Our Blog

February 02, 2024

RELEASE: Revolving Door Project Applauds House Dems’ Calls For Biden To Fill Postal Board Vacancies

Letter Co-Signed By 80+ Lawmakers Underscores Louis DeJoy’s Destructive Continued Leadership

February 02, 2024

Conspiracy (Taylor’s Version): On Conservative Crazies, The Media Definition of “Economist,” And Our Humble Little Clown Show

On Conservative Crazies, The Media Definition of “Economist,” And Our Humble Little Clown Show

February 02, 2024

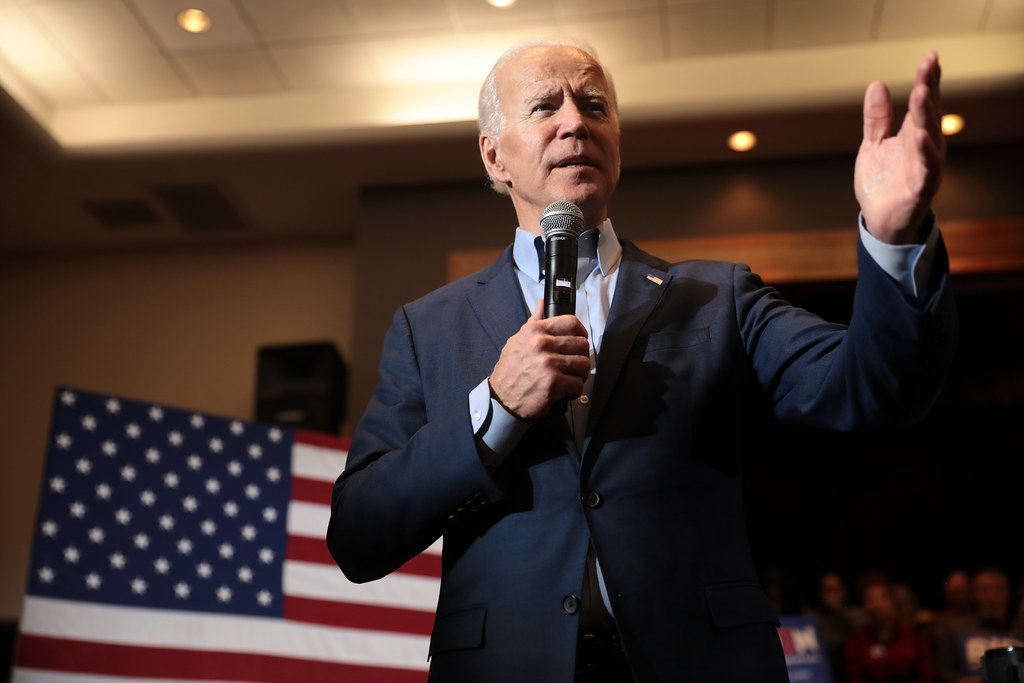

Advocates Thank President Biden and USTR Katherine Tai For Withdrawing Support For Extreme Digital Trade Proposals

RDP joined a coalition of labor unions, nonprofits and activist groups to thank President Biden and United States Trade Representative Katherine Tai for standing firm in support of a worker-centered trade agenda that preserves space for needed public interest policies.

February 02, 2024 | The American Prospect

Biden Should Begin the Tax Wars Now

He needs to highlight his positions against the Republicans’. And not give away too much in interim deals.

January 31, 2024 | Revolving Door Project Newsletter

More Revolvers Join The Fight Against The Regulatory State

The regulatory authority of the executive branch is under attack, and BigLaw firms stacked with revolvers are on the front lines leading the assault. I’ve previously written about former FTC Commissioner Christine Varney challenging the legitimacy of her former employer on behalf of pharma company Illumina. Lawyers at Latham & Watkins, a firm stacked with revolvers from executive branch agencies, are before the Supreme Court challenging the Chevron Doctrine, which defers to executive agencies’ interpretations when legislative statutes are unclear. The Securities and Exchange Commission’s ability to hold administrative proceedings hangs in the balance as we await the Supreme Court’s decision in SEC v. Jarkesy, where the Fifth Circuit’s ruling decimated the agency’s authority. In a new attack, revolvers on the labor/management relations team at Morgan Lewis & Bockius have their sights set on the plutocrats’ latest target: the National Labor Relations Board.

January 29, 2024 | The Sling

To Save the Planet, Biden Should Not Renominate Powell

Inflation is falling, but Jerome Powell has nothing to do with it. Our democracy and climate face mounting instability—and he has everything to do with that.

January 26, 2024

The FTC Ain’t Nothin to Mess With

The FTC has won its lawsuit against Martin Shkreli, the pharmaceutical executive infamous for jacking up the price of the antiparasitic drug Daraprim from $13.50 to $750 overnight in 2015 and later using his ill-gotten fortune to buy an exclusive Wu-Tang Clan album for $2 million. Shkreli is the quintessential corporate ghoul, having already racked up convictions for securities fraud—which resulted in an indefinite ban from the securities industries—and failure to pay $1.26 million in New York state taxes. Now, his price gouging has finally caught up with him, as the FTC successfully argued that he spearheaded an anti-competitive scheme to monopolize the drug. The presiding judge found Shkreli’s conduct to be “egregious, deliberate, repetitive, long-running, and ultimately dangerous,” issuing a $64.6 million fine and imposing a lifetime ban from the pharmaceutical industry.

January 26, 2024 | The American Prospect

Corporate Self-Oversight

Accounting’s technical jargon makes the industry obscure to most Americans. It’s likely your next-door neighbor has no idea of the PCAOB’s activities, its responsibility to protect investors, or its history of negligence. That’s expected, but chair Williams is now working to turn the ship around to fix the shortcomings of one of America’s most consequential oligopolies, and it will improve the economic lives of an unaware public.

January 24, 2024 | Revolving Door Project Newsletter

Fox News Doesn’t Like Us Pointing Out Underutilized EPA Powers

You know you’re doing something right when Fox News is mad about it. So I guess we can count Fox’s vexed coverage of the coalition letter that we and 146 other organizations sent the Environmental Protection Agency last week as a sign that we’re ruffling the right feathers.

January 24, 2024

Press Release: The Revolving Door Project Calls On Senate To Delay Confirmation Of Sean Patrick Maloney Until Crypto Ties Can Be Investigated

The Senate Foreign Relations Committee Waved Maloney Through Without So Much As A Whisper About His Connections To Coinbase, The Cryptocurrency Firm That Has Employed Him Since His Nomination Was Announced.

January 24, 2024

PODCAST: RDP's KJ Boyle Talks Trump's Labor Record On The Majority Report

RDP Research Assistant KJ Boyle joined the Majority Report with Sam Seder to discuss his piece in The New Republic titled Donald Trump Is No Friend to the Working Class.

January 23, 2024 | The New Republic

Donald Trump Is No Friend to the Working Class

It’s no contest: The Biden administration’s labor policies have been dramatically better for ordinary Americans than those of his predecessor.

January 19, 2024

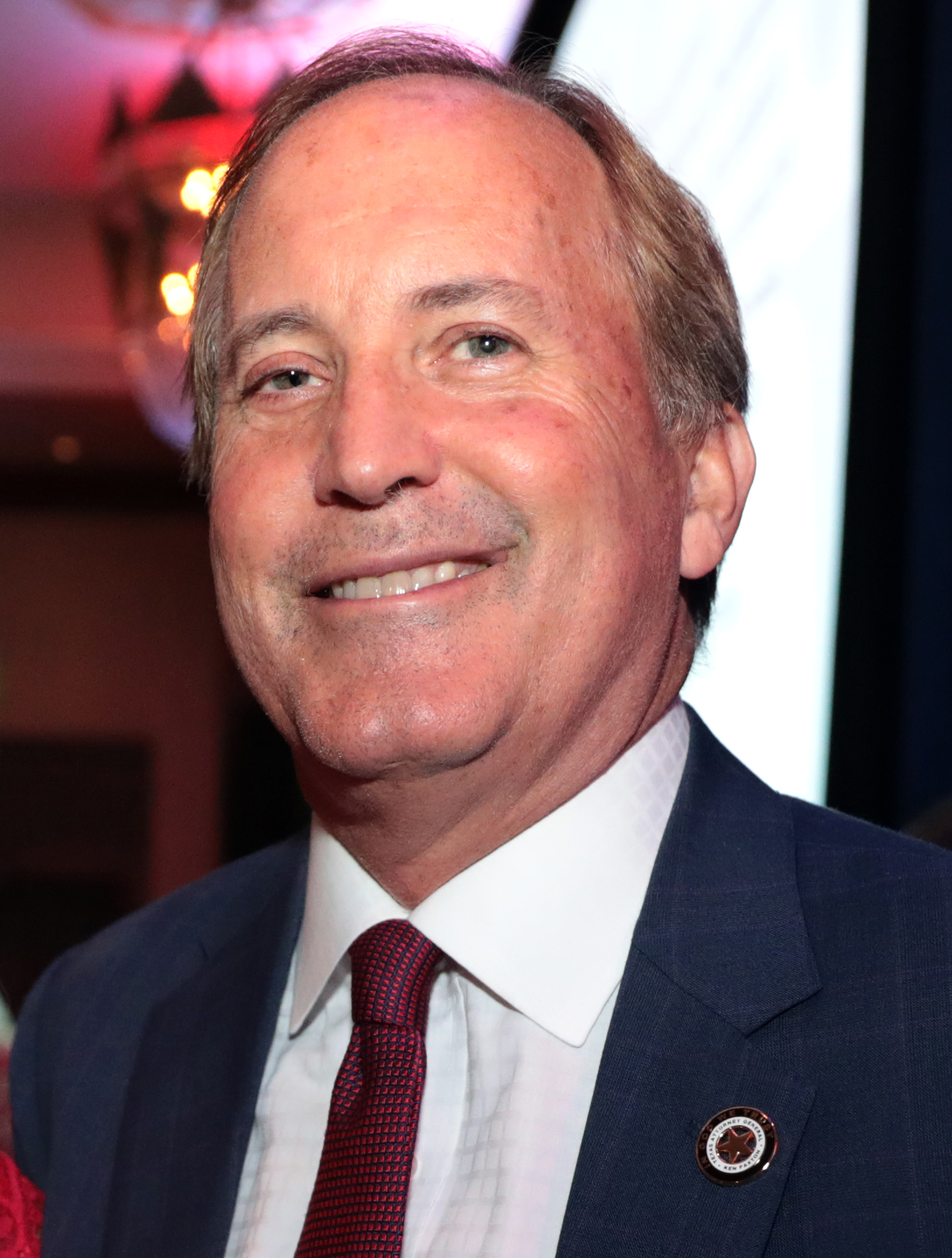

The Republican Attorneys General Association Sells Access To Major State Officers Nationwide

The Republican Attorneys General Association (RAGA) is a national organization dedicated to electing and reelecting state-level Republican Attorneys General. It is a partisan political organization, but it also functions as a dark money influence machine selling access to AGs, their staff, and their offices.