December 04, 2024

RELEASE: Donald Trump’s Nomination of Paul Atkins to Chair the SEC Is a Huge Gift to the Crypto Industry

If Atkins is confirmed by the Senate, crypto grifters will surely rejoice at their newfound freedom to swindle, but most investors in the U.S. will be much less safe.

November 22, 2024

Silicon Valley’s Not-So Subtle Influence Peddler Wants Attention

Adam Kovacevich has spent his career pushing for more big tech influence. His latest bid? Pretend to be a reasonable progressive voice

November 18, 2024 | The American Prospect

The Department of Government Efficiency Is Inefficient

DOGE is a new weapon in Trump’s ongoing war against the administrative state. But it’s important to remain clear-eyed about the value federal civil servants provide. These individuals help ensure the safety of our food, medicine, transportation, air, and water. They are also the backbone of our education, health care, and financial regulatory systems. There is no doubt that many Americans feel burned by their recent interactions with these systems, but federal employees are the wrong targets of their ire.

November 08, 2024

Hackwatch 2024 ElectionAnti-MonopolyCorporate CrackdownCryptocurrencyEconomic MediaEconomic PolicyRevolving DoorTech

Hot (Takes) To Go

Some Notes on Centrists Blaming Everyone but Themselves

November 04, 2024

RDP Suspicion of Crypto-Connected Betting Websites Proves Correct

Who would’ve guessed that an offshore political betting market relying upon cryptocurrency deposits is riddled with issues?

October 01, 2024

Addressing Readers’ Struggles With Reading Comprehension

Hackwatch reader Matthew Yglesias is having trouble understanding, so we’re going to slow it down for him and explain some basic concepts of trustworthiness

September 27, 2024

Dylan Gyauch-Lewis Henry Burke

Hackwatch Anti-MonopolyCatherine RampellCryptocurrencyEconomic MediaEconomic PolicyGovernment CapacityHousingMatt YglesiasTaxes

Two Cheers for Antitrust

Reid Hoffman hates Lina Khan, but the polling firm he funds keeps demonstrating the popularity of her crackdown on corporate monopoly power.

September 23, 2024

Kamala Harris’ Acquiescence to Crypto Will Lead to Disaster

Bloomberg reports that Harris promised support for crypto at a NYC fundraiser are disappointing. Changes in securities law to benefit the digital asset industry will unnecessarily undermine consumer safety.

August 21, 2024

Matt Yglesias’ Weird Approach To Crypto

Matt Yglesias recognizes cryptocurrency can be dangerous. He also wants Harris to be nicer to crypto. Why? Pure vibes.

August 02, 2024

Don’t Let Silicon Valley Crucify Mankind On A Cross Of Blockchain

The latest proposal from the cryptocurrency-backed Republican Party? A handout for Bitcoin investors in the guise of public policy.

July 16, 2024

Graft And Scams Rule The Republican Party. Let Them Have It.

Biden’s Futile Attempts To Win Back The Hearts Of Long-Gone Crypto Scammers Won’t Work. They Will, However, Allow The Democratic Party And Its Base To Get Fleeced.

June 20, 2024

Déjà Vu All Over Again: Cryptocurrency Edition

We already know how the industry’s money gets lawmakers to launder its image, let’s not fall for it again.

May 22, 2024

RDP Work Round-Up: Memorial Day Edition

As we head into Memorial Day Weekend, we’re taking some time to review recent work at Revolving Door Project—boosting pieces we want to make sure readers here see, and staying focused on priority areas for our team. Here’s hoping the extra time in your week gives you some space to go down a revolving rabbit hole (or two) with us, whether on the crypto industry’s continuing efforts to influence how they’re regulated, or on Scott Sheffield, the former fossil fuel CEO engaged in an oil price-fixing scheme.

April 05, 2024

Maybe Financial Regulators Shouldn’t See The Best In Everyone

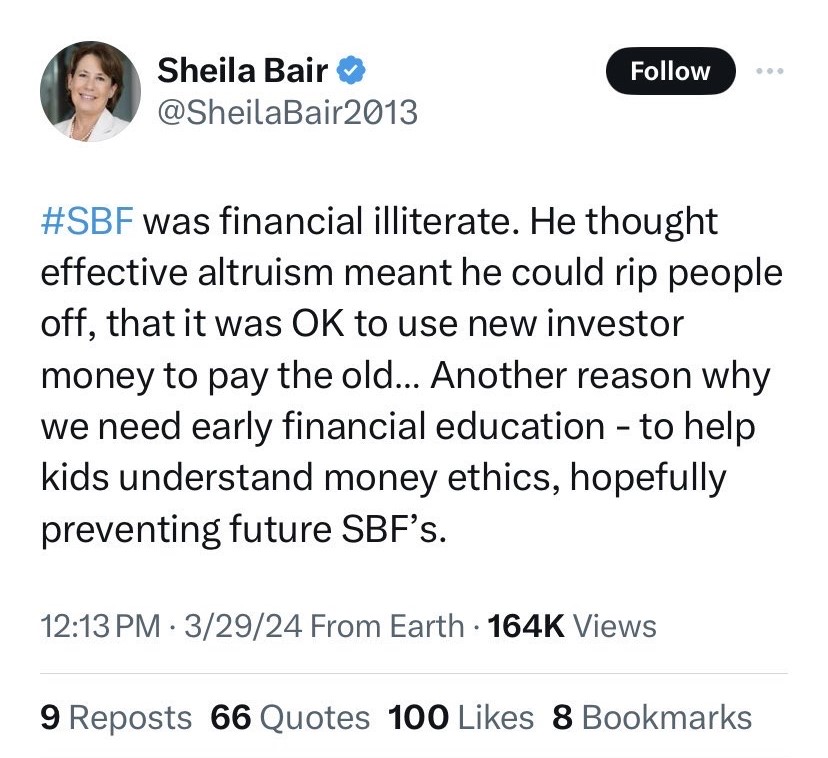

Last Friday, former FDIC Chair Sheila Bair decided to offer her two cents on the broader conversation surrounding the recent sentencing of Sam Bankman-Fried . Her takeaway from SBF’s trial and conviction on seven counts of fraud and conspiracy? We need financial literacy classes for children.

March 22, 2024

Crypto Is Hoping You Won’t Notice Their Redoubled Influence Campaign

The media has done a good job highlighting the cryptocurrency industry’s continued attempts to influence elections but crypto’s hiring of political insiders continues to go unnoticed.