Search Results for

January 28, 2022

Capacity Shortfalls At The FHFA

The Federal Housing Finance Agency (FHFA) is an independent federal agency established by the Housing and Economic Recovery Act of 2008 (HERA) following the 2008-2010 subprime mortgage crisis. Upon its creation, the FHFA replaced the Federal Housing Finance Board (FHFB), the Office of Federal Housing Enterprise Oversight (OFHEO), and the GSE mission office at the Department of Housing and Urban Development (HUD). The FHFA is responsible for ensuring regulated entities “fulfill their mission by operating in a safe and sound manner to serve as a reliable source of liquidity and funding for the housing finance market throughout the economic cycle.” The agency oversees the supervision, regulation, and housing mission oversight of Fannie Mae, Freddie Mac (the Enterprises) and the Federal Home Loan Bank System, which includes the 11 Federal Home Loan Banks (FHLBanks) and the Office of Finance.

January 27, 2022

Sabotaged HUD Must Rebuild to Fix The Housing Crisis

As the pandemic exacerbates the nation’s ongoing housing crisis, President Biden has promised swift and immediate action. Effectively deploying the federal government’s powers to address this crisis, however, will require more than just good policy and motivated leadership. Past administrations eroded the federal government’s capacity to carry out effective policy to help tenants and homeowners. This administration will need to form new infrastructure, with an outsized focus on staffing reforms, in order to both restore capacity and implement new housing policies that will enable Americans to readily access safe and affordable housing.

January 26, 2022

Multifamily Housing and the FHFA

Through its oversight of Fannie Mae and Freddie Mac, the FHFA is closely involved in regulating financing for multifamily housing across the country.

January 24, 2022

Corporate Capture’s Circle of Life: The Copyright Office’s New Disney Lawyer

Since the Copyright Office provides expert recommendations and advice to Congress, the executive branch, and the courts, Disney’s recent employees may soon be advising government officials about copyright policy.

January 24, 2022

Revolver Spotlight: Tommy Beaudreau Is Big Oil’s Back Door to Biden’s Interior

President Biden nominated Tommy Beaudreau to be his Deputy Secretary of the Department of the Interior last April, and he was confirmed to the position by June. Unfortunately, though Biden seeks to be seen as a climate champion, Beaudreau was, and is, a uniquely terrible choice to help helm a climate-focused administration. His revolving door record is extensive, his conflicts of interest are nearly unprecedented, and his (re)installment at the highest circles of the Department of the Interior was ultimately a win for oil and gas conglomerates.

January 20, 2022

Revolving Door Project Examines Agency Capacity

The Revolving Door Project is fighting for an executive branch whose every corner is working tirelessly to advance the broad public interest and not to further entrench corporate power. That means scrutinizing the federal government’s highest ranks and applying pressure to keep them free of undue corporate influence. It also means interrogating whether the institutions those political leaders steer have the provisions they need to fulfill their missions.

January 19, 2022

Climate Finance Capacity: Office of the Comptroller of the Currency

supervising all national banks, federal savings associations, and agencies of foreign banks. It primarily regulates the risk that banks can take on, delineates what is considered “banking,” and investigates banks’ balance sheets.

January 19, 2022

The State of Independent Agency Nominations - Update for Fall 2021

Since the start of the year, we have warned that failure to promptly fill vacant and expired seats on independent agency boards would undermine the Biden administration’s agenda across many issue areas. Now, as executive branch policymaking kicks into high gear across this administration, we are seeing examples of this warning becoming a reality.

January 14, 2022

Personnel Is Policy For Communities On The Wrong Side Of The Digital Divide

Many of Biden’s broadband equity initiatives are being overseen by a former telecom lobbyist with little expertise in digital equity.

January 11, 2022

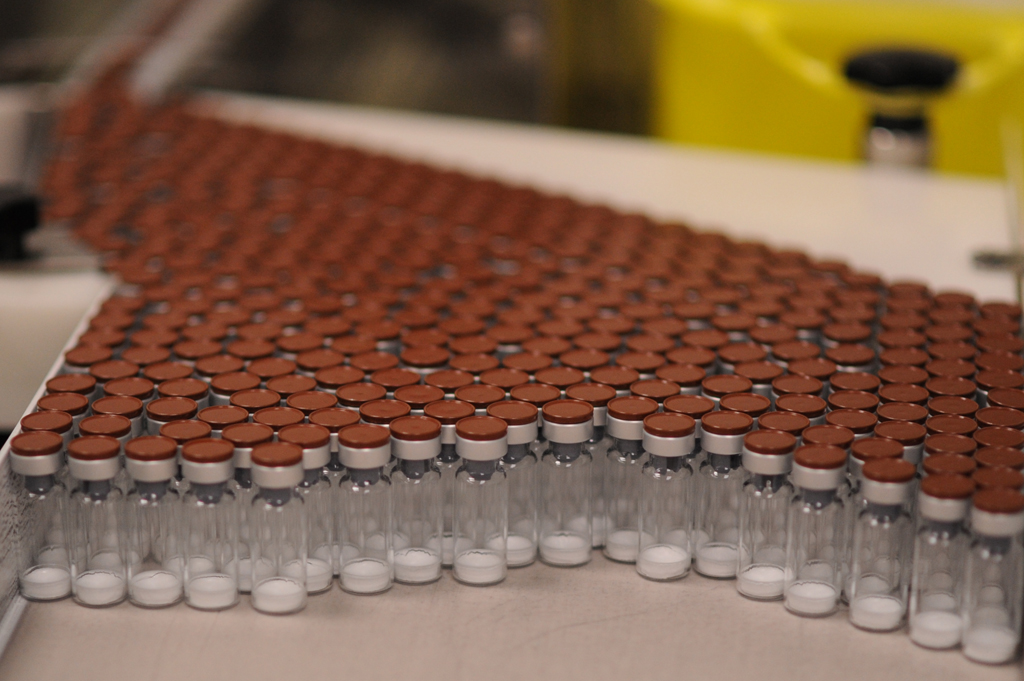

The Case For Vaccine Equity

To truly bring an end to the Covid-19 pandemic which has ravaged the globe, the Biden administration must embrace a strategy of vaccine equity.

January 11, 2022

Climate Finance Capacity Project: Securities and Exchange Commission

Climate change poses a serious threat to everything the Securities and Exchange Commission (SEC) is meant to protect and oversee. The Commodity Futures Trading Commission (CTFC)’s “Managing Climate Risk in the U.S. The Financial System ”report makes this abundantly clear. The report concludes that climate change may “exacerbate existing, non-climate related vulnerabilities in the financial system, with potentially serious consequences for market stability”. Furthermore, the physical and transitional risks of climate change will likely lead to systemic and sub-systemic financial shocks. These shocks would cause “unprecedented disruption in the proper functioning of financial markets and institutions” and further marginalize communities underserved by the financial system. To fulfill its mandate, of maintaining fair, orderly, and efficient markets, protecting investors, and facilitating capital formation, the SEC must proactively ensure there is enough personnel to monitor and enforce regulations that will keep markets stable and adaptable.

January 10, 2022

Questions And Answers About The FDIC

McWilliams resigned after spending December publicly insisting that Chopra, Gruenberg, and Hsu were undermining her authority by conducting a legal, notational vote-by-mail on a proposed Request For Information (RFI) about possible updates to bank merger review rules.

January 04, 2022

Amidst a Record Supply Chain Crisis, What is the Federal Maritime Commission’s Capacity?

One tiny federal agency with 116 full-time employees and a $28.9 million dollar budget is in charge of regulating the global marine economy, which contributes $397 billion to the US GDP annually and accounts for 80 percent of goods shipped worldwide. That’s not just an apples and oranges discrepancy—that’s like an apple versus Apple. The budget for the military’s marching bands is fifteen times greater than the Federal Maritime Commission’s budget; the Marines alone have five times more musicians than the Commission has staff.

December 22, 2021

Blog Post Corporate CrackdownEducationEthics in GovernmentExecutive BranchIndependent AgenciesRevolving Door

The Administration’s Actions on Federal Student Aid Deserve Sustained Scrutiny

Biden made big promises to American college students and graduates in his presidential campaign, just to walk them back when he became president.

December 14, 2021

Biden Gets Why Meat Prices Are So High. Why Isn't He Going On Offense About It?

Being correct, it turns out, isn’t enough. A dry blog post full of economic statistics and analysis simply isn’t how best to message the President’s position to the public.