July 16, 2024

Graft And Scams Rule The Republican Party. Let Them Have It.

Biden’s Futile Attempts To Win Back The Hearts Of Long-Gone Crypto Scammers Won’t Work. They Will, However, Allow The Democratic Party And Its Base To Get Fleeced.

July 09, 2024

Interview Climate and EnvironmentEthics in GovernmentExecutive BranchFinancial RegulationIndependent AgenciesJudiciarySupreme Court

PODCAST: RDP's Vishal Shankar Talks SCOTUS Chevron Ruling On KALW's Your Call

RDP’s Vishal Shankar joined KALW’s Your Call to discuss the Supreme Court’s overturning of Chevron deference and the right-wing Big Money interests that lobbied for the ruling.

July 02, 2024

Coalition of Over 30 Leading Consumer Advocacy and Environmental Organizations Urges U.S. Regulators To Address Threats Of Climate Change to the Financial System

Revolving Door Project joined a coalition of over 30 organizations urging the Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation to address the growing threats posed by climate change to banks and the broader financial system.

June 27, 2024

Amicus Spotlight: SEC v. Jarkesy

Thirteen right-wing groups linked to court-whisperers like Leonard Leo and Charles Koch urged SCOTUS to weaken our top financial regulator.

June 24, 2024

Press Release Climate and EnvironmentDepartment of TransportationEducationEthics in GovernmentExecutive BranchFEMAFinancial RegulationHousingImmigrationLaborRevolving Door

RELEASE: New Memos Detail The Trump Administration’s Troubling Stewardship of the Federal Executive Branch

The memos, which cover a broad range of themes, including disaster and emergency management, labor, housing, transportation, financial regulation and more, highlight the myriad ways the former president and his cast of conflicted appointees prioritized corporate interests while jeopardizing the health, safety and wellbeing of the American people.

June 20, 2024

Déjà Vu All Over Again: Cryptocurrency Edition

We already know how the industry’s money gets lawmakers to launder its image, let’s not fall for it again.

May 28, 2024

What Jamie Dimon Gets That Matt Yglesias Doesn’t

JPMorgan Chase CEO Jamie Dimon understood that no Vice Chair for Supervision could make Jerome Powell’s Fed take regulation seriously. Why didn’t Matt Yglesias?

May 08, 2024

Powell Goes Soft On Wall Street Again? Can’t Say We Didn’t Warn You

By refusing to endorse new bonus pay regulations, the Fed Chair has once again stood in the way of corporate accountability.

May 07, 2024

Researchers Urge National Association of Insurance Commissioners and U.S. Treasury Department to Ensure Public Access to Data

Revolving Door Project Executive Director Jeff Hauser joined other researchers in calling on state and federal insurance officials to make the property insurance data now being collected available to the public.

May 07, 2024

Advocates Urge National Association of Insurance Commissioners and Federal Insurance Office to Ensure Public Access to Data

The Revolving Door Project joined other groups in calling on state and federal insurance officials to make the property insurance data now being collected available to the public.

April 26, 2024

The U.S. Midwest's Home Insurance Crisis Should Be a Wake-Up Call

Soaring premiums, denied claims, and disappearing coverage in Iowa and elsewhere underscore the need for progressive interventions to reduce climate risks and redistribute costs.

April 18, 2024

PODCAST: RDP's Kenny Stancil Talks Home Insurance On Arnie Arnesen Attitude

RDP Senior Researcher Kenny Stancil joined Arnie Arnesen to discuss a pair of co-authored pieces on the escalating climate-insurance-housing crisis.

April 16, 2024

RELEASE: New Report Details How the National Association of Insurance Commissioners Impedes Effective Climate Action

The NAIC exists primarily to stave off federal regulation while setting the lowest possible bar for state regulators, who are often captured by industry interests.

April 16, 2024 | The American Prospect

Democrats Must Start Distinguishing Themselves on Insurance Policy

Amid a crisis for homeowners, Democrats have done little while Republicans pursue an agenda of bailouts and deregulation.

April 05, 2024

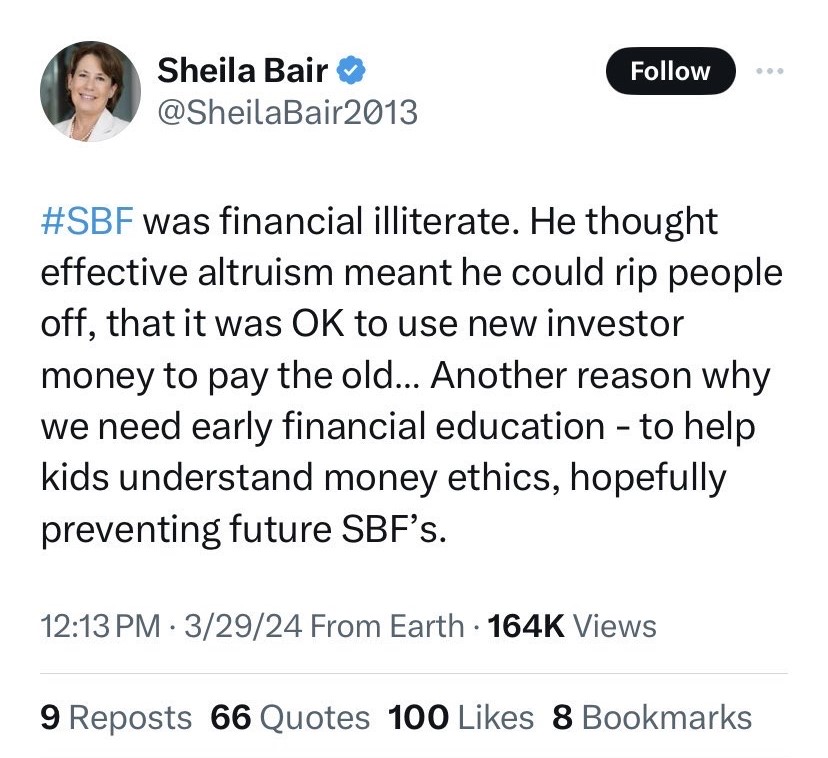

Maybe Financial Regulators Shouldn’t See The Best In Everyone

Last Friday, former FDIC Chair Sheila Bair decided to offer her two cents on the broader conversation surrounding the recent sentencing of Sam Bankman-Fried . Her takeaway from SBF’s trial and conviction on seven counts of fraud and conspiracy? We need financial literacy classes for children.