy with patent law firms while he served in government. Iancu came in via the revolving door from patent litigation firm Irell & Manella, where he earned $4,733,748 as a managing partner in the year before he was nominated, and went out the door and back to the firm when his term was up. He is now a partner in Sullivan & Cromwell’s patent practice.

August 17, 2023 | The American Prospect

The CFTC Ponders Gambling on Democracy’s Future

As long as one party remains totally united behind a man who attempted to overthrow the government by force, was the most corrupt president in American history, and undermines the public’s faith in elections at every turn, the future of American democratic self-government is at risk.

Sounds scary. But what if I told you this was a great opportunity for fun and profit? Silicon Valley–backed startup Kalshi is attempting to expand the amount of gambling on the country’s elections with the introduction of an “event contract” centered around congressional elections. Simply put, the firm aims to allow traders to bet on the event: Which party will win control of Congress?

July 14, 2023

The Crypto Industry Thinks Gary Gensler Should Recuse Himself From Enforcement Actions.

If we were to agree to the industry’s demand that policy experts should be precluded from regulating issues they have spent significant amounts of time developing expertise in, we would be setting a precedent that severely undermines any kind of public-minded enforcement. In fact, banning experts such as Gensler would leave the public with a pool of potential regulators who are either already corporate-aligned or unqualified to adequately opine on pressing issues.

July 11, 2023

A Corporate-Led Trade Agenda Is the Wrong Path Forward

Yet despite these promises, email correspondence obtained through FOIA requests by Demand Progress show that senior officials across USTR, including Deputy U.S. Trade Representative Sarah Bianchi, actively seek input from executives at Big Tech firms such as Amazon and Google. Giving Big Tech a privileged ability to mold American trade policy undermines Biden’s commitment to a new era of trade deals.

July 07, 2023 | The American Prospect

Secretary Yellen, Where Are the Crypto Tax Regulations?

Despite this, Janet Yellen’s Treasury Department has yet to formalize the regulations that would usher in this new reporting regime. The initial expectation was to have Treasury provide the new guidance by the end of 2022, allowing reporting changes to begin with transactions completed in 2023. However, despite approval of the proposed regulations by the Office of Information and Regulatory Affairs in February (the usual stumbling block in this sort of proceeding), the department has yet to publish the regulations.

June 01, 2023 | The American Prospect

How to Cover a Presidential Campaign

As the past six years have clearly illuminated, hollowing out government capacity and rewarding loyalists is at the heart of the Trump gospel, and leveraging power is DeSantis’s modus operandi as well. As coverage of the Republican primaries ramps up, the press must focus on how this style of executive branch mismanagement endangers democracy and the public interest. That’s more important than trying to figure out if DeSantis has the personality to sell this anti-democratic vision.